FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

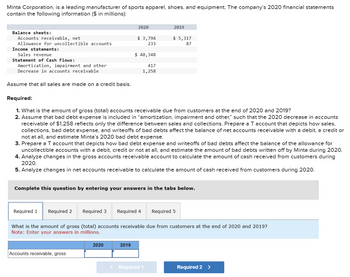

Transcribed Image Text:Minta Corporation, is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2020 financial statements

contain the following information ($ in millions):

Balance sheets:

Accounts receivable, net

Allowance for uncollectible accounts

Income statements:

Sales revenue

Statement of Cash Flows:

Amortization, impairment and other

Decrease in accounts receivable

Assume that all sales are made on a credit basis.

Required 1

2020

Required:

1. What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019?

2. Assume that bad debt expense is included in "amortization, impairment and other," such that the 2020 decrease in accounts

receivable of $1,258 reflects only the difference between sales and collections. Prepare a T account that depicts how sales,

collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a debit, a credit or

not at all, and estimate Minta's 2020 bad debt expense.

3. Prepare a T account that depicts how bad debt expense and writeoffs of bad debts affect the balance of the allowance for

uncollectible accounts with a debit, credit or not at all, and estimate the amount of bad debts written off by Minta during 2020.

4. Analyze changes in the gross accounts receivable account to calculate the amount of cash received from customers during

2020.

5. Analyze changes in net accounts receivable to calculate the amount of cash received from customers during 2020.

$3,794

233

$ 40,348

417

1,258

Complete this question by entering your answers in the tabs below.

Accounts receivable, gross

2020

2019

Required 2 Required 3 Required 4 Required 5

2019

$ 5,317

87

What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019?

Note: Enter your answers in millions.

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Laiho Industries's 2020 and 2021 balance sheets (in thousands of dollars) are shown. Laiho Industries: Balance Sheets as of December 31 (thousands of dollars) 2021 2020 Cash $ 102,785 $ 89,530 Accounts receivable 103,454 85,552 Inventories 39,771 36,287 Total current assets $ 246,010 $ 211,369 Net fixed assets 63,528 40,673 Total assets $ 309,538 $ 252,042 Accounts payable $ 32,604 $ 24,450 Accruals 29,905 21,470 Notes payable 16,454 13,454 Total current liabilities $ 78,963 $ 59,374 Long-term debt 76,373 65,273 Total liabilities $ 155,336 $ 124,647 Common stock 105,000 95,000 Retained earnings 49,202 32,395 Total common equity $ 154,202 $ 127,395 Total liabilities and equity $ 309,538 $ 252,042 The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis…arrow_forwardN1.arrow_forwardMinta Corporation, is a leading manufacturer of sports apparel, shoes, and equipment. The company’s 2020 financial statements contain the following information ($ in millions): 2020 2019 Balance sheets: Accounts receivable, net $ 2,804 $ 4,327 Allowance for uncollectible accounts 215 33 Income statements: Sales revenue $ 37,558 Statement of Cash Flows: Amortization, impairment and other 399 Decrease in accounts receivable 1,240 Assume that all sales are made on a credit basis. Required: What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019? Assume that bad debt expense is included in “amortization, impairment and other,” such that the 2020 decrease in accounts receivable of $1,240 reflects only the difference between sales and collections. Prepare a T account that depicts how sales, collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a…arrow_forward

