FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:2. Prepare an income statement for 2020 restated to 2020

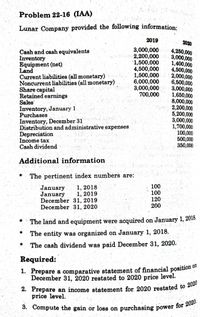

Problem 22-16 (IAA)

Lunar Company provided the following information:

2019

2020

3,000,000

2,200,000

1,500,000

4,500,000

1,500,000

6,000,000

3,000,000

700,000

Cash and cash equivalents

Inventory

Equipment (net)

Land

Current liabilities (all monetary)

Noncurrent liabilities (all monetary)

Share capital

Retained earnings

Sales

Inventory, January 1

Purchases

4,250,000

3,000,000

1,400,000

4,500,000

2,000,000

6,500,000

3,000,000

1,650,000

8,000,000

2,200,000

5,200,000

3,000,000

1,700,000

100,000

500,000

350,000

Inventory, December 31

Distribution and administrative expenses

Depreciation

Income tax

Cash dividend

Additional information

The pertinent index numbers are:

January

January

December 31, 2019

December 31, 2020

1, 2018

1, 2019

100

100

120

200

The land and equipment were acquired on January 1, 2018.

The entity was organized on January 1, 2018.

The cash dividend was paid December 31, 2020.

Required:

1. Prepare a comparative statement of financial position ol

December 31, 2020 restated to 2020 price level.

2. Prepare an income statement for 2020 restated to 202

price level.

3. Compute the gain or loss on purchasing power for 20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 70 Using Financial Statements for 2018-2019, the amount of cash and marketable securities at the end of the year is $4,202,000. TRUE OR FALSE?arrow_forwardP. P. Bank loan payable-current portion P. 26,000 21,000 P. P. P. Bank loan payable-non-current portion 382,000 217,000 P. Common shares P. 196,000 89,000 Retained earnings 41,000 26,000 P. P. P. Total liabilities and shareholders' equity $695,000 $396.000 P. P. P. P. Additional information regarding 2021: P. P. 1. Net income was $52,000. P. P. P. 2. A gain of $9,000 was recorded on the disposal of a small parcel of land. No land was purchased during the year. A gain on the disposal of $39,000 was recorded when an old building was sold for $57,000 cash. A new building was purchased for $367.000 and depreciation expense on buildings for the year was $60,000. 3. P. P. P. P. Equipment costing $68.000 was purchased while a loss of $9,000 was recorded on equipment that was sold for $5,000. The equipment that was sold late in the year had accumulated depreciation of $11,000. 4. 5. The company took out $205,000 of new bank loans during the year. 6. Dividends were declared and paid and no…arrow_forwardLoans and borrowings Deferred taxek liability 14,130 10,220- 1,010 960- 15,140 11,180 Current Liabilities Trade payable Current tax 1,260 1,140 1,040 920 payable Interest payable 980- 740k 3,280 40,190 2,800 32,960 Total Equity and Liabilities 2019 £'000 2018 £'000 Sales Cost of sales Distribution costse Administration expenses Gain on disposal of PPE 22,000 (11,800) (3,100) (1,630) 280 16,000 (8,200) (2,600) (1,420) Interest expensee a Тах еexpensee (1,140) (1,820) (760) (1,240) Net profit 2,790 1,780 1. The company disposal of PPE during the year with a book value of £1,000,000. 2. Depreciation of property, plant and equipment for the year was £650,000.4 The intangibles were acquired for cash towards the end of the year and were not sub ject to any amortisation in the current period.e 3. Prepare the statement of cash flows using the indirect method.arrow_forward

- Question 66 Using Financial Statements for 2018-2019. Net asset value per share of preferred stock for 2019 is $685.71. TRUE OR FALSE?arrow_forwardPLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 155,100 74,800 87,000 2,400 171,800 88,000 72,800 1,200 Accounts receivable Inventory Prepaid rent Long-term assets: Land 440,000 732,00ө (406, ө00) $1,085,300 440, ө0ө 630,000 252,000) $1,151,800 Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: 91,000 6,900 6,400 $ 77,800 13,800 4, 200 115,000 230,000 Common stock 660,000 206,000 $1,085,300 660,000 166,000 $1,151,800 Retained earnings Total liabilities and stockholders' equity Additional Information for 2021: 1. Net income is $61,000. 2. The company purchases $102,000 in equipment. 3. Depreciation expense is $154,000. 4. The company repays $115,000 in notes payable. 5. The company declares and pays a cash dividend of $21,000. %24 %24 %24arrow_forwardQuestion The management of Flames Technologies Ltd (FTL) provided the following information relating to its operations for the year ended December 31, 2020: Sales $1,610,000 $50,000 Sales returns It began the 2020 year with inventory at cost, $248,000 and valued at retail, $441,600 During the year the company made purchases at cost, $964,000 and valued at retail $1,363,800; freight charges were $30,500. Purchase returns at cost were $30,200 and valued at retail at $49,600 The management of FTL also provided information pertaining to markups and markdowns as shown below: The company had additional markups of $93,200 Markup cancellations during the year amounted to $10,800 Markdowns during the year amounted to $39,200 Markdown cancellations during the year amounted to $10,500 Normal shortages due to theft amounted to $58,200 On 31 December 2020, a major fire destroyed all the company's inventory in its warehouse, and in order to make an insurance claim, the management team of FTL has…arrow_forward

- Maya company has seen slow but steady growth over the past 10 years. Maya company started small, and all of the employees were family members. However, the business is now big enough that it is important to start setting up a more sophisticated internal control structure, including segregation of duties. What are the three specific functions that must be kept separate?arrow_forwardLOGIC COMPANYComparative Income StatementFor Years Ended December 31, 2019 and 2020 2020 2019 Gross sales $ 19,000 $ 15,000 Sales returns and allowances 1,000 100 Net sales $ 18,000 $ 14,900 Cost of merchandise (goods) sold 12,000 9,000 Gross profit $ 6,000 $ 5,900 Operating expenses: Depreciation $ 700 $ 600 Selling and administrative 2,200 2,000 Research 550 500 Miscellaneous 360 300 Total operating expenses $ 3,810 $ 3,400 Income before interest and taxes $ 2,190 $ 2,500 Interest expense 560 500 Income before taxes $ 1,630 $ 2,000 Provision for taxes 640 800 Net income $ 990 $ 1,200 LOGIC COMPANYComparative Balance SheetDecember 31, 2019 and 2020 2020 2019 Assets Current assets: Cash $ 12,000 $ 9,000 Accounts receivable 16,500 12,500 Merchandise inventory 8,500 14,000 Prepaid expenses 24,000 10,000 Total current assets $ 61,000 $ 45,500 Plant and…arrow_forwardPls stepwise with explanation and correct only.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education