FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

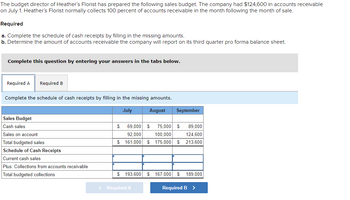

Transcribed Image Text:The budget director of Heather's Florist has prepared the following sales budget. The company had $124,600 in accounts receivable

on July 1. Heather's Florist normally collects 100 percent of accounts receivable in the month following the month of sale.

Required

a. Complete the schedule of cash receipts by filling in the missing amounts.

b. Determine the amount of accounts receivable the company will report on its third quarter pro forma balance sheet.

Complete this question by entering your answers in the tabs below.

Required A Required B

Complete the schedule of cash receipts by filling in the missing amounts.

July

August

Sales Budget

Cash sales

Sales on account

Total budgeted sales

Schedule of Cash Receipts

Current cash sales

Plus: Collections from accounts receivable

Total budgeted collections

$

69,000 $ 75,000 $

92,000 100,000

175,000 $

$ 161,000 $

September

< Required A

89.000

124,600

213.600

$ 193,600 $167,000 $ 189,000

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare Bates & Hill's cash receipts budget for the first quarter. (Enter answers in necessary fields only. Leave other fields blank. Do not enter 0.) Laura Falk, Bates & Hill Fabricators' accounts receivable manager, has just received the company's sales budget for the first quarter. January February March Quarter Budgeted revenue $525,000 $588,000 $672,000 $1,785,000 The company makes all sales on credit. Laura recently reviewed the company's collection history and found that 72% of the sales are collected in the month of the sale, 26% of sales are collected in the month following the sale, and 2% of sales are uncollectible. The company expects to have a net accounts receivable balance of $98,200 on January 1, and this amount represents the remaining receivables from December's sales.arrow_forwardsarrow_forwardSolution in full explain and Do not give solution in image formatarrow_forward

- The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Cash Sales Month Sales On Account Purchases Continued.. August September October November $85,000 $70,000 $88,550 $77,160 $174,870 $640,000 $550,000 $600,000 $800,000 $500,000 $420,000 $550,000 $500,000 $600,000 $450,000 ix) Taxation of $85,000 has to be settled in December. A money market instrument purchased by the company with a face value of $300,000 will mature on October 15, 2021. In order to meet the financial obligations of the business, management has decided to liquidate the investment upon maturity. On that date quarterly interest computed at a rate of 5% per annum is also expected to be collected. x) December An analysis of the records shows that trade receivables are settled…arrow_forwardKingston budgets total sales for June and July of $330,000 and $408,000, respectively. Cash sales are 65% of total sales. Of the credit sales, 15% are collected in the month of sale, 65% are collected during the first month after the sale, and the remaining 20% are collected in the second month after the sale. Determine the amount of accounts receivable reported on the company's budgeted balance sheet as of July 31. Hint: Determine the percent of June and July sales that are uncollected at July 31. Sales month Total Sales June July Total S 330,000 408,000 Credit Sales As of July 31 Percent Uncollected Amount Uncollectedarrow_forwardFloss Company has $13,000 in cash on hand on January 1 and has collected the following budget data: Assume Floss has cash payments for selling and administrative expenses including salaries of $66,000 plus commissions of 2% of sales, all paid in the month of sale. The company requires a minimum cash balance of $11,000. Prepare a cash budget for January and February. Will Floss need to borrow cash by the end of February? Beginning bye preparing the cash budget for January, then the cash budget for February. (Complete all input fields. Enter a “0” for any zero balances. )arrow_forward

- The budgeted sales of Kelley, SA for the given months are as follows: Cash Sales Credit Sales April $38,000 $256,000 May $54,000 $250,000 June $36,000 $192,000 July $33,000 $190,000 August $35,000 $287,000 To prepare a cash budget, the company needs to determine the expected cash collections each month, and has provided the following additional information: The Accounts Receivable balance on April 1 was $82,015. Of this amount, $57,015 represented uncollected March sales and $25,000 represented uncollected February sales. Collections on Credit sales: 65% in month of sale 30% in month following sale 5% in second month following sale Part 1: What should the April cash collected be? $BLANK Part 2: For August 1, what is budgeted Accounts Receivable? (76,100, 100,300, 109,950, 144950, OR 79,700)arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardHillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter: As of December 31 (the end of the prior quarter), the company’s general ledger showed the following account balances: Cash $ 43,000 Accounts receivable 202,400 Inventory 58,200 Buildings and equipment (net) 353,000 Accounts payable $ 86,025 Common stock 500,000 Retained earnings 70,575 $ 656,600 $ 656,600 Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 253,000 January $ 388,000 February $ 585,000 March $ 299,000 April $ 196,000 Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales. The company’s gross margin is…arrow_forward

- Kingston budgets total sales for June and July of $430,000 and $338,000, respectively. Cash sales are 65% of total sales. Of the credit sales, 25% are collected in the month of sale, 65% are collected during the first month after the sale, and the remaining 10% are collected in the second month after the sale. Determine the amount of accounts receivable reported on the company’s budgeted balance sheet as of July 31. Hint: Determine the percent of June and July sales that are uncollected at July 31. As of July 31 Sales month Total Sales Credit Sales Percent Uncollected Amount Uncollected June $430,000 July 338,000 Totalarrow_forwardSubject - account Please help me. Thankyou.arrow_forwardOn March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company's sales are made on account. The following information has been provided by Spicer's management. Month January February March April May Credit Sales $ 300,000 (actual) 400,000 (actual) 559,000 (estimated) 556,000 (estimated) 800,000 (estimated) The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale Collections one month after the sale. Collections two months after the sale Uncollectible accounts. 50% 30 Cash balance on March 31 Cash balance on April 30 Cash balance on May 31 15 5 Spicer's total cash expenditures for March, April, and May have been estimated at $1.200,000 (an average of $400.000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education