FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:### Cost Analysis of Patio Sets Production

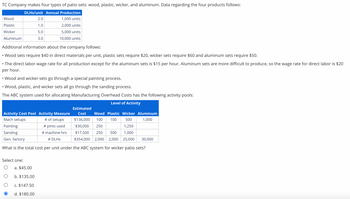

TC Company manufactures four types of patio sets: wood, plastic, wicker, and aluminum. Below is a comprehensive breakdown of the production data and cost allocation using the Activity-Based Costing (ABC) system.

#### Production Data

| Product Type | DLHs/unit | Annual Production |

|--------------|-----------|-------------------|

| Wood | 2.0 | 1,000 units |

| Plastic | 1.0 | 2,000 units |

| Wicker | 5.0 | 5,000 units |

| Aluminum | 3.0 | 10,000 units |

#### Additional Information

- **Direct Material Costs:**

- Wood: $40 per unit

- Plastic: $20 per unit

- Wicker: $60 per unit

- Aluminum: $50 per unit

- **Direct Labor Wage Rate:**

- Standard rate: $15/hour

- Aluminum: $20/hour due to production difficulty

- **Processes:**

- Wood and wicker sets undergo a special painting process.

- Wood, plastic, and wicker sets include a sanding process.

#### ABC System for Manufacturing Overhead Costs

The ABC system categorizes costs into activity pools, each defined by activity measures:

| Activity Cost Pool | Activity Measure | Estimated Cost | Level of Activity |

|--------------------|------------------|----------------|---------------------------|

| | | | Wood | Plastic | Wicker | Aluminum |

| Mach setups | # of setups | $136,000 | 100 | 100 | 500 | 1,000 |

| Painting | # pints used | $30,000 | 250 | | 1,250 | |

| Sanding | # machine hrs | $17,500 | 250 | 500 | 1,000 | |

| Gen. factory | # DLHs | $354,000 | 2,000| 2,000 | 25,000 | 30,000 |

#### Cost Calculation

The total cost per unit under the ABC system for wicker patio sets is calculated.

##### Question:

What is the total cost per unit under the ABC system for wicker patio sets?

##### Options:

- a. $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the activity rate for each activity cost pool. (Round your answers to 2 decimal places.)arrow_forward[The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: DirectLabor-Hoursper unit AnnualProduction Rims 0.40 18,000 units Posts 0.70 77,000 units Additional information about the company follows: Rims require $14 in direct materials per unit, and Posts require $11. The direct labor wage rate is $15 per hour. Rims are more complex to manufacture than Posts and they require special equipment. The ABC system has the following activity cost pools: Estimated Activity Activity Cost Pool Activity Measure EstimatedOverheadCost Rims Posts Total Machine setups Number of setups $ 30,030 120 80 200 Special processing Machine-hours $ 147,840 2,000 0 2,000 General factory Direct labor-hours $ 576,000 7,000 29,000 36,000 Required: 1. Compute the activity rate for each activity cost pool. (Round your answers to 2…arrow_forwardMartinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $6.20 $ 3.70 $ 1.60 $ 4.00 $3.20 $ 2.20 $ 1.20 $ 0.45 Foundational 1-3 (Algo) 3. If 8,000 units are produced and sold, what is the variable cost per unit produced and sold? Note: Round your answer to 2 decimal places.arrow_forward

- Mahaley, Incorporated, manufactures and sells two products: Product Q9 and Product FO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product 09 Product Fe Total direct labor-hours Product Q9 Product Fe The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $ 175.60 $ 147.40 Activity Cost Pools Labor-related Expected Production 870 870 Machine setups Order size The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Overhead Cost Direct Labor- Hours Per Unit 8.7 6.7 Activity Measures DLHS setups MHS Total Direct Labor- Hours 7,569 5,829 13,398 $ 386,680 47,330 288, 200 $ 722,210 Expected Activity Product Q9 Product Fe 7,569 5,829 650 550 3,800 3,600 Total 13,398 1,200 7,400 The unit product cost…arrow_forwardMemanarrow_forwardCane Company manufactures two products called Alpha and Beta that sell for $190 and $155, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 122,000 units of each product. Its average cost per unit for each product at this level of activity is given below: Alpha Beta Direct materials $ 40 $ 24 Direct labor 34 28 Variable manufacturing overhead 21 19 Traceable fixed manufacturing overhead 29 32 Variable selling expenses 26 22 Common fixed expenses 29 24 Total cost per unit $ 179 $ 149 The company’s traceable fixed manufacturing overhead is avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 15. Assume Cane’s customers would buy a maximum of 94,000 units of Alpha and 74,000 units of Beta. Also assume the company’s raw material available for production is limited to 228,000 pounds. If Cane uses its 228,000…arrow_forward

