Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

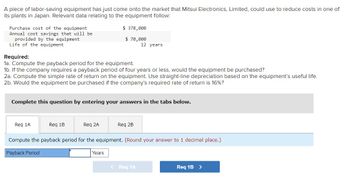

Transcribed Image Text:A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Limited, could use to reduce costs in one of

its plants in Japan. Relevant data relating to the equipment follow:

Purchase cost of the equipment

Annual cost savings that will be

provided by the equipment

Life of the equipment

Required:

1a. Compute the payback period for the equipment.

1b. If the company requires a payback period of four years or less, would the equipment be purchased?

2a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment's useful life.

2b. Would the equipment be purchased if the company's required rate of return is 16%?

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

$ 378,000

$ 70,000

12 years

Req 2A

Years

Req 2B

Compute the payback period for the equipment. (Round your answer to 1 decimal place.)

Payback Period

< Req 1A

Req 1B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please tutor help me with this questionarrow_forwardA pipeline engineer working in Kuwait for the oil giant BP wants to perform a present worth analysis on alternative pipeline routings-the first predominately by land and the second primarily undersea. The undersea route is more expensive initially due to extra corrosion protection and installation costs, but cheaper security and maintenance reduces annual costs. Perform the annual worth analysis for the engineer at 12% per year as basis of choosing which route is to be selected. Land Undersea Installation cost P 315,000,000 P 450,000,000 Pumping, operating, security per year P 18,000,000 P 4,200,000 Replacement of valves and P 40,000,000 P 85,000,000 appurtenances in year 25 Life, years 50 50arrow_forwardA company is considering supplying employees with company cars. Employee travel is expected to be a total of 30,000 miles per year for all employees. Supplying employees with company cars would involve the following cost components: Car purchase: $22,000 with an estimated 3-year life Salvage value: $5000 Insurance cost: $1000/year Operating and maintenance expenses: $0.22 per mile The company uses a MARR of 10%. The total cost per mile of providing company cars to employees is: $ per mile (Round the answer to two decimal places. Do not enter the dollar symbol or the words per mile in you answer. If the number is a fraction less than one, include the leading zero in the answer. eg. 0.12) The company pays employees $0.40 per mile to use their own car. Compare this with the number you calculated in the previous question. The company should provide cars to its employees? Type Yes or No for the decision:arrow_forward

- A company purchases a component, which is critical in the production process, from an international supplier. Recently, quality problems with this component have increased. For this reason, managers of the company are considering of producing this part in-house. The economic life of the new production system will be 8 years. The savings and expenditures related to the new production system are given below. The MARR is 15%. According to the information, answer the questions from 8 to 9. Capital expenditures (Investment costs): Building: 500,000 TL Machines and equipment: 2,200,000 TL The annual saving from material and quality control: 5,000,000 TL Annual operating cost: 1,500,000 TL Annual income tax: 800,000 TL Salvage value: 1,500,000 TL 8. What is the discounted payback period of the new production system? A.Less than 1 year B.1 year C.between 1 and 2 years D.between 2 and 3 years 9. What is the net present worth of the new production system? A.9,415,000 TL…arrow_forwardHiren Add explanationarrow_forwardThanks to acquisition of a key patent, your company now has exclusive production rights for barkelgassers (BGs) in North America. Production facilities for 245,000 BGs per year will require a $25.9 million immediate capital expenditure. Production costs are estimated at $74 per BG. The BG marketing manager is confident that all 245,000 units can be sold for $109 per unit (in real terms) until the patent runs out five years hence. After that, the marketing manager hasn’t a clue about what the selling price will be. Assume the real cost of capital is 10%. To keep things simple, also make the following assumptions: The technology for making BGs will not change. Capital and production costs will stay the same in real terms. Competitors know the technology and can enter as soon as the patent expires, that is, they can construct new plants in year 5 and start selling BGs in year 6. If your company invests immediately, full production begins after 12 months, that is, in year 1. (Assume it…arrow_forward

- vaibhavarrow_forwardA manufacturing company is considerign the purchase of new machinery to increase its production capacity. The company has identified a new machine that costs $500,000 and is expected to increase production by 20%. The company expects to sell the additional products for $600,000, resulting in a net profit of $100,000. The company can finance the purchase through a bank loan with an interest rate of 5% over a five year term. What is the expected return on investment (ROI) for the purchase of the new machinery 5% 10% 20% 25%arrow_forwardWinthrop Company has an opportunity to manufacture and sell a new product for a five-year period. To pursue this opportunity, the company would need to purchase a plece of equipment for $130,000. The equipment would have a useful life of five years and a $10,000 salvage value. The CCA rate for the equipment is 30%. After careful study. Winthrop estimated the following annual costs and revenues for the new product: Sales revenues: Variable expenses Fixed expenses $250,000 $130,000 $ 70,000 The company's tax rate is 30% and its after-tax cost of capital is 10%. Required: 1. Compute the net present value of the project. (Hint Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and PV factor. Round the final answers to the nearest whole dollar. Negative value should be indicated with minus sign.) 2. Would you recommend that the project be undertaken? 1. Net present value 2 Would you recommend that the project be undertaken?arrow_forward

- A manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardA piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Limited, could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow: Purchase cost of the equipment Annual cost savings that will be provided by the equipment Life of the equipment $ 600,000 $ 100,000 12 years Required: 1a. Compute the payback period for the equipment. 1b. If the company requires a payback period of four years or less, would the equipment be purchased? 2a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment's useful life. 2b. Would the equipment be purchased if the company's required rate of return is 12%? Complete this question by entering your answers in the tabs below. ces Reg 1A Reg 18 Req 2A Req 28 Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment's useful life. (Round your answer to 1 decimal place i.e. 0.123 should be…arrow_forwardThanks to acquisition of a key patent, your company now has exclusive production rights for barkelgassers (BGs) in North America. Production facilities for 210,000 BGs per year will require a $25.2 million immediate capital expenditure. Production costs are estimated at $67 per BG. The BG marketing manager is confident that all 210,000 units can be sold for $102 per unit (in real terms) until the patent runs out five years hence. After that, the marketing manager hasn’t a clue about what the selling price will be. Assume the real cost of capital is 10%. To keep things simple, also make the following assumptions: The technology for making BGs will not change. Capital and production costs will stay the same in real terms. Competitors know the technology and can enter as soon as the patent expires, that is, they can construct new plants in year 5 and start selling BGs in year 6. If your company invests immediately, full production begins after 12 months, that is, in year 1. (Assume it…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education