Concept explainers

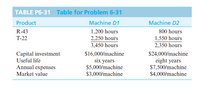

A new manufacturing facility will produce two products, each of which requires a drilling operation during processing. Two alternative types of drilling machines (D1 and D2) are being considered for purchase. One of these machines must be selected. For the same annual demand, the annual production requirements (machine hours) and the annual operating expenses (per machine) are listed in the shown Table. Which machine should be selected if the MARR is 15% per year? Show all your work to support your recommendation. Assumptions: The facility will operate 2,000 hours per year. Machine availability is 80% for Machine D1 and 75% for Machine D2. The yield of D1 is 90%, and the yield of D2 is 80%. Annual operating expenses are based on an assumed operation of 2,000 hours per year, and workers are paid during any idle time of Machine D1 or Machine D2. State any other assumptions needed to solve the problem.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- You are considering two different methods of constructing a new warehouse. The first method uses prefabricated building segments, would have an initial cost of $4.8 million, would have annual maintenance costs of $100,000 and would last for 25 years. The second alternative would employ a new carbon fibre panel technology, would have an initial cost of $6 million would have maintenance costs of $525,000 every ten years and is expected to last 40 years. Both buildings are in CCA class 1 (CCA rate of 4%). The salvage value for each would be 25% of initial cost. The firm uses a 15% cost of capital and it has a 38% tax rate. Calculate the NPV for each machine using the six step approach (nearest dollar without dollar sign ($) or comma eg 15000) Negative cash flow is -15000): What is the NPV for Alternative A? What is the NPV for Alternative B? What is the EAC for Alternative A? What is the EAC for Alternative B?arrow_forwardI could use a hand with thisarrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flowarrow_forward

- You are considering relocating your outdoor-equipment manufacturing plant and have narrowed your choices to four possible locations based on the availability of high quality labor, rail transportation, and an adequate distribution network. Based on the following costs and benefits associated with each location, use incremental analysis and IRR to choose the most cost-effective location assuming MARR = 15%. Initial cost (Year 0) Annual operations and maintenance costs (Years 1 thru 5) Annual gross benefits (Years 1 thru 5) Upload Choose a File Question 6 Portland, OR Bend, OR Boise, ID $700,000 $800,000 $600,000 500,000 800,000 Seattle, WA $1,000,000 1,000,000 400,000 1,100,000 You consider purchasing a new piece of equipment (7yr MACRS property) f 1,375,000 625,000 1,500,000 sod POLE 1-10 1arrow_forwardYou have been asked to determine the most financially advantageous option for a new Product Packaging machine. It has been determined by the Marketing Department that product packaging actually makes a difference in the anticipated Yearly Revenue generated by this product and have been provided below. The director now wants an annual worth analysis performed on the two final designs based on a shortened project life of only 9 years. Compare the alternatives at the MARR of 10% per year. (all dollar values are in thousands) Packaging Packaging Machine Design Machine Design A B First Cost, $ -900 -1,500 AOC, $ per year -200 -300 Salvage value, $ (after 7 years of use) 200 Salvage value, $ (after 3 years of use) 100 Salvage value, $ (after 2 years of use) 20 50 Annual revenue, $ per year 800 900 Life, years 3 7 AW ($K per year) for one full life 268.312 312.967 cycle AW for a particle life of 2 years ($K 90.953 -240.476 per year) Assuming that the AW values for Designs A and B provided in…arrow_forwardYou are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $400 per unit and sales volume to be 1,000 units in year 1; 1,500 units in year 2; and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $165,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $35,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What change in NWC occurs at the end of year 1?arrow_forward

- You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $450 per unit and sales volume to be 1,200 units in year 1; 1,325 units in year 2; and 1,000 units in year 3. The project has a 3-year life. Variable costs amount to $250 per unit and fixed costs are $100,000 per year. The project requires an initial investment of $150,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $30,000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 10 percent. What is the operating cash flow for the project in year 2? Note: Enter your answer as a whole number. Operating cash flowarrow_forwardYou are investigating the cost of project to renovate the kitchens in a large apartment building, the payments for this work will be $32,500 up front and $13500 a month for 8 months, followed by a completion payment of $31500. To start this project you will need to purchase equipment for $70,000 at the beginning of the project and you expect monthly materials and operating costs to be about $7,500. The Rate of Return is 12%. What is the total PV of the 8 monthly payments of $13500 per month. You should assume that the payments are made at the end months 1 through 8. (So this is a ordinary simple annuity). Round your answer to the nearest penny. Your Answer: Answerarrow_forwardYou have been given the construction and marketing studies for the proposed project. Several sites have been selected, but a decision has not been made. Your boss needs to know how much he can afford to pay for the land and still manage to return 16% on the entire project. The strategic plan calls for a construction phase of 1 year and an operation phase of 5 years, after which time the property will be sold. The staff says that a 1.3-acre site will be adequate because the studies indicate that this site will support the project with a gross leasable area (GLA) of 26,520 square feet. The gross building area (GBA) will be 31,200 square feet, giving a leasable ratio of 85%. The staff further assures you that the space can be rented for $20.4 per square foot. The head of the construction division maintains that all direct costs (excluding interest carry and all loan fees) will be $3.5 million. The Grace bank will provide the construction loan for the project. The bank will finance all of…arrow_forward

- You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units In year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial Investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What change in NWC occurs at the end of year 1? (Enter a decrease as a negative amount using a minus sign.) Decrease ofarrow_forwardOregon Equipment Company wants to develop a new log-splitting machine for rural homeowners. Market research has determined that the company could sell 6,000 log-splitting machines per year at a retail price of $700 each. An independent catalog company would handle sales for an annual fee of $2,000 plus $50 per unit sold. The cost of the raw materials required to produce the log-splitting machines amounts to $80 per unit. If company management desires a return equal to 10 percent of the final selling price, what is the target conversion and administrative cost per unit? Round answer to the nearest cent.arrow_forwardYour company is deciding whether to purchase a high-quality printer for your office or one of lesser quality. The high-quality printer costs $45 000 and should last five years. The lesser quality printer costs $25 000 and should last two years. If the cost of capital for the company is 12 per cent, then what is the equivalent annual cost for the best choice for the company?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education