FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

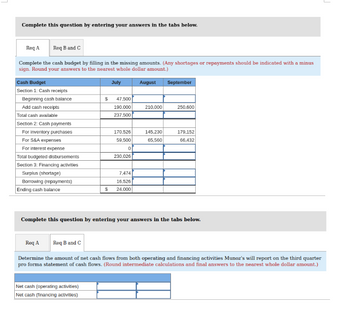

The accountant for Munoz’s Dress Shop prepared the following

Required

-

Complete the cash budget by filling in the missing amounts.

-

Determine the amount of net

cash flows from operating activities Munoz’s will report on the third quarter pro forma statement of cash flows. -

Determine the amount of net cash flows from financing activities Munoz’s will report on the third quarter pro forma statement of cash flows.

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req A Req B and C

Complete the cash budget by filling in the missing amounts. (Any shortages or repayments should be indicated with a minus

sign. Round your answers to the nearest whole dollar amount.)

August September

Cash Budget

Section 1: Cash receipts

Beginning cash balance

Add cash receipts

Total cash available

Section 2: Cash payments

For inventory purchases

For S&A expenses

For interest expense

Total budgeted disbursements

Section 3: Financing activities

Surplus (shortage)

Borrowing (repayments)

Ending cash balance

$

$

Net cash (operating activities)

Net cash (financing activities)

July

47,500

190,000

237,500

170,526

59,500

0

230,026

7,474

16,526

24,000

210,000

145,230

65,560

250,600

179,152

66,432

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

Determine the amount of net cash flows from both operating and financing activities Munoz's will report on the third quarter

pro forma statement of cash flows. (Round intermediate calculations and final answers to the nearest whole dollar amount.)

J

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The controller of Optimum wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance Dividends were declared on June 15* $130,000 44, 000 83,600 13,000 198,000 122,400 47,000 70, 000 Cash expenditures to be paid in July for operating expenses Depreciation expense Cash collections to be received Merchandise purchases to be paid in cash Equipment to be purchased for cash Optimum wishes to maintain a minimum cash balance of *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ending July 31, 2021, indicating how much, if anything, Optimum will need to borrow to meet its minimum cash requirement. (Leave no cells blank - enter "O" wherever required).arrow_forwardGarden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: Total cash receipts Total cash disbursements 1st Quarter $ 210,000 $ 281,000 The company's beginning cash balance for the upcoming fiscal year will be $26,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Beginning cash balance Total cash receipts Total cash available Total cash disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments Interest Required: Prepare the company's cash budget for the upcoming fiscal year.…arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $ 519,000 $ 468,000 404,000 452,000 353,000 521,000 Kayak requires a minimum cash balance of $40,000 at each month end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forward

- Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash payments January February March $ 519,000 409,000 476,000 $ 459,200 349,200 532,000 Kayak requires a minimum cash balance of $30,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $30,000 is used to repay loans at month-end. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1. Prepare monthly cash budgets for January, February, and March. Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Beginning cash balance Add: Cash receipts Total cash available Less: Cash payments for Interest on loan…arrow_forwardIn 2021 the company “AROFAH” will prepare a cash budget. The cash receipts and disbursements plan for the first six months (January to June) are as follows: Admission Plan: Sales Receipts: Sales are made in cash as much as 50% and 50% credit of sales. Of credit sales, 60% is received one month after the month of sale and the remaining is received 2 months after the month of sale. The total receipts of receivables in January and February are IDR 200,000 and IDR 300,000, respectively. The acceptance plans are: A. The amount of sales are: B. Other receipts are: January IDR 1,400,000 January IDR 200,000 February IDR 1,500,000 February IDR 300,000 March IDR 1,500,000 March IDR 100,000 April IDR 1,600,000 April IDR 200,000 May IDR 1,700,000 May IDR 400,000 June IDR 1,650,000 June IDR 500,000 2. Expediture Plan : A. Purchase of raw materials: B. Purchase of…arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February⚫ March Cash Receipts Cash payments $ 521,000 408,000 457,000 $ 467,800 354,800 522,000 Kayak requires a minimum cash balance of $50,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $50,000 is used to repay loans at month-end. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forward

- 2arrow_forwardWestern Company is preparing a cash budget for June. The company has $10,400 in cash at the beginning of June and anticipates $31,600 in cash receipts and $37,700 in cash payments during June. Western Company has an agreement with its bank to maintain a minimum cash balance of $10,000. As of May 31, the company has no loans outstanding. To maintain the $10,000 required balance, during June the company must:arrow_forwardPlease do not give solution in image format ?arrow_forward

- The budget director of Heathers Florist has prepared the following sales budget. The company had $ 121,600 in accounts receivable on July 1. Heathers Florist normally collects 100 percent of accounts receivable in the month following the month of sale.Required Complete the schedule of cash receipts by filling in the missing amounts.Determine the amount of accounts receivable the company will report on its third quarter pro forma balance sheet.arrow_forwardGarden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: Total cash receipts. Total cash disbursements 1st Quarter 2nd Quarter 3rd Quarter $ 210,000 $ 240,000 $ 281,000 $ 241,000 The company's beginning cash balance for the upcoming fiscal year will be $26,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Beginning cash balance Total cash receipts Total cash available Total cash disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments Interest $360,000 $ 251,000 Required: Prepare…arrow_forwardFoyert Corporation requires a minimum $7,000 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at the end of each month). Any preliminary cash balance above $7,000 is used to repay loans at month-end. The cash balance on October 1 is $7,000, and the company has an outstanding loan of $3,000. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. (please see picture for other info) October November December Cash receipts $ 23,000 $ 17,000 $ 21,000 Cash payments 25,500 16,000 15,000 Prepare a cash budget for October, November, and December.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education