FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

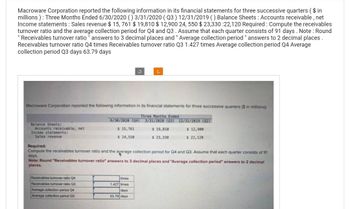

Transcribed Image Text:Macroware Corporation reported the following information in its financial statements for three successive quarters ($ in

millions): Three Months Ended 6/30/2020 () 3/31/2020 (Q3) 12/31/2019 () Balance Sheets: Accounts receivable, net

Income statements : Sales revenue $15, 761 $ 19,810 $ 12,900 24, 550 $ 23,330:22,120 Required: Compute the receivables

turnover ratio and the average collection period for Q4 and Q3. Assume that each quarter consists of 91 days. Note: Round

"Receivables turnover ratio " answers to 3 decimal places and " Average collection period" answers to 2 decimal places.

Receivables turnover ratio Q4 times Receivables turnover ratio Q3 1.427 times Average collection period Q4 Average

collection period Q3 days 63.79 days

Balance Sheets:

Accounts receivable, net

Income statements:

Sales revenue

Macroware Corporation reported the following information in its financial statements for three successive quarters ($ in millions):

Three Months Ended

3/31/2020 (03) 12/31/2019 (02)

$ 19,810

$ 12,900

$ 23,330

$ 22,120

Ű

Receivables tumover ratio 04

Receivables tumover ratio 03

Average collection period Q4

Average collection period 03

6/30/2020 (04)

$ 15,761

$ 24,550

C

Required:

Compute the receivables turnover ratio and the average collection period for Q4 and Q3. Assume that each quarter consists of 91

days.

Note: Round "Receivables turnover ratio" answers to 3 decimal places and "Average collection period" answers to 2 decimal

places.

times

1.427 times

days

63.79 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company reports the following: Sales $890,600 Average accounts receivable (net) 44,530 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover 20 b. Number of days' sales in receivables 18 X daysarrow_forwardThe following data are taken from the financial statements of Colby Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 Accounts Receivable turnover Average collection period (b) 2022 $550,000 2022 2021 4,300,000 4,000,000 7.9 times $540,000 2021 7.5 times 46.2 days 48.7 days What conclusions about the management of accounts receivable can be drawn from the accounts receivable turnover and the average collections period.arrow_forwardA company reports the following: Sales $838,040 Average accounts receivable (net) 51,100 Round your answers to one decimal place. Assume a 365-day year. a. Determine the accounts receivable turnover. b. Determine the number of days' sales in receivables.arrow_forward

- A company reports the following: Line Item Description Amount Sales $235,060 Average accounts receivable (net) 51,100 Determine (a) the accounts receivable turnover and (b) the days’ sales in receivables. When required, round your answers to one decimal place. Assume a 365-day year. Line Item Description Answer a. Accounts receivable turnover b. Days' Sales in Receivablesarrow_forwardThe financial statements of Bolero Manufacturing Inc. report net credit sales of $900,000 and accounts receivable of S80,000 and $40,000 at the beginning of the year and end of the year, respectively. What is the average collection period for accounts receivable in days (rounded)? O 49 days O 16 days 24 days 32 daysarrow_forwardAccounts Receivable Turnover and Average Collection Period The Forrester Corporation disclosed the following financial information (in millions) in its recent annual report: Net Sales Beginning Accounts Receivable (net) Ending Accounts Receivable (net) Previous Year Current Year $67,096 3,896 3,696 $81,662 3,696 3,598 a. Calculate the accounts receivable turnover ratio for both years. (Round your answer to two decimal points.) b. Calculate the average collection period for both years. (Use 365 days for calculation. Round to the nearest whole number.) c. Is the company's accounts receivable management improving or deteriorating? a. Accounts receivable turnover b. Average collection period Previous Year 17.7 x Current Year 22.4 x 21▾ 16 c. The company's receivable management Improved Checkarrow_forward

- A company reports the following: Line Item Description Amount Sales $1,069,085 Average accounts receivable (net) 105,850 Determine (a) the accounts receivable turnover and (b) the days’ sales in receivables. When required, round your answers to one decimal place. Assume a 365-day year.arrow_forwardAccounts Receivable Turnover and Average Collection Period The Forrester Corporation disclosed the following financial information (in millions) in its recent annual report: Previous Year Current Year Net Sales $157,105 $171,669 Beginning Accounts Receivable (net) 11,899 11,369 Ending Accounts Receivable (net) 11,369 11,544 Calculate the accounts receivable turnover ratio for both years. (Round your answer to two decimal points.) Calculate the average collection period for both years. (Use 365 days for calculation. Round to the nearest whole number.) Is the company's accounts receivable management improving or deteriorating? Previous Year Current Year a. Accounts receivable turnover Answer Answer b. Average collection period Answer Answer c. The company's receivable management Answerarrow_forwardThe following data are taken from the financial statements of Sigmon Inc. Accounts receivable, end of year Sales on account 20Y2 $182,600 $197,000 1,043,900 1,001,560 20Y3 1. Accounts receivable turnover For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 20Y2 2. Number of days' sales in receivables 20Y1 20Y3 $211,800 Days Daysarrow_forward

- The following is select financial statement information from Vortex Computing: Year Net Credit Sales Ending Accounts Receivable 2018 $1,557,200 $398,000 2019 $1,755,310 $444,400 2020 $1,865,170 $500,780 Compute the accounts receivable turnover ratios and the number of days’ sales in receivables ratios for 2019 and 2020 (round answers to two decimal places): 2019 Accounts Receivable Turnover = ["", "", "", ""] times. 2019 Days' Sales in Receivables = ["", "", "", ""] days. 2020 Accounts Receivable Turnover = ["", "", "", ""] times. 2020 Days' Sales in Receivables = ["", "", "", ""] days.arrow_forwardsarrow_forwardPlease Do not Give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education