- BatCo makes baseball bats. Each bat requires 1.00 pounds of wood at $18 per pound and 0.35 direct labor hour at $30 per hour. Overhead is assigned at the rate of $60 per direct labor hour.arrow_forwardFogerty Company makes two products-titanium Hubs and Sprockets. Data regarding the two products follow: Direct Labor-Hours per Hubs Sprockets Unit 0.50 0.10 Annual Production 13,000 units 41,000 units Additional information about the company follows: a. Hubs require $35 in direct materials per unit, and Sprockets require $14. b. The direct labor wage rate is $10 per hour. c. Hubs require special equipment and are more complex to manufacture than Sprockets. d. The ABC system has the following activity cost pools: Activity Cost Pool (Activity Measure) Machine setups (number of setups) Special processing (machine-hours) General factory (organization-sustaining) Required: 1. Compute the activity rate for each activity cost pool. Estimated Overhead Activity Cost Hubs $ 20,790 105 Sprockets 84 Total $ 200,000 5,000 0 $ 68,000 NA NA 189 5,000 NA 2. Determine the unit product cost of each product according to the ABC systemarrow_forwardRequired information [The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts: Direct Labor- Hours per unit 0.40 0.60 Additional information about the company follows: a. Rims require $20 in direct materials per unit, and Posts require $18. b. The direct labor wage rate is $18 per hour. c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Activity Cost Pool Machine setups Special processing General factory Annual Production 26,000 units 88,000 units Unit product cost of Rims Unit product cost of Posts Activity Measure Number of setups Machine-hours Direct labor-hours. Estimated Overhead Cost $28,160 $ 164,560 $ 780,000 Estimated Activity Rims 110 2,000 10,400 Posts 90 0 52,800 Total 200 2,000 63,200 2. Determine the unit product cost of each product…arrow_forward

- Cane Company manufactures two products called Alpha and Beta that sell for $175 and $135, respectively. Each product uses only one type of raw material that costs $5 per pound. The company has the capacity to annually produce 117,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 40 30 18 26 23 26 $ 163 Beta $15 30 16 29 19 21 $ 130 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Maximum price to be paid per pound 15. Assume that Cane's customers would buy a maximum of 91,000 units of Alpha and 71,000 units of Beta. Also assume that the company's raw material available for production is limited to 225,000…arrow_forwardAileen Co manufactures two components, L and M. Both components are manufactured on the machine ZX. The following cost information per unit of L and M is available: Direct material Direct labour Variable overhead Fixed overhead Total cost L M ($) ($) 12 18 25 15 8 7 6 46 10 55 Component L requires three hours on machine ZX and component M requires five hours. Manufacturing requirements show a need for 1,500 units of each component per week. The maximum number of machine ZX hours available per week is 10,000. An external supplier has offered to supply Aileen Co with the components for a price of $57 per component L and $55 per component M. Identify, by clicking on the relevant boxes in the table below, whether each of the following statements are true or false. would be cheaper for Aileen Co to produce all the components in-house if the hours on machine ZX were available Aileen Co should purchase 400 units of component M from the external supplier TRUE TRUE FALSE FALSEarrow_forwardGable Company uses three activity pools. Each pool has a cost driver. Information for Gable Company follows: Total Cost of Pool $ 454,960 100,000 72,720 Estimated Cost Driver 96,800 10,000 505 Activity Pools Machining Designing costs Setup costs Suppose that Gable Company manufactures three products, A, B, and C. Information about these products follows: Product A Product B 38,000 4,000 40 Number of machine hours Number of design hours Number of batches Cost Driver Number of machine hours Number of design hours Number of batches Product A Product B Product C Total Overhead Assigned 48,000 2,200 170 Required: Using activity rates, determine the amount of overhead assigned to each product. Note: Do not round intermediate calculations. Round the final answer to nearest whole number. Product C 10,800 3,800 295arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education