FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

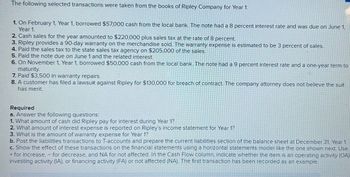

Transcribed Image Text:The following selected transactions were taken from the books of Ripley Company for Year 1:

1. On February 1, Year 1, borrowed $57,000 cash from the local bank. The note had a 8 percent interest rate and was due on June 1,

Year 1.

2. Cash sales for the year amounted to $220,000 plus sales tax at the rate of 8 percent.

3. Ripley provides a 90-day warranty on the merchandise sold. The warranty expense is estimated to be 3 percent of sales.

4. Paid the sales tax to the state sales tax agency on $205,000 of the sales.

5. Paid the note due on June 1 and the related interest.

6. On November 1, Year 1, borrowed $50,000 cash from the local bank. The note had a 9 percent interest rate and a one-year term to

maturity.

7. Paid $3,500 in warranty repairs.

8. A customer has filed a lawsuit against Ripley for $130,000 for breach of contract. The company attorney does not believe the suit

has merit.

Required

a. Answer the following questions:

1. What amount of cash did Ripley pay for interest during Year 1?

2. What amount of interest expense is reported on Ripley's income statement for Year 1?

3. What is the amount of warranty expense for Year 1?

b. Post the liabilities transactions to T-accounts and prepare the current liabilities section of the balance sheet at December 31, Year 1.

c. Show the effect of these transactions on the financial statements using a horizontal statements model like the one shown next. Use

+ for increase, - for decrease, and NA for not affected. In the Cash Flow column, indicate whether the item is an operating activity (OA)

investing activity (IA), or financing activity (FA) or not affected (NA). The first transaction has been recorded as an example.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Rosewood Company made a loan of $11,600 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice $696 in Year 1 and $0 in Year 2 $0 in Year 1 and $696 in Year 2 О $174 in Year 1 and $522 in Year 2arrow_forwardGeary Corporation had the following transactions: Apr. 15 - Issued a $6,000, 60-day, eight percent note payable in payment of an account with Marion Company. May 22 - Borrowed $50,000 from Sinclair Bank, signing a 60-day note at nine percent. June 14 - Paid Marion Company the principal and interest due on the April 15th note payable. July 13 - Purchased $15,000 of merchandise from Sharp Company; signed a 90-day note with eight percent interest. July 21 - Paid the May 22 note due to Sinclair Bank. Oct 02 - Borrowed $38,000 from Sinclair Bank, signing a 120-day note at twelve percent interest. Oct 11 - Paid the note payable and accrued interest to the Sharp Company (July 13). Record these transactions in general journal form. Record any adjusting entries for interest in general journal form. Geary Corporation has a December 31 year-end.arrow_forwardPuzzles Company sells merchandise with a 1-year warranty. In Year 1, sales consisted of 3,700 units. It is estimated that warranty repairs will average $16 per unit sold, and 40% of the repairs will be made in Year 1 and 60% in Year 2. In the income statement for Year 1, Puzzles Company should show warranty expense of a. $35,520. b. $23,680. c. $0. d. $59,200.arrow_forward

- Geary Corporation had the following transactions: · Apr. 15 - Received $6,000 from Marion Company and signed a 60-day, eight percent note payable. · May 22 - Borrowed $50,000 from Sinclair Bank, signing a 60-day note at nine percent. · June 14 - Paid Marion Company the principal and interest due on the April 15th note payable. July 13 - Purchased $15,000 of merchandise from Sharp Company; signed a 90-day note with eight percent interest. July 21 - Paid the May 22 note due to Sinclair Bank. · Oct 02 - Borowed $38,000 from Sinclair Bank, signing a 120-day note at twelve percent interest. · Oct 11 - Paid the note payable and accrued interest to the Sharp Company (July 13). Required: 1. Record these transactions in a general journal format. 2. Record any adjusting entries for interest in a general journal format. Geary Corporation has a December 31 year-end.arrow_forwardAnne Taylor comapany borrowed cash on august 1 of year 1, by signing a $46,620(face amount), one year note payable, due on july 31 of year 2. the accounting period of Anne yalor ends December 31. Assume an effective interest rate of 11%. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming the note is a noninterest-bearing note?arrow_forwardRosewood Company made a loan of $7,000 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice O O $420 in Year 1 and $0 in Year 2 $0 in Year 1 and $420 in Year 2 $105 in Year 1 and $315 in Year 2 $315 in Year 1 and $105 in Year 2arrow_forward

- On April 1, Year 1, Halo Co. issued a $5,000 face value discount note to the Capri Bank. The note had a 12 percent discount rate and a one-year term. 8. The amount of cash Halo received on April 1, Year 1, was a. $5,000. b. $4,250. c. $4,400. d. $5,500. 9. The total carrying value of Halo’s liabilities on December 31, Year 1, would be a. $5,600. b. $5,000. c. $5,450. d. $4,850. 10. If Halo Co. earned $2,000 of revenue in Year 1, the amount of net income would be a. $2,000. b. $1,550. c. $1,400. d. $1,850.arrow_forwardOn January 1, $50,000 cash is borrowed from a bank in return for a 6% installment note with 24 monthly payments of $2,216 each. 1. Prepare the journal entry to record the issuance of the note.2. Prepare the journal entry to record the first monthly interest payment.arrow_forward11). rosewood company made a loan of $12,600 to one of the company's employees on april 1, year 1. the one-year note carried a 6% rate of interest. what is the amount of interest revenue that rosewood would report in year 1 and year 2 respectively?arrow_forward

- Rosewood Company made a loan of $12,200 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice $0 in Year 1 and $732 in Year 2 $732 in Year 1 and $0 in Year 2 $183 in Year 1 and $549 in Year 2 $549 in Year 1 and $183 in Year 2arrow_forwardClayton Company borrowed $7, 300 from the State Bank on April 1, Year 1. The one-year note carried a 19% rate of interest. The amount of interest expense that Clayton would report in Year 1 and Year 2, respectively would be: Multiple Choice $1, 387 and $o. $1,040 and So. So and $1,387. $1,040 and $347.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education