FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets

| Number of Units | Molding Department | Trimming Department | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Hours per Unit | Total Hours | Hours per Unit | Total Hours | ||||||

| Part Z | 3,000 | 2.0 | MH per unit | 6,000 | MH | 3 | DLH per unit | 9,000 | DLH |

| Part X | 4,000 | 2.5 | MH per unit | 10,000 | MH | 4 | DLH per unit | 16,000 | DLH |

| Totals | 16,000 | MH | 25,000 | DLH |

Required:

1. Compute the plantwide overhead rate using direct labor hours as the allocation base.

2. Determine the overhead cost per unit for each part using the plantwide rate.

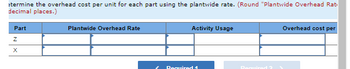

Transcribed Image Text:etermine the overhead cost per unit for each part using the plantwide rate. (Round "Plantwide Overhead Rat

decimal places.)

Part

Z

X

Plantwide Overhead Rate

Activity Usage

Required 1

Overhead cost per

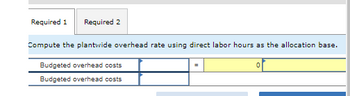

Transcribed Image Text:Required 1 Required 2

Compute the plantwide overhead rate using direct labor hours as the allocation base.

Budgeted overhead costs

Budgeted overhead costs

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carter Company manufactures two products, Deluxe and Regular, and uses a traditional two-stage cost allocation system. The first stage assigns all factory overhead costs to two production departments, A and B. based on machine hours. The second stage uses direct labor hours to allocate overhead to individual products. For the current year, the firm budgeted $1,550,000 total factory overhead cost. The $1,550,000 was for the planned levels of machine and direct labor hours shown in the following table. Machine hours Direct labor hours Units produced and sold Unit cost of direct materials The following information relates to the firm's operations for the month of January: Hourly direct labor wage rate Direct labor hours in Department A per unit Direct labor hours in Department B per unit Activity Material movement Machine setups Inspections Shipment Production Production Department A Department B 6,200 31,000 1. Deluxe unit cost Regular unit cost 2. Deluxe unit overhead Regular unit…arrow_forwardUse the following information for the Exercises below. (Algo) Skip to question [The following information applies to the questions displayed below.]Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets overhead cost of $248,750 in the Molding department and $208,750 in the Trimming department. The company budgets 16,000 machine hours (MH) in Molding and 25,000 direct labor hours (DLH) in Trimming. Actual production information follows. Number of Units Molding Department Trimming Department Hours per Unit Total Hours Hours per Unit Total Hours Part Z 3,000 2.0 MH per unit 6,000 MH 3 DLH per unit 9,000 DLH Part X 4,000 2.5 MH per unit 10,000 MH 4 DLH per unit 16,000 DLH Totals 16,000 MH 25,000 DLH Exercise 17-8 (Algo) Departmental overhead rates LO P2 Required:1. Compute a departmental overhead rate for the Molding department based on machine hours and a departmental overhead rate…arrow_forwardFast & Furious Company produces two products: toy planes and toy race cars. It uses departmental overhead rates for the two production departments: Molding and 1 more notification Finishing uses direct labor hours. 50,000 planes and 250,000 race cars are produced. Fast & Furious has prepared the following data: Estimated overhead Actual overhead Expected direct labor hours: Planes Race cars Expected machine hours: Planes Race cars Actual direct labor hours: Planes Race cars Actual machine hours: Planes Race cars Molding $250,000 $240,000 5,000 5,000 17,000 3,000 4,500 5,500 16,500 3,200 How much overhead is applied to the planes? Oa. $225,000 Ob. $192,500 Oc. $60,000 Od. $250,000 Finishing Total $100,000 $350,000 $120,000 $360,000 5,000 35,000 3,000 7,000 5,500 34,500 3,500 6,800 10,000 40,000 20,000 10,000 10,000 40,000 20,000 10,000arrow_forward

