FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

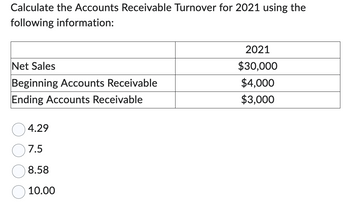

Transcribed Image Text:Calculate the Accounts Receivable Turnover for 2021 using the

following information:

Net Sales

Beginning Accounts Receivable

Ending Accounts Receivable

4.29

7.5

8.58

10.00

2021

$30,000

$4,000

$3,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following financial statement information from Black Water Industries. BLACK WATER INDUSTRIES Ending Accounts Receivable Year Net Credit Sales 2017 $690,430 $335,250 2018 705,290 364,450 2019 770,500 406,650 A. Compute the accounts receivable turnover ratios for 2018 and 2019. Round your answers to two decimal places. 2018 times 2019 times B. Using the accounts receivable turnover, choose the statement that most closely describes the company's management of its receivables. a. The company's lending policies may be too strict. b. Collection efforts are not aggressive enough. There may be uncollectable receivables affecting the beginning and ending C. balances. d. All of the above statements may be correct. a b darrow_forwardYao Company reports the following in its 2021 annual report: Sales Accounts Receivable 2021 2020 2019 $2,650,000 $2,800,000 $2,500,000 $250,000 $240,000 $200,000 Answer the following question(s) by filling in the blanks. Do not include any symbols besides decimals in your answers (do not input commas). Formulas are provided after the questions. 1. Calculate the accounts receivable turnover for A. 2021. [1A] times B. 2020. [2A] times Accounts Receivable Turnover = Sales Revenue / Average Accounts Receivable [1A] = 11.52 x (/10.8+/) [1B] = 12.17 x (/12.7+/) 2. Calculate the average collection period for A. 2021. [2A] days B. 2020. [2B] days Average Collection Period Average Accounts Receivable / Average Daily Sales = 365/ Accounts Receivable Turnover = Yao Company reports the following in its 2021 annual report: Sales Accounts. Receivable C 2021 2020 2019 $2,650,000 $2,800,000 $2,500,000 $250,000 $240,000 $200,000 Answer the following question(s) by filling in the blanks. Do not include…arrow_forwardNumber 3arrow_forward

- Walmart Inc (WMT) has the following excerpts from their financial statements January 31, 2022 January 31, 2021 Net Receivables * (in $ Millions) 8,280 6,516 *Net Receivable = Gross receivable minus Allowance Walmart’s fiscal year “FY22” is defined as the period between February 1, 2021 – January 31, 2022 Gross (Accounts) Receivables, January 31, 2022: $9,265 Million Gross Receivables, January 31, 2021: $7,421 Million Accounts Written-off in FY 22 $221 Million 2% of credit sales is assumed to be uncollectable CALCULATE The ending balance of Allowance for uncollectable accounts as of January 31, 2022 Bad Debt Expense for the fiscal year ending on January 31, 2022. Collections during FY22arrow_forwardThe following data are taken from the financial statements of Sigmon Inc. Accounts receivable, end of year Sales on account 20Y2 $182,600 $197,000 1,043,900 1,001,560 20Y3 1. Accounts receivable turnover For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 20Y2 2. Number of days' sales in receivables 20Y1 20Y3 $211,800 Days Daysarrow_forwardJoseph Co. reported the following financial information for 2020: Accounts receivable, January 1, 2020 P1,200 Accounts Receivable, December 31, 2020 250 Cash collection from customer on account 1,300 Joseph Co.’s service revenue rendered on account to clients amounted toarrow_forward

- How do I solve this?arrow_forwardThe following select financial statement information from Candid Photography. CANDID PHOTOGRAPHY Year Net Credit Sales Ending Accounts Receivable 2017 $2,988,000 $1,290,450 2018 2019 3,750,860 4,000,350 1,345,600 1,546,550 Compute the accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What is the Average Accounts Receivable? What is the Net Credit Sales that would be used? What is the Accounts Relievable Turnover? what is the Days in Receivable Ratio?arrow_forwardTask 2: Evaluate the company's efficiency in collecting its accounts receivable during the fiscal year ended 31 December 2021. Use the company's information from its annual reports: Receivables as of 31 December 2020 $4,468,392 $4,972,722 $45,349,943 Receivables as of 31 December 2021 Sales revenue for year ended 31 December 2021 1. Calculate the company's number of days of sales outstanding (DSO) for the fiscal year ended 31 December 2021. (Use the average receivables to calculate the ratio). Not Accounting receivable Average Day's sales in receivable = 154; 2. Interpret the calculated ratio. 3. Assume that the industry average DSO ratio is 60 days. Based on this information and the subject company's DSO ratio, critically evaluate the company's credit policy and its implications.arrow_forward

- As of December 31, 2017 Cash $ 17,900 Accounts payable $ 29,500 Accounts receivable $ 39,600 Notes payable 15,400 Less: Allowance for doubtful accounts 3,200 36,400 Unearned revenue 3,800 Inventory 61,100 Total current liabilities $ 48,700 Prepaid expenses 7,400 Total current assets $ 122,800 The following errors in the corporation's accounting have been discovered: Keane collected $ 5,200 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company's controller recorded the amount as revenue. 1. The inventory amount reported included $ 2,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $ 1,600 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30. 2. Sales for the first day in January 2018 in the amount of $ 11,100 were entered in the sales journal as of December 31, 2017. Of these, $ 7,000 were sales on…arrow_forwardNumber 5arrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education