Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting question

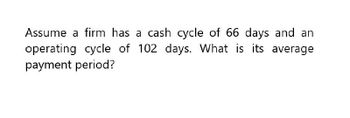

Transcribed Image Text:Assume a firm has a cash cycle of 66 days and an

operating cycle of 102 days. What is its average

payment period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume a firm has a cash cycle of 38 days and an operating cycle of 63 days. What is its average payment period? Average payment period daysarrow_forwardIf the average age of the inventory is 90 days, the average age of accounts payable is 65 days, and the average age of accounts receivable is 60 days, how many days would be the net cash cycle?arrow_forwardA firm with a cash conversion cycle of 40 days can stretch its average payment period from 15 days to 20 days. This will result in a/an ... O a. decrease of 20 days in the cash conversion cycle. b. decrease of 5 days in the cash conversion cycle. increase of 5 days in the cash conversion cycle. X Od. increase of 20 days in the cash conversion cycle. C. Which of the following inarrow_forward

- For the Bayer Company, the average age of accounts receivable is 60 days, the average age of accounts payable is 45 days, and the average age of inventory is 72 days. Assuming a 365-day year, what is the length of of the firm's cash conversion cycle?arrow_forwardConsider a uniform series of cash flows. The first cash flow of $10,000 occurs at time 10 and the last cash flow in the series occurs at time 20. If the interest rate is 8% per period, what is the present equivalent (time = 0) of the series of cash flows?arrow_forwardA firm has an average age of inventory of 100 days, an average collection period of 40 days, and an average payment period of 30 days. The firm's cash conversion cycle is?arrow_forward

- ML has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 50 days Average collection period = 17 days Payables deferral period = 25 days 34 days 46 days 31 days 38 days O 42 daysarrow_forwardEdward Lewis is an accounting major at a midwestern state university located approximately 60 miles from a major city. Many of the students attending the university are from the metropolitan area and visit their homes regularly on the weekends. Edward, an entrepreneur at heart, realizes that few good commuting alternatives are available for students doing weekend travel. He believes that a weekend commuting service could be organized and run profitably from several suburban and downtown shopping mall locations. Edward has gathered the following investment information. Five used vans would cost a total of $76,194 to purchase and would have a 3-year useful life with negligible salvage value. Edward plans to use straight-line depreciation. 1. 2. Ten drivers would have to be employed at a total payroll expense of $47,400. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,100, Maintenance $3,200, Repairs $4,100, Insurance $3,800, and…arrow_forwardThe expected period of time that will elapse between the date of a capital investment and thecomplete recovery of the amount of cash investedis called: A.The average rate of return period B.The cash payback period C.The net present value period D.The internal rate of return periodarrow_forward

- Romano Inc. has the following data. What is the firm's cash conversion cycle? Inventory Conversion Period = 59 days Receivables Collection Period = 19 days Payables Deferral Period = 41 days Please explain process and show calculations.arrow_forwardIF DAYS INVENTORY OUTSTANDING IS 30, DAYS SALES OUTSTANDING IS 25, AND DAYS PAYABLE OUTSTANDING IS 20, WHAT IS THE CASH CONVERSION CYCLE?arrow_forwardConsider a series of cash flows that starts with $1,000 at the end of time 1 and decreases by $20 each period. The last cash flow in the series occurs at time 15. If the interest rate is 8% per period, what is the present equivalent (time = 0) of the series of cash flows?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning