FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

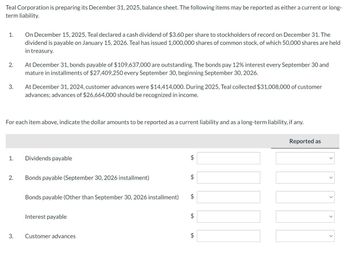

Transcribed Image Text:Teal Corporation is preparing its December 31, 2025, balance sheet. The following items may be reported as either a current or long-

term liability.

1.

2.

3.

1.

2.

On December 15, 2025, Teal declared a cash dividend of $3.60 per share to stockholders of record on December 31. The

dividend is payable on January 15, 2026. Teal has issued 1,000,000 shares of common stock, of which 50,000 shares are held

in treasury.

For each item above, indicate the dollar amounts to be reported as a current liability and as a long-term liability, if any.

3.

At December 31, bonds payable of $109,637,000 are outstanding. The bonds pay 12% interest every September 30 and

mature in installments of $27,409,250 every September 30, beginning September 30, 2026.

At December 31, 2024, customer advances were $14,414,000. During 2025, Teal collected $31,008,000 of customer

advances; advances of $26,664,000 should be recognized in income.

Dividends payable

Bonds payable (September 30, 2026 installment)

Bonds payable (Other than September 30, 2026 installment)

Interest payable

Customer advances

$

$

$

$

$

Reported as

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Mechforce, Incorporated had net income of $150,000 for the year ended December 31, 2022. At the beginning of the year, 17,000 shares of common stock were outstanding. On April 1, an additional 19,000 shares were issued. On October 1, the company purchased 4,000 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Mechforce paid the annual dividend on the 8,000 shares of 4.60%, $100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2022. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. Earnings per share $ 0.74 xarrow_forwardFall Corporation's capital structure consists of 500,000 authorized shares of common stock, of which 100,000 have been issued and are still outstanding. At December 31, 2022, an analysis of the accounts and discussions with company officials revealed the following information: Accounts payable...... Accounts receivable (trade accounts). Accumulated depreciation..... Accumulated other comprehensive income. Allowance for uncollectible accounts. Amortization expense.. Cash....... Common stock ($1 par value) Cost of goods sold Deferred revenue.. Depreciation expense. Dividend revenue.. Fair value adjustment (trading securities - debit balance). Gain on investments (Unrealized, NI).... General and administrative expenses. Interest expense... Interest payable..... Inventory, December 31, 2022. Investments in trading securities (cost)... Land held for future plant site.... 4% Notes payable (maturity 7/1/26 - $40,000 due July 1, 2023)... Paid in capital in excess of par.. Patents...... Pension…arrow_forwardWhite Corporation provided you with the following summary of total assets and liabilities at January 1, 2021 and at December 31, 2021.Assets, January 1, 2021 - P9,000,000Assets, December 31, 2021 - P12,000,000Liabilities, January 1, 2021 - P3,200,000Liabilities, December 31, 2021 - P4,500,000During 2021, the company issued 10,000 shares of its P100 par ordinary share at P150 per share and declared dividends of P280,000. There were no other changes affecting the equity accounts. How much is White Corporation’s profit for the year 2021?arrow_forward

- Oriole Corporation is authorized to issue 1,000,000 shares of $1 par value common stock. During 2020, the company has the following stock transactions. Jan. 15 Issued 430,000 shares of stock at $6 per share. Sept. 5 Purchased 34,000 shares of treasury stock at $8 per share. Journalize the transactions for Oriole Corporation. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Cash Common Stock Pald-In Capltal In Excess of Stated Value-Common Stock >arrow_forwardOn October 1, 2024, Carla Vista Co. declared an annual cash dividend to preferred shareholders of $3 per share; at the time the dividend was declared, there were 2.500 preferred shares issued and outstanding. The date of record for the dividend was December 1 and the dividend was paid on December 31. On October 31, 2024 the company also declared a 3% stock dividend for common shareholders; at the time the stock dividend was deared the common shares were trading at $10 per share and Carla Vista had 22.000 commons shares issued and outstanding. The date of record was December 15 and the issuance date of the dividend was December 31. (a) Record any and all journal entries that occurred on each of the dates indicated above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter "O" for the amounts. List all debit entries before credit entries. Record journal entries in…arrow_forwardAshvinarrow_forward

- The shareholders’ equity section of Superior Corporation’s balance sheet as of December 31, 2018, is as follows: 1. Prepare journal entries for each of the above transactions. 2. Calculate the number of authorized, issued, and outstanding common shares as of December 31, 2019. 3. Calculate Superior’s legal capital at December 31, 2019.arrow_forwardCrane Ltd. began operations on January 2, 2024. During the year, the following transactions affected shareholders' equity: 1. Crane's articles of incorporation authorize the issuance of 2.5 million common shares and the issuance of 253,000 preferred shares, the latter of which pay an annual dividend of $3.0 per share. 2. A total of 303,000 common shares were issued for $6 a share, 3. A total of 35,000 preferred shares were issued for $10 per share. 4. The full annual dividend on the preferred shares was declared. 5. The dividend on the preferred shares was paid. 6. A dividend of $0.12 per share was declared on the common shares but was not yet paid. 7. The company had net income of $170,000 for the year. (Assume sales of $500,000 and total operating expenses of $330,000.) 8. The dividends on the common shares were paid. 9. The closing entry for the Dividends Declared account was prepared.arrow_forwarda) Prepare all the journal entries for the stated transactions b) Assume that the income for the year is $13,500,000. Prepare a statement of changes in shareholders' equity c) Prepare the shareholders' equity section of the balance sheet at the end of the yeararrow_forward

- Following is a recent Tangent press release: MINNEAPOLIS, March 12, 2020 /PRNewswire/—The board of directors of Tangent Corporation has declared a quarterly dividend of 82 cents per common share. The dividend is payable June 10, 2020, to shareholders of record at the close of business May 20, 2020. Prepare the journal entries Tangent used to record the declaration and payment of the cash dividend for its 500 million shares.arrow_forwardHelp mearrow_forwardPlease show your work.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education