Concept explainers

Accounts Receivables turnover ratio means the number of times a company collects its average accounts receivable balance per year. Accounts receivable turnover ratio is calculated by dividing your net credit sales by your average accounts receivable. The ratio is used to measure how effective a company is at extending credits and collecting debts. Generally, the higher the accounts receivable turnover ratio, the more efficient your business is at collecting credit from your customers.

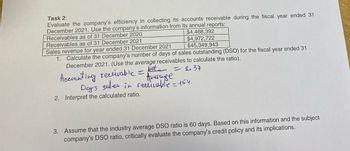

Average collection period also known as Days of sales outstanding (DSO) is calculated by dividing number of days in a period by accounts receivables turnover ratio. DSO measures the number of days it takes for a business to collect cash from its customers.

Step by stepSolved in 3 steps

- Task 2: Evaluate the company's efficiency in collecting its accounts receivable during the fiscal year ended 31 December 2021. Use the company's information from its annual reports: Receivables as of 31 December 2020 $4,468,392 $4,972,722 $45,349,943 Receivables as of 31 December 2021 Sales revenue for year ended 31 December 2021 1. Calculate the company's number of days of sales outstanding (DSO) for the fiscal year ended 31 December 2021. (Use the average receivables to calculate the ratio). Not Accounting receivable Average Day's sales in receivable = 154; 2. Interpret the calculated ratio. 3. Assume that the industry average DSO ratio is 60 days. Based on this information and the subject company's DSO ratio, critically evaluate the company's credit policy and its implications.arrow_forwardNumber 5arrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forward

- The financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardFollowing is some financial information of 250R Corp: 250 CORP Statement of Income For the years ended December 31, 2020 and 2021 Year Ended 31.12.2021 Sales Revenues Cost of Goods Sold Gross Margin Salaries expense Depreciation expense Interest expense Net income Long-term borrowings Accounts receivable Property, plant & equipment (PPE): Cost Accumulated Depreciation $750,000 (300,000) $450,000 (75,000) (70,000) (30,000) $275,000 Some Selected Balance Sheet Data As at 31.12.2021 $300.000 $525,000 $350,000 210,000 Year Ended 31.12.2020 $500,000 (200,000) $300,000 (50,000) (70,000) (30,000) $150,000 As at 31.12.2020 $300.000 $250.000 $350,000 140,000arrow_forwardThe following information was taken from the accounts receivable records of Pina Colada Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $154,000 0.5% 31 – 60 days outstanding 63,200 2.5% 61 – 90 days outstanding 39,100 4.0% 91 – 120 days outstanding 21,600 6.5% Over 120 days outstanding 5,300 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,170 prior to the adjustment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,990 prior to…arrow_forward

- The following information is from the annual financial statements of Raheem Company, Year 2 Year 3 $ 270,000 20,900 $ 201,000 16,700 Net sales Accounts receivable, net (year-end) (1) Compute its accounts receivable turnover for Year 2 and Year 3. (2) Assuming its competitor has a turnover of 20.5, is Raheem performing better or worse at collecting receivables than its competitor? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute its accounts receivable turnover for Year 2 and Year 3. Year 2: Year 3:1 Choose Numerator: 7 1 1 Accounts Receivable Turnover Choose Denominator: (Required 1 Year 1 $ 248,000 15,400 W Accounts Receivable Turnover Accounts receivable turnover = Required 2 > times timesarrow_forwardNumber 1arrow_forwardJudon Corp. provides the following information from its annual report. Assume all revenues are credit sales. The cost of revenues can be used as an approximation of the company's purchases for the year. Revenues $ 546,190 Cost of revenues $ 340,275 Inventories as of 31 January 2022 $44,064 Inventories as of 31 January 2021 $41,020 Accounts payable as at 31 January 2022 $58,600 Accounts payable as at 31 January 2021 $51,800 Accounts receivable as at 31 January 2022 $7,482 Accounts receivable as at 31 January 2021 $5,434 Compute the following financial ratios for Judon Corp for 2022 1. Account Receivable Turnover Ratio (Times)? 2. Collection Interval (DSO) / Days? 3. Inventory Turnover Ratio (Times) ? 4. Holding Interval (Days) ? 5. Account Payable Turnover Ratio (Times)? 6.Payment Interval (Days)? 7. Does Judon Corp need short-term financing? 8. Using the information provided, compute the change in operating working captialarrow_forward

- Macroware Corporation reported the following information in its financial statements for three successive quarters ($ in millions): Three Months Ended 6/30/2020 () 3/31/2020 (Q3) 12/31/2019 () Balance Sheets: Accounts receivable, net Income statements : Sales revenue $15, 761 $ 19,810 $ 12,900 24, 550 $ 23,330:22,120 Required: Compute the receivables turnover ratio and the average collection period for Q4 and Q3. Assume that each quarter consists of 91 days. Note: Round "Receivables turnover ratio " answers to 3 decimal places and " Average collection period" answers to 2 decimal places. Receivables turnover ratio Q4 times Receivables turnover ratio Q3 1.427 times Average collection period Q4 Average collection period Q3 days 63.79 days Balance Sheets: Accounts receivable, net Income statements: Sales revenue Macroware Corporation reported the following information in its financial statements for three successive quarters ($ in millions): Three Months Ended 3/31/2020 (03) 12/31/2019…arrow_forwardPlease helparrow_forwardYou are considering two possible companies for investment purposes. The following data is available for each company. Company A Net credit sales, Dec. 31, 2019 $540,000 Net Accounts receivable, Dec 31, 2018 $120,000 Net accounts receivable, Dec 31, 2019 $180,000 Number of days sales in receivables ratio, 2018 103 days Net Income, Dec. 31, 2018 $250,000 Company B Net credit sales, Dec. 31, 2019 $620,000 Net Accounts receivable, Dec 31, 2018 $145,000 Net accounts receivable, Dec 31, 2019 $175,000 Number of days sales in receivables ratio, 2018 110 days Net Income, Dec. 31, 2018 $350,000 Additional Information: Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education