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Blinks 1,037 3 7 Dinks 2,059 6 6 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $111,000. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $88,600. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs. The single plantwide rate, if it is based on machine hours instead of labor hours, is a.$23.41 per machine hour b.$12.72 per machine hour c.$8.14 per machine hour d.$10.18 per machine hourarrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Textra produces parts for a machine manufacturer. Parts go through two departments, Molding and Trimming. The company budgets overhead cost of $246,250 in the Molding department and $206,250 in the Trimming department. The company budgets 16,000 machine hours (MH) in Molding and 25,000 direct labor hours (DLH) in Trimming. Actual production information follows. Number of Molding Department Units Hours per Unit Total Hours Trimming Department Hours per Unit Total Hours Part Z Part X Totals 3,000 2.0 MH per unit 4,000 2.5 MH per unit 6,000 MH 10,000 MH 16,000 MH 3 DLH per unit 9,000 DLH 4 DLH per unit 16,000 DLH 25,000 DLH Exercise 17-7 (Algo) Plantwide overhead rate LO P1 Required: 1. Compute the plantwide overhead rate using direct labor hours as the allocation base. 2. Determine the overhead cost per unit for each part using the…arrow_forwardAleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Rings 1,080 6 5 Dings 1,740 5 10 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $83,500. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $68,000. Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The Fabrication Department's factory overhead rate is a.$3.58 per direct labor hour b.$4.48 per machine hour c.$4.88 per direct labor hour d.$3.66 per machine hourarrow_forward

- Aleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Direct Labor HoursPer Unit Machine HoursPer Unit Rings 1,150 4 8 Dings 2,170 3 11 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $81,300. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $65,800. Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The total factory overhead allocated per unit of Dings is: a.$44.31 b.$6.33 c.$44.82 d.$43.36arrow_forwardRamapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Number of Direct Labor Hours Machine Hours Product Units Per Unit Per Unit Blinks 963 5 7 4 Dinks 1,983 4 8 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $81,600. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $107,600. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks is O a. $59.37 Ob. $538.03 Oc. $74.20 Od. $14.50arrow_forwardAleutian Company produces two products: Rings and Dings. They are manufactured in two departments: Fabrication and Assembly. Data for the products and departments are listed below. Product Number of Units Direct Labor HoursPer Unit Machine HoursPer Unit Rings 1,100 2 4 Dings 1,710 5 7 All of the machine hours take place in the Fabrication Department, which has estimated total factory overhead of $83,600. All of the labor hours take place in the Assembly Department, which has estimated total factory overhead of $67,600. Aleutian Company uses the multiple production department factory overhead rate method. The Fabrication Department uses machine hours as an allocation base, and the Assembly Department uses direct labor hours. The total factory overhead allocated per unit of Rings is a. $67.22 b. $7.69 c. $33.02 d. $53.81arrow_forward

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Number of Direct Labor Hours Machine Hours Product Units Per Unit Per Unit Blinks 972 4 4 Dinks 1,877 3 9 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $114,400. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $94,200. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blink is Oa. S10.75 Оb. 565.74 Oc. S87.64 Od. $376.85arrow_forwardRamapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are as follows: Number of Direct Labor Hours Machine Hours Per Unit Per Unit Product Units Blinks 916 Dinks 2,222 1 5 7 7 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $87,300. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $89,600. a. $60.91 b. $73.55 c. $14.71 d. $89.61 Ramapo Company uses a single plantwide overhead rate (rounded to the nearest cent) to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks isarrow_forwardKlamath Corp. produces two products: saws and drills. Three activities are used in their manufacture. These activities and their associated costs and bases are as follows: Activity Stamping Assembly Setup Activity Base Machine hours Labor hours Number of setups Units produced Budgeted Costs Saws Drills $200,000 400,000 30,000 Saws 4,000 7,000 $ 3 500 Activity Base Machine hours Labor hours Number of setups a. Determine the activity rate for each activity. Stamping Assembly Setup Drills 6,000 13,000 12 600 per machine hour per labor hour per setup b. Determine the factory overhead to be allocated to each unit of product. Round your answers to two decimal places, if necessary. per unit per unit Total 10,000 20,000 15 Previousarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education