FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

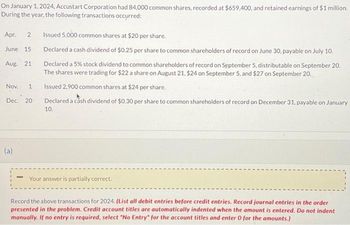

Transcribed Image Text:On January 1, 2024, Accustart Corporation had 84,000 common shares, recorded at $659,400, and retained earnings of $1 million.

During the year, the following transactions occurred:

Apr. 2

June 15

Aug. 21

Nov.

Dec. 20

(a)

Issued 5,000 common shares at $20 per share.

Declared a cash dividend of $0.25 per share to common shareholders of record on June 30, payable on July 10.

Declared a 5% stock dividend to common shareholders of record on September 5, distributable on September 20.

The shares were trading for $22 a share on August 21, $24 on September 5, and $27 on September 20.

Issued 2,900 common shares at $24 per share.

Declared a cash dividend of $0.30 per share to common shareholders of record on December 31, payable on January

10.

Your answer is partially correct.

Record the above transactions for 2024. (List all debit entries before credit entries. Record journal entries in the order

presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following transactions occurred for Rothman Corp. during 2024, its first quarter of operations (fiscal year ending Dec. 31): 1. 2. On Oct. 5, Rothman issued 2000 shares of $10 par common stock in an IPO and 400 shares of $40 par preferred stock for a lump sum of $85,000 cash. The values of the common and preferred stock were appraised separately at $30 and $50 per share, respectively. On Oct. 20, Rothman declared an 80% common stock dividend, when the market value per share of the common stock was $32. 3. On Dec. 5, the common stock dividend was issued. 4. On Dec. 20, a 3-for-1 stock split occurred for common stock. 5. On Dec. 30, Rothman purchased 100 shares of its own common stock for $14 per share. Instructions: A. Prepare the general journal entries to record each of the above transactions. B. Determine the number of common shares (1) issued and (2) outstanding at Dec. 31, 2024.arrow_forwardWeaver Corporation had the following stock issued and outstanding at January 1, Year 2: 1.147,000 shares of $4 par common stock. 2. 7,500 shares of $50 par, 5 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 7,500 shares of preferred stock and a $3 per share dividend for the common shareholders. The dividend will be paid on July 1 to the shareholders of record on June 20. 券 Required Determine the total amount of dividend to be paid to the preferred shareholders and common shareholders, 彩 Preferred stock Common stock Total dividend Mc Graw Hill Prey 15 of 20 Next >arrow_forwardThe annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $170,000 in the current year. It also declared and paid dividends on common stock in the amount of $2.70 per share. During the current year, Sneer had 1 million common shares authorized; 370,000 shares had been issued; and 163,000 shares were in treasury stock. The opening balance in Retained Earnings was $870,000 and Net Income for the current year was $370,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forward

- The shareholder's equity section of Chen Industries Limited at November 30, 2022 is shown below: Shareholders' Equity $1.50 cumulative preferred shares, 1,000 shares issued $ 50,000 Common shares, 10,000 shares issued Retained earnings $306,000 During 2023 the company completed the following transactions: 196,000 February 10 Declared a regular cash dividend on the preferred shares. March 10 Paid the cash dividend Declared a 10% stock dividend on April 14 the common shares. Market price per May 14 July 6 share REQUIRED: 60,000 1. November 20 Received equipment valued at $30,000 and issued 3,750 common shares. common share was $7/ share Distributed the stock dividend Issued 2,000 common shares for $5/ Journalize Chen's transactions. Explanations are not required. 2. Prepare the shareholder's equity section of Chen Industries Limited balance sheet atarrow_forwardPlease help mearrow_forwardOn January 1, 2022, Skysong, Inc. had $1,190,000 of common stock outstanding that was issued at par and retained earnings of $749,000. The company issued 43,000 shares of common stock at par on July 1 and earned net income of $395,000 for the year. Journalize the declaration of a 15% stock dividend on December 10, 2022, for the following two independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) No. Account Titles and Explanation (a) Par value is $10 and market price is $15. Par value is $5 and market price is $8. (b) Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Debit 277,425 147,960 Credit 184,950 277,425 92,475 332,910arrow_forward

- During the year ended December 31, 20--, Choi Company completed the following transactions: Apr. 15 Declared a semiannual dividend of $1.50 per share on preferred stock and $0.40 per share on common stock to shareholders of record on May 5, payable on May 10. Currently, 6,000 shares of $50 par preferred stock and 80,000 shares of $1 par common stock are outstanding. May 10 Paid the cash dividends. Oct. 15 Declared semiannual dividend of $1.50 per share on preferred stock and $0.40 per share on common stock to shareholders of record on November 5, payable on November 20. Nov. 20 Paid the cash dividends. 22 Declared a 10% stock dividend to common shareholders of record on December 8, distributable on December 16. Market value of the common stock was estimated at $7 per share. Dec. 16 Issued certificates for common stock dividend. 20 Board of directors declared a two-for-one common stock split. Required: Prepare journal entries for the transactionsarrow_forwardSubject: acountingarrow_forwardPet Boutique Corp, reported $4,365.410 of profit for 2023. On November 2, 2023, it declared and paid the annual preferred dividends of $283,560 On January 1, 2023, Pet Boutique had 111,410 and 567,000 outstanding preferred and common shares, respectively. The following transactions changed the number of shares outstanding during the year: Feb. 1 Declared and issued a 20% common share dividend. Apr.30 Sold 111,060 common shares for cash. May 1 Sold 45,550 preferred shares for cash. Oct. 31 Sold 32,760 common shares for cash. a. What is the amount of profit available for distribution to the common shareholders? Earnings available to common shareholders $ 4,081,850 Check my wark b. What is the weighted-average number of common shares for the year?arrow_forward

- The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $300,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.00 per share. During the current year, Sneer had 1 million common shares authorized; 500,000 shares had been issued; and 280,000 shares were in treasury stock. The opening balance in Retained Earnings was $700,000 and Net Income for the current year was $200,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forwardThe following information is available for ConocoPhillips on December 31, 2022: Common Stock, $1.75 par, 400,000 shares authorized Additional Paid in Capital - Common Stock Retained Earnings Total Stockholders' Equity During 2023, ConocoPhillips completed these transactions (in chronological order): 1) Declared and issued a 2.0% stock dividend on the outstanding stock. At that time, the stock was quoted at a market price of $20 per share. 2) Issued 2,400 shares of common stock at the price of $18 per share. 3) Net Income for the year was $410,400. Determine the ending balance in the Additional Paid in Capital - Common Stock account on December 31, 2023: Select one: O O $651,000 840,000 756,000 $2,247.000 a. $1,014,780 b. $1,025,000 c. $1,032,000 d. $975,780 e. $879,000 4arrow_forwardOriole Corporation was organized on January 1, 2021. During its first year, the corporation issued 1,950 shares of $50 par value preferred stock and 105,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $5,000; 2022, $13,900; and 2023, $27,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education