FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

2022 tax rules

Transcribed Image Text:the

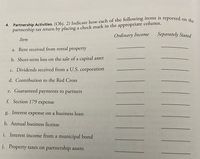

4. Partnership Activities. (Obj. 2) Indicate how each of the following items is reported on

partnership tax return by placing a check mark in the appropriate column.

Separately Stated

Ordinary Income

Item

a. Rent received from rental property

b. Short-term loss on the sale of a capital asset

c. Dividends received from a U.S. corporation

d. Contribution to the Red Cross

e. Guaranteed payments to partners

f. Section 179 expense

g. Interest expense on a business loan

h. Annual business license

i. Interest income from a municipal bond

j. Property taxes on partnership assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ubmitting an essay on the effect the adoption of IFRS has had, and will continue to have, on tax planning strategy. While reporting under IFRS will not be required until 2015 or 2016, we are already beginning to see changes in the tax industry, particularly when considering planning for the future. The purpose of this assignment is for you to consider how and to what extent the adoption of IFRS in the United States will affect current tax planning strategy, both in the short-term and the long-term.arrow_forwardProblem 04-02 (Static) [LO 4-2] Refer to the 2023 individual rate schedules in Appendix C. Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a married individual filing separately with $42,500 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $150,500 taxable income? c. What are the tax liability, the marginal tax rate, and the average tax rate for a head of household individual with $275,000 taxable income? d. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $630,000 taxable income?arrow_forwardFor business deductions, which of the following is true (mark all that apply): A. An expense is not deductible under Federal law unless Congress creates a specific provision allowing it. B. None of these are true. OC. An expense has been held to be ordinary if it is normal, usual, or customary in the type of business conducted by the taxpayer, and an expense need not be recurring to be considered ordinary. D. An expense has been held to be necessary if a prudent businessperson would incur the same expense and the expense is expected to be appropriate and helpful in the taxpayer's business. OE. The courts have held that for any expense to be ordinary and necessary, it must also be reasonable in amount. If an expense is unreasonable, it is not deductible.arrow_forward

- Question 14 What is your average tax rate if you pay taxes of $7134 on taxable income of $57920? (Reminder: Enter your answer as a decimal, not a percentage.) Your Answer: Answerarrow_forwardF7 A certain state uses the following progressive tax rate for calculating individual income tax: 7 ht©2003-2022 International Academy of Science. All Rights Reserved. F8 0-10,000 3% 10,001 - 50,000 5% 50,001 - 100,000 5.5% Calculate the state income tax owed on a $90,000 per year salary. tax = $[?] Round your answer to the nearest whole dollar amount. F9 Income Range ($) h 8 9. prtsc F10 home F11 Progressive Tax Rate . F12 + 11. delete Enter Backspace Num Lock CE 9:07. 11/5/20 +1_arrow_forwardQuestion 30 Which type of tax is used to finance the Social Security program in the United States? (A) consumption tax B income tax payroll tax D) property taxarrow_forward

- 7arrow_forward[The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $537,000. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. a. All of his income is salary from his employer. Assume his modified AGI is $570,000. Income tax Net investment income tax Total tax liability Amountarrow_forwardExhibit 19-6 Estate tax law changes The Tax Cuts and Jobs Act of 2017 and the Economic Growth and Tax Relief Reconciliation Act of 2001 brought important and significant changes to the federal estate, gift, and generation-skipping transfer (GST) taxes. Estate Highest Exemption Estate Unified or Тах Gift Credit GST Tax Exemption Amount ($ ($ million) million) Rate Exemption ($ million) Notes Tax Year (%) 2001 55 0.675 0.675 0.675 2002 50 1.00 1.00 1.00 Estate tax exemption raised to $1 million; top estate tax cut to 50%. 2003 49 1.00 1.00 1.00 Top estate tax cut to 49%. 2004 48 1.00 1.50 1.50 Estate tax exemption rises to $1.5 million; top estate tax rate cut to 48%. 2005 47 1.00 1.50 1.50 Top estate tax cut to 47%. 2006 46 1.00 2.00 2.00 Exemption rises to $2 million; top rate declines to 46%. 2007 45 1.00 2.00 2.000 Top rate declines to 45%. 2008 45 1.00 2.00 2.00 No change. 2009 45 1.00 3.50 3.50 Exemption rises to $3.5 million. 2010 1.00 Repeal Repeal Estate tax completely repealed.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education