FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What will be the balance reported as a liability?

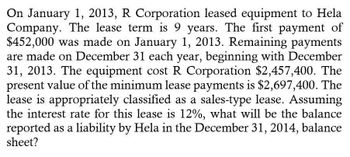

Transcribed Image Text:On January 1, 2013, R Corporation leased equipment to Hela

Company. The lease term is 9 years. The first payment of

$452,000 was made on January 1, 2013. Remaining payments

are made on December 31 each year, beginning with December

31, 2013. The equipment cost R Corporation $2,457,400. The

present value of the minimum lease payments is $2,697,400. The

lease is appropriately classified as a sales-type lease. Assuming

the interest rate for this lease is 12%, what will be the balance

reported as a liability by Hela in the December 31, 2014, balance

sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Skor Co. leased equipment to Douglas Corp. on January 2, 2011, for an 8-year period expiring December 31, 2018. Equal payments under the lease are $600,000 and are due on January 2 of each year. The first payment was made on January 2, 2011. The cost of the equipment is $2,800,000. The lease is appropriately accounted for as a sales-type lease. The present value of the lease payments is $3,300,000. What amount of net profit on the sale should Skor report for the year ended December 31, 2011? a. $720,000 b. $500,000 c. $90,000 d. $600,000 e. $2,800,000arrow_forwardedom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2013. The lease terms, provisions, and related events are as follows: 11 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,00 to be made in advance at the beginning of eacy year. 2. The equipment costs $313,000. the equipment has an estimatd life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the leae is 14%. 5. The intial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Prepare journal entries for Edom for the years 2013 and 2014. Do not give answer in image formatearrow_forwardedom Company, the lessor, enters into a lease with Davis Company to lease equipment to Davis beginning January 1, 2013. The lease terms, provisions, and related events are as follows: 11 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of $100,00 to be made in advance at the beginning of eacy year. 2. The equipment costs $313,000. the equipment has an estimatd life of 6 years and, at the end of the lease term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs. 4. The interest rate implicit in the leae is 14%. 5. The intial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Prepare journal entries for Edom for the years 2013 and 2014.arrow_forward

- Berne Company (lessor) enters into a lease with Fox Company to lease equipment to Fox beginning January 1, 2016. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease noncancelable and requires annual rental payments of $50,000 to be made at the end of each year. 2. The equipment costs $130,000. The equipment has an estimated life of 4 years and an estimated residual value at the end of the lease term of zero 3. Fox agrees to pay all executory costs. 4. The interest rate implicit in the lease is 12%. 5. The initial direct costs are insignificant and assumed to be zero. 6. The collectibility of the rentals is reasonably assured, and there are no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor. Required: 1. Next Level Determine if the lease is a sales-type or direct financing lease from Berne's point of view (calculate the selling price and assume that this is also the fair value).…arrow_forwardOn June 30, 2016, Georgia-Atlantic, Inc., leased a warehouse facility from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $562,907 over a three-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2016. Georgia-Atlantic’s incremental borrowing rate is 10%, the same rate IC uses to calculate lease payment amounts. Depreciation is recorded on a straight-line basis at the end of each fiscal year. The fair value of the warehouse is $3 million. Required: 1. Determine the present value of the lease payments at June 30, 2016 (to the nearest $000) that Georgia-Atlantic uses to record the leased asset and lease liability. 2. What amounts related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2016 (ignore taxes)? 3. What amounts related to the lease would Georgia-Atlantic report in its income statement for the year ended December 31, 2016 (ignore taxes)?arrow_forwardTimmer Company signs a lease agreement dated January 1, 2016, that provides for it to lease equipment from Landau Company beginning January 1, 2016. The lease terms, provisions, and related events are as follows: • The lease is noncancelable and has term of 5 years. • The annual rentals are $83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. • Timmer agrees to pay all executory costs at the end of each year. In 2016, these were insurance, $3,760; property taxes, $5,440. In 2017: insurance, $3,100; property taxes, $5,330. • There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of $300,000, an economic life of 5 years, and a zero residual value. Timmer's incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of…arrow_forward

