Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ines)

Text Predictions: On

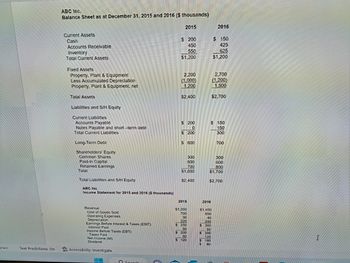

ABC Inc.

Balance Sheet as at December 31, 2015 and 2016 ($ thousands)

Current Assets

Cash

Accounts Receivable

Inventory

Total Current Assets

Fixed Assets

Property, Plant & Equipment

Less Accumulated Depreciation

Property, Plant & Equipment, net

Total Assets

Liabilities and S/H Equity

Current Liabilities

Accounts Payable

Notes Payable and short-term debt

Total Current Liabilities

Long-Term Debt

Shareholders Equity

Common Shares

Pald-In Capital

Retained Earnings

Total

Total Liabilities and S/H Equity

ABC Inc.

Income Statement for 2015 and 2016 ($ thousands)

Revenue

Cost of Goods Sold

Operating Expenses

Depreciation

Earnings Before Interest & Taxes (EBIT)

Interest Paid

Income Before Taxes (EBT)

Taxes Paid

Net Income (N1)

Dividend

Accessibility: Investigate

O sente

2015

$ 200

450

550

$1,200

2,200

(1.000)

1,200

$2,400

$ 200

0

$ 200

$ 600

*****

$1,600

$2,400

2015

$1,200

700

30

220

$ 250

50

$ 200

300

600

700

8.0

S 120

1

2016

2016

$1,450

850

40

200

$360

60

$ 300

120

$ 180

$ 80

$ 150

425

625

$1,200

2,700

11.200)

1.500

$2,700

$ 150

150

300

300

600

800

$1,700

$2,700

700

I

Transcribed Image Text:e) Calculate the Net Working Capital (NWC) for 2016 = Total Current Assets - Total Current

Liabilities = $1,200 $300 = $900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The calculation of working capital requires the inclusion of: A.liabilities expected to be paid in more than 1 year B.current assets minus total liabilities C.assets expected to be used,sold or converted to cash within 1 year D.total assets and total liabilitiesarrow_forward: Answers the days of Working capital based on the information below: 2020 2021 Profit of the year $126,000 $175,000 Depreciation/Amortization 25,000 35,000 Trade receivables 260,000 285,000 Inventories 350,000 390,000 Trade and other payables 290,000 310,000 Revenue 1,800,000 2,100,000arrow_forwardA summary of B's capital account for the year ended December 31, 2022 is as follows: Balance, Jan. 1, 2022 Additional investment, May 1 Withdrawal, Sept 2 Balance, Dec. 31, 2022 Compute for the weighted average capital. 1,200,000 230,000 (100,000) 1,330,000arrow_forward

- As part of your analysis, you are required to investigate Insignia Corporation Limited’s cash flows. Required: Using the financial statement provided: Calculate the following for 2020: Operating Cash Flow Net Capital Spending Change in Net Working Capitalarrow_forwardCalculates the Dupont formula and presents reasons that justify the company's profitability and motivate capital investment. Balance Sheet 2018 2019 Cash $63,000 $201,000 Accounts Receivable 199,000 305,000 Marketable Securities 81,000 42,000 Inventories 441,000 455,000 Prepaids 5,000 9,000 Total Current Assets 789,000 1,012,000 Property, Plant, and Equipment, net 858,000 858,000 Total Assets $1,647,000 $1,870,000 Account Payable $150,000 $100,000 Accruals 101,000 95,000 Total Current Liabilities $251,000 $195,000 Bonds Payable 405,000 575,000 Total Liabilities 656,000 770,000 Common Stocks 700,000 700,000 Retained Earnings 291,000 400,000 Total Stockholders’ Equity 991,000 1,100,000 Total Liabilities & Equity $1,647,000 $1,870,000 Income…arrow_forwardCalculate the Rate of Return on Assets (ROA) for 2011. Disaggregate ROA into the profit margin for ROA and total assets turnover components. Calculate the Rate of Return on Common Stockholders’ Equity (ROCE) for 2011. Disaggregate ROCE into the profit margin for ROCE, total assets turnover and capital structure leverage components.arrow_forward

- 7. New World has total assets of $31,300, long-term debt of $8,600, net fixed assets of $20,300, and owners' equity of $21,100. What is the value of the net working capital?arrow_forwardGiven the following information, calculate for 2016 the number of days of working capital financing the firm will need to obtain from other sources? (i.e., show the calculations of the Days Outstanding (including embedded Turnover ratios) for each of Accounts Receivable, Inventory, and Accounts Payable, as well as the intermediate calculation of Purchases used to calculate Days Outstanding for Payables, and finally, the number of days of external working capital financing required.arrow_forwardCash Flow From AssetsIf your corporation's operating cash flow for 2020 is $7,300, net capital spending is $3,500, and your change in net working capital is $1,600, what is your 2020 cash flow from assets? Please show your formula and calculations in the space provided.arrow_forward

- Industrial Industries' 2023 balance sheet shows current assets of $1,400 and current liabilities of $1,200. Their 2022 balance sheet shows current assets of $1,575 and current liabilities of $1,250. What was the firm's investment in net working capital for 2023? Question 5 options: ($63) ($175) ($125) $63 $188arrow_forwardBalance Sheet You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $391,000, Accounts receivable = $191,000, Inventory = $91,000, Accrued wages and taxes = $10,900, Accounts payable = $309,000, and Notes payable = $609,000. What is Campus's net working capital? Multiple Choice $1,601,900 О $673,000 О -$255,900 $928,900arrow_forwardBased on the following quotes 1/1/20 CAD/USD = 1.85 1/1/21 CAD/USD = 2.25 During 2020, the CAD (against the USD). O appreciated by 21.62% O depreciated by 21.62% appreciated by 17.78% O depreciated by 17.78%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education