FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

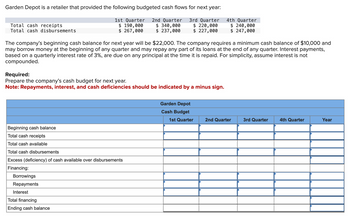

Transcribed Image Text:Garden Depot is a retailer that provided the following budgeted cash flows for next year:

3rd Quarter

$ 220,000

$ 227,000

Total cash receipts

Total cash disbursements

1st Quarter 2nd Quarter

$ 190,000 $ 340,000

$ 267,000 $ 237,000

The company's beginning cash balance for next year will be $22,000. The company requires a minimum cash balance of $10,000 and

may borrow money at the beginning of any quarter and may repay any part of its loans at the end of any quarter. Interest payments,

based on a quarterly interest rate of 3%, are due on any principal at the time it is repaid. For simplicity, assume interest is not

compounded.

Required:

Prepare the company's cash budget for next year.

Note: Repayments, interest, and cash deficiencies should be indicated by a minus sign.

Beginning cash balance

Total cash receipts

Total cash available

Total cash disbursements

Excess (deficiency) of cash available over disbursements

Financing:

Borrowings

Repayments

Interest

Total financing

Ending cash balance

Garden Depot

Cash Budget

4th Quarter

$ 240,000

$ 247,000

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total cash receipts $ 320,000 $ 440,000 $ 370,000 $ 390,000 Total cash disbursements $ 372,000 $ 342,000 $ 332,000 $ 352,000 The company’s beginning cash balance for the upcoming fiscal year will be $27,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Prepare the company’s cash budget for the upcoming fiscal year.arrow_forwardGarden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows: es Total cash receipts Total cash disbursements 1st Quarter $ 250,000 $ 309,000 2nd Quarter $ 400,000 3rd Quarter $ 280,000 4th Quarter $ 300,000 $ 279,000 $ 269,000 $ 289,000 The company's beginning cash balance for the upcoming fiscal year will be $34,000. The company requires a minimum cash balance of $10,000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments, interest, and cash deficiencies should be indicated by a minus sign.)arrow_forwardVishnuarrow_forward

- Valley Trails is preparing the Cash Budget for the upcoming period, and is concerned about their ability to meet their financial obligations in the short term. Following is information relating to Valley’s financial performance: Beginning-of-period balances: Accounts Receivable: $81,000 Accounts Payable: $40,500 Accumulated Factory Depreciation: $432,000 Cash: $20,250 Estimates for end-of-period balances: Accounts Receivable: $101,250 Accounts Payable: $27,000 Accumulated Factory Depreciation: $444,000 Budgeted activity levels for the period: Sales: $375,000 Purchases of Direct Materials: $67,200 Direct Labor Wages: $112,500 Manufacturing Overhead: $37,500 Selling and Administrative Expenses: $63,000 Except for purchases of direct materials, all expenses are paid as incurred. What is the budgeted ending cash balance for the period? Select one: a. $133,800 b. None of these options are correct. c. $93,300 d. $105,300 e. $115,050arrow_forwardThe following information was taken from Trusted Care Company's cash budget for the month of April: Beginning cash balance Cash receipts Cash disbursements If the company has a policy of maintaining an end of the month minimum cash balance of $25,000, the amount the company would have to borrow is $10,000 $13,000 $11,000 $0 $27,000 62,000 75,000arrow_forwardSurity Corporation is preparing its cash payments budget for next month. The following information pertains to the cash payments: 1 Click the icon to view the data.) How much cash will be paid out next month? Surity Corporation Cash Payments Budget Cash payments for direct materials: 45% of last month's purchases 55% of next month's purchases Cash payments for direct labor Cash payments for manufacturing overhead Cash payments for operating expenses Cash payment for taxes Total cash paymentsarrow_forward

- The company provides the following information regarding the cash budget for next year: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Beginning cash balance $5,000 $5,000 $5,000 $5,000 Excess (Deficiency) ($3,000) $2,000 ($2,500) $1,000 The company's policy is to start each quarter with a cash balance of $5,000.The company has access to a line of credit in the amount of $50,000 for any short term borrowing needs and pays the loans off as quickly as possible.The company assumes the cash budget for the year will begins with no loans.What is the expected loan balance at the end of Quarter 2 (ignore interest)?arrow_forwardKarim Corporation requires a minimum $8,300 cash balance. Loans taken to meet this requirement cost 2% interest per month (paid at the end of each month). Any preliminary cash balance above $8,300 is used to repay loans at month-end. The cash balance on July 1 is $8,700, and the company has no outstanding loans. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments Beginning cash balance Add: Cash receipts Total cash available Less: Cash payments for Interest on loan July $ 24,300 28,450 Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) Total cash payments Preliminary cash balance Loan activity Additional loan (loan repayment) Ending cash balance August $ 32,300 30,300 Loan balance - Beginning of month Additional loan (loan…arrow_forwardVaughn, Inc. prepared the following cash budget for the fourth quarter. Fill in the missing amounts, assuming that Vaughn desires to maintain a $15,000 minimum monthly cash balance and all equipment was purchased during December. Any required borrowings and repayments must be made in even increments of $1,000. (Enter answers in necessary fields only. Leave other fields blank. Do not enter 0.) Beginning cash balance Collections from sales Total cash available Less disbursements Materials purchases Direct labor Manufacturing overhead Selling & administrative expenses Equipment purchase Dividends Total disbursements Excess (deficiency) of cash Minimum cash balance Cash available (needed) Financing: Borrowings Repayments Interest Total financing Ending cash balance October 50,000 66,500 5,000 20,000 28,500 66,000 15.000 -14,500 $15.500 November $15.500 $ 93,500 10.000 6,000 24,000 25,000 28.500 15.000 -150 -15,150 $13,350 $ December 120,000 14,000 8,000 22,000 5,000 15,000 9,000 $ Quarter…arrow_forward

- Karim Corporation requires a minimum $8,100 cash balance. Loans taken to meet this requirement cost 2% interest per month (paid at the end of each month). Any preliminary cash balance above $8,100 is used to repay loans at month-end. The cash balance on July 1 is $8,500, and the company has no outstanding loans. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments Beginning cash balance Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) Total cash available July August $ 24,100 $ 32,100 28,150 30,100 Total cash payments Preliminary cash balance Loan activity Ending cash balance September $ 40,100 32,100 KARIM CORPORATION Cash Budget $ July Loan balance Loan balance - Beginning of month Additional loan (loan repayment) Loan balance…arrow_forwardThe controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: Sales/Costs Sales Manufacturing costs Selling and admin. expenses Capital expenses April May June $150,000 $175,000 $195,000 66,000 87,000 115,000 40,000 46,000 51,000 0 0 120,000 The company expects to sell about 15% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month after sale). Depreciation, insurance, and property tax expense represent $12,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in December, and the annual property taxes are paid in September. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of April 1 include cash of $42,000, marketable…arrow_forwardGarden Depot is a retailer that provided the following budgeted cash flows for next year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total cash receipts $ 180,000 $330,000 $210,000 $230,000 Total cash disbursements $ 260,000 $230,000 $220,000 $240,000 The company's beginning cash balance for next year will be $20,000. The company requires a minimum cash balance of $10,000 and may borrow money at the beginning of any quarter and may repay any part of its loans at the end of any quarter. Interest payments, based on a quarterly interest rate of 3%, are due on any principal at the time it is repaid. For simplicity, assume interest is not compounded. Required: Prepare the company's cash budget for next year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education