- Allied Industries manufactures high-performance conveyers that often are leased to industrial customers. On December 31, 2016, Allied leased a conveyer to Poole Carrier Corporation for a three-year period ending December 31, 2019, at which time possession of the leased asset will revert back to Allied. Equal payments under the lease are $200,000 and are due on December 31 of each year. The first payment was made on December 31, 2016. Collectibility of the remaining lease payments is reasonably assured, and Allied has no material cost uncertainties. The conveyer cost $450,000 to manufacture and has an expected useful life of six years. Its normal sales price is $659,805. The expected residual value of $150,000 at December 31, 2019, is guaranteed by United Assurance Group. Poole Carrier’s incremental borrowing rate and the interest rate implicit in the lease payments are 10%. Required: 1. Show how Allied Industries calculated the $200,000 annual lease payments. 2. How should this lease…arrow_forwardOn June 30, 2021, Hercule, Inc. leased warehouse equipment from Marble, Inc. The lease agreement calls for Hercule to make semiannual lease payments of $1,828,052 over a three-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2021. Hercule's incremental borrowing rate is 6%, the same rate Marble used to calculate lease payment amounts. Marble manufactured the equipment at a cost of $9.5 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which Marble is "selling" the equipment (present value of the lease payments) at June 30, 2021. 2. What amounts related to the lease would Marble report in its balance sheet at December 31, 2021? (Ignore taxes.) 3. What would be the net effect of the lease that Marble would report in its income statement for the year ended December 31, 2021? (Ignore taxes.) (For all requirements, round your…arrow_forwardOn January 1, 2024, Gravel Incorporated leased construction equipment from Rocky Mountain Leasing. Rocky Mountain Leasing purchased the equipment from Bishop Incorporated at a cost of $2,069,621. Gravel's borrowing rate for similar transactions is 10%. The lease agreement specified four annual payments of $432,000 beginning January 1, 2024, the beginning of the lease, and at each December 31 thereafter through 2026. The useful life of the equipment is estimated to be six years. The present value of those four payments at a discount rate of 10% is $1,506,319. On January 1, 2026 (after two years and three payments), Gravel and Rocky Mountain agreed to extend the lease term by two years. The market rate of interest at that time was 9%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare the appropriate journal entries for Gravel Incorporated on January 1, 2026, to adjust its lease liability for the…arrow_forward

- Eubank Company, a lessee, enters into a lease agreement on January 1, 2021, for equipment. The following data are relevant to the lease agreement: - The term of the noncancelable lease is 4 years. Payments of $978,446 are due on January 1 of each year. The first payment is January 2021. - The fair value of the equipment on January 1, 2021 is $3,500,000. The equipment has an economic life of 6 years with nosalvage value. - Eubank uses the straight-line method of depreciation. - Eubank’s implicit rate is 8%. - This will be treated as a finance lease (Lessee Perspective). Instructions: Prepare the journal entries on Eubank’s books (lessee) that relate to the lease agreement for the following dates, you do not need to create an amortization schedule. a. January 1, 2021. b. December 31, 2021.arrow_forwardOn Jan 1, 20x1, Panda Yummy entered into an agreement to lease packaging equipment from RCT financing. The lease was for 6 years, commencing immediately on January 1, 20x1. Under the agreement, Panda Yummy would make a lease payment of $24,000 at the beginning of each of the 6 years. The equipment was expected to have an economic life of 1O years. Under the agreement, Panda Yummy had the option of purchasing the packaging equipment for $2,000 at the end of the lease term, when the equipment was expected to be worth $8,000. The lessor's rate of return on the leasing arrangement was 7% Panda Yummy had a year-end of Dec 31. Required Prepare an amortization table for Panda Yummy for the lease. Prepare all Journal entries for 20x1 and 20X2 Prepare the journal entries that Panda Yummy would make when exercising the bargain purchase option at the end of the lease term.arrow_forwardOn January 1, 2010, Gallant Company entered into a lease agreement with Blacksheep Company for a machine which was carried on the accounting records of Gallant at P2,000,000. Total payments under the lease which expires on December 31, 2019, aggregate P3,550,800 of which P2,400,000 represents cost of the machine to Blacksheep. Payments of P355,080 are due each January 1 of each year. The interest rate of 10% which was stipulated in the lease is considered fair and adequate compensation to Gallant for the use of its funds. Blacksheep expects the machine to have a 10-year life, no residual value and be depreciated on a straight line basis. The lease is to be conceived as a sales type lease. What should be the total income before income tax derived by Gallant from this lease for the year ended December 31, 2010? a. 204,492 b. 604,492 c. 355,080 d. 755,080arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education