- I need help with last problem " return on Equilty" I need rounding it.arrow_forwardUse the following information for Ingersoll, Inc. Assume the tax rate is 21 percent. 2019 $18,798 2,494 6,741 1,183 Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2018 $17,049 2,386 5,740 1,350 Cash flow from assets Cash flow to creditors Cash flow to stockholders 1,115 1,330 8,681 9,277 11,498 13,512 1,684 1,651 29,090 35,254 72,792 77,640 6,275 6,670 20,441 21,872 2,029 2,324 For 2019, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardTech Supplies Company, Incorporated, is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended February 1, 2020, are shown below. Tech Supplies Company, IncorporatedBalance SheetAt February 1, 2020($ in millions)Assets Current assets: Cash and cash equivalents $ 2,126Accounts receivable (net) 1,237Inventory 5,066Other current assets 422Total current assets 8,851Long-term assets 3,708Total assets $ 12,559Liabilities and Shareholders’ Equity Current liabilities: Accounts payable $ 5,200Other current liabilities 3,975Total current liabilities 9,175Long-term liabilities 2,246Shareholders’ equity 1,138Total liabilities and shareholders’ equity $ 12,559Tech Supplies Company, IncorporatedIncome StatementFor the Year Ended February 1, 2020($ in millions)Revenues $ 39,603Costs and expenses 38,168Operating income 1,435Other income (expense)* (80)Income…arrow_forward

- How can this be worked out ?arrow_forwardThis Information will be used for all questions: Selected Balance Sheet Information Year 2020 Year 2021 Cash 40,000 ? Accounts Receivable 10,000 14,000 Prepaid Rent 5,000 6,000 Inventory 35,000 30,000 Accounts Payable 3,000 2,000 Unearned Revenue 5,000 7,000 Income Taxes Payable 14,000 12,000 Other Relevant Information for 2021 Beginning Cash Balance 40,000 Net Income 65,000 Depreciation Expense 40,000 Cash Paid for Dividends 10,000 Cash Received for Loan 40,000 Cash Repaying Loan 10,000 Cash Payment to Purchase Land 12,000 Cash Received for Sale of Equipment 15,000 Gain on Sale of Equipment 5,000 Cash Received for Issuance of Stock…arrow_forwardThis Information will be used for all questions: Selected Balance Sheet Information Year 2020 Year 2021 Cash 40,000 ? Accounts Receivable 10,000 14,000 Prepaid Rent 5,000 6,000 Inventory 35,000 30,000 Accounts Payable 3,000 2,000 Unearned Revenue 5,000 7,000 Income Taxes Payable 14,000 12,000 Other Relevant Information for 2021 Beginning Cash Balance 40,000 Net Income 65,000 Depreciation Expense 40,000 Cash Paid for Dividends 10,000 Cash Received for Loan 40,000 Cash Repaying Loan 10,000 Cash Payment to Purchase Land 12,000 Cash Received for Sale of Equipment 15,000 Gain on Sale of Equipment 5,000 Cash Received for Issuance of Stock…arrow_forward

- Compute the following ratios and measurement for 2020 a. cash flow from operations to current liabilities b. inventory turnover c. rate of gross profit on salesarrow_forwardThe following information has been extracted from the financial statements and notes of Spring Ltd. 2020 2019 Cash and Cash Equivalents 60,600 59,700 Account Receivable(net) 130,800 128,900 Account Payable 54,700 52,900 Revenue 780,000 750,000 Cost of Goods Sold 450,500 445,500 Profit 65,500 58,500 Inventory 234,700 215,300 Total assets 580,000 590,000 Current Liabilities 250,900 265,700 Total liabilities 300,000 330,000 Short-term investments 67,400 75,900 Based on the above information calculate the following ratios: 1) Return on assets for 2020. 2) Profit Margin ratio for 2020. 3) Debt to assets ratio for 2020. 4) Acid-test ratio for 2020. 5) Inventory Turnover ratio for 2020.arrow_forwardMinta Corporation, is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2020 financial statements contain the following information ($ in millions): 2020 $ 3,574 229 2019 $ 5,097 75 Balance sheets: Accounts receivable, net Allowance for uncollectible accounts Income statements: Sales revenue Statement of Cash Flows: Amortization, impairment and other Decrease in accounts receivable $ 39,728 413 1,254 Assume that all sales are made on a credit basis. Required: What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and2019? Assume that bad debt expense is included in "amortization, impairment and other," such that the 2020 decrease in accounts receivable of $1,254 reflects only the difference between sales and collections. Prepare a T account that depicts how sales, collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a debit, a credit or not at all, and estimate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education