FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

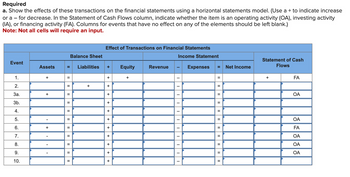

Transcribed Image Text:Required

a. Show the effects of these transactions on the financial statements using a horizontal statements model. (Use a + to indicate increase

or a - for decrease. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity

(IA), or financing activity (FA). Columns for events that have no effect on any of the elements should be left blank.)

Note: Not all cells will require an input.

Effect of Transactions on Financial Statements

Balance Sheet

Income Statement

Event

Assets

=

Liabilities

+

Equity

Revenue

Expenses

=

Net Income

Statement of Cash

Flows

1.

+

II

II

=

+

+

II

+

FA

+

+

II

=

2.

За.

+

3b.

4.

5.

6.

+

7.

8.

9.

10

10.

=

=

+++++++

+

+

=

OA

OA

FA

OA

OA

OA

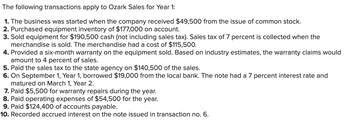

Transcribed Image Text:The following transactions apply to Ozark Sales for Year 1:

1. The business was started when the company received $49,500 from the issue of common stock.

2. Purchased equipment inventory of $177,000 on account.

3. Sold equipment for $190,500 cash (not including sales tax). Sales tax of 7 percent is collected when the

merchandise is sold. The merchandise had a cost of $115,500.

4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would

amount to 4 percent of sales.

5. Paid the sales tax to the state agency on $140,500 of the sales.

6. On September 1, Year 1, borrowed $19,000 from the local bank. The note had a 7 percent interest rate and

matured on March 1, Year 2.

7. Paid $5,500 for warranty repairs during the year.

8. Paid operating expenses of $54,500 for the year.

9. Paid $124,400 of accounts payable.

10. Recorded accrued interest on the note issued in transaction no. 6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Match the words to the definitions. Solvency Accounts Receivable Balance Sheet Noncurrent Assets Income Statement Retained Earnings Noncurrent Liabilities. Liquidity Current Assets Cash Flow Statement ✓ [Choose ] A forecast of the amount and timing of future cash inflows and outflows over some period of time. A summary of the revenues and expenses of a business over a given period of time. When net worth is greater than zero, or assets are greater than liabilities on the balance sheet. The ability to meet the day-to-day cash needs of the firm. Profits that are not paid out in dividends but are reinvested in the firm itself. Summarizes a firm's financial position at a given point in time and lists the firm's assets, liabilities, and net worth. Debts that others owe the business, usually arising from previous credit sales. Something the firms owns or uses that will not turn into cash within the next accounting period. Either cash or an items that will become cash in the next accounting…arrow_forwardAnswer only please.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $10,000 of common stock for cash. 2. Recognized $210,000 of service revenue earned on account. 3. Collected $162,000 from accounts receivable. 4. Paid operating expenses of $125,000. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $320,000 of service revenue on account. 2. Collected $335,000 from accounts receivable. 3. Determined that $2,150 of the accounts receivable were uncollectible and wrote them off. 4. Collected $800 of an account that had previously been written off. 5. Paid $205,000 cash for operating expenses. 6. Adjusted the accounts to…arrow_forward

- Directions: Fill in the following table using the equation: ∆Cash = - ∆Noncash Assets + ∆Liabilities + ∆Stockholders Equity. Indicate the name of the noncash asset, liability, or equity account affected by the transaction and if change in cash is classified as operating (O), investing (I), financing (F), or noncash (NC). The first line has been completed for you as an exampleItem∆Cash = - ∆Noncash Assets + ∆Liabilities + ∆Stockholders Equity1. Prepaid office rent for cash -O = - + Prepaid Rent + + 2. Sale of land held for cash = - + + 3. Cash payment of taxes payable = - + + 4. Issue preferred stock to investors for cash = - + + 5. Purchase equipment that is financed directly by the seller = - + + 6. Paid cash dividend = - + + 7. Pay notes payable = - + + 8. Pay interest payable = - + +arrow_forwardWhich of the following is not a financial statement? Multiple Choice All of the above are financial statements. Income Statement. Statement of Changes in Assets. Balance Sheet. Statement of Cash Flows.arrow_forwardDefine the 3 sections of the Cash flow Statement without copying straight from the text. - Cash from Operating Activities - Cash from Financing Activities - Cash from Investing Activitiesarrow_forward

- Accounting equation refers to the relations between line items on the balance sheet, and can be summarized as Assets = (Liabilities + Equity) - (Debt + Net worth). True Falsearrow_forwardIdentify how each of the following separate transactions 1 through 10 affects financial statements. For increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with dollar amounts. The first transaction is completed as an example. Required: a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total equity. For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Transaction 1. Owner invests $900 cash in business in exchange for stock 2. Receives $700 cash for services provided 3. Pays $500 cash for employee wages 4. Buys $100 of equipment on credit 5. Purchases $200 of…arrow_forwardAnswer only please. Answer all parts of question please.arrow_forward

- Which of the following is not classified among the financing activities in a statement of cash flows? a Long-term borrowing. b Payment of dividends to stockholders. c Short-term borrowing. d Payment of interest to creditors.arrow_forwardUsing the following answer keys, you are to identify in which activity each of the transactions is classified and its effect on cash flows. Cash Flow Classification.using the capital letter only: . .Operating Activity • L.Investing Activity • F..Financing Activity • OL.Operating and Investing Activity • N.Noncash Transaction Effect on Cash Flows.using the capital letter only: • .Increase • D.Decrease N.No Effect Transaction Cash Flow Classification Effect on Cash Flows Paid a cash dividend. Decreased accounts receivable. Increased inventory. Retired long-term debt with cash. Sold long-term securities at a loss. Issued stock for equipment. Decreased prepaid insurance. Purchased treasury stock with cash. Retired a fully depreciated truck (no gain or loss). Transferred cash to money market account.arrow_forward3. Using the following answer keys, you are to identify in which activity each of the transactions is classified and its effect on cash flows. Cash Flow Classification...using the capital letter only: O...Operating Activity I...Investing Activity F...Financing Activity OI...Operating and Investing Activity N...Noncash Transaction Effect on Cash Flows...using the capital letter only: I...Increase D...Decrease N...No Effect Transaction Cash Flow Classification Effect on Cash Flows Declared and paid a cash dividend. Sold short-term trading securities at a gain. Retired fully depreciated equipment. Sold a machine at a loss. Purchased long-term available-for-sale securities. Decreased accounts receivable. Purchased 90-day Treasury bill. Incurred a net loss. Declared and issued a stock dividend. Sold treasury stock.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education