Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

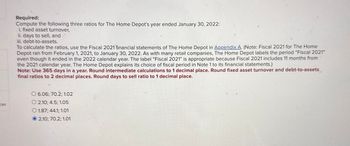

Required:

Compute the following three ratios for The Home Depot's year ended January 30, 2022:

i. fixed asset turnover,

ii. days to sell, and

iii. debt-to-assets.

To calculate the ratios, use the Fiscal 2021 financial statements of The Home Depot in Appendix A. (Note: Fiscal 2021 for The Home

Depot ran from February 1, 2021, to January 30, 2022. As with many retail companies, The Home Depot labels the period "Fiscal 2021"

even though it ended in the 2022 calendar year. The label "Fiscal 2021" is appropriate because Fiscal 2021 includes 11 months from

the 2021 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.)

Note: Use 365 days in a year. Round intermediate calculations to 1 decimal place. Round fixed asset turnover and debt-to-assets

final ratios to 2 decimal places. Round days to sell ratio to 1 decimal place.

O 6.06; 70.2; 1.02

O2.10; 4.5; 1.05

O 1.87; 44.1; 1.01

© 2.10; 70.2; 1.01

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The current ratio including transaction c. is The debt ratio including transaction c is screenshots attached thank youarrow_forwardCompute the following ratiosat December 31, 2019: i.Current ratio ii.Acid-test Ratio iii.Account Receivables Turnover iv.Average collection period v.Inventory Turnover vi.Days in inventory vii.Profit margin viii.Debts to Asset ratio ix.Return on Assets x.Times Interest Earnedarrow_forwardRara Sdn. Bhd Balance Sheets 31st December (in millions) 2020 2019 Assets Current assets Cash RM460 RM444 Acount receivable (net) 1,188 1,190 Inventories 1,132 247 1,056 225 Other current assets 3,027 3,281 Total current assets 2,915 3,128 Property (net) Other assets 5.593 5,804 Total assets RM11.901 RM11,847 Liabilities and Stockholders' Equity Current liabilities RM3,313 6,826 RM3,184 6,509 Long-term liabilities Stockholders' equity - common 1.762 RM11,901 2.154 RM11,847 Total liabilities and stockholders' equity Rara Sdn. Bhd Income Statements For the year ended 31st December (in millions) 2020 RM13,198 2019 Net sales RM12,397 Cost of goods sold Gross profit Selling and administrative expenses Income from operations 7.750 5,448 7,108 5,289 3.472 3.299 1,990 1,976 Interest expense 233 248 Other (income) expense, net 11 1,732 Income before income taxes 1,742 Income tax expense 503 502 Net income RM1,229 RM1.240arrow_forward

- Byrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forwardThe following is a partial listing of accounts for XYZ, Inc., for the year ended December 31, 2020. Required: Prepare multiple step income statement for the year of 2020. Finished Goods Current Maturities of Long-Term Debt Accumulated Depreciation Accounts Receivable $ 38,872 2,515 19,960 Sales Revenue 6,273 127,260 Treasury Stock 251 Prepaid Expenses 2,199 Deferred Taxes (long-term liability) 8,506 Interest Expense 2,410 Allowance for Doubtful Accounts 915 Retained Earnings 18,951 Raw Materials 9,576 Accounts Payable 19,021 Cash and Cash Equivalents 8,527 Sales Salaries Expense 872 Cost of Goods Sold 82,471 Investment in Unconsolidated 3,559 Subsidiaries Income Taxes Payable 8,356 Work In Process 1,984 Additional Paid-In Capital 9,614 Equipment 41,905 Long-Term Debt 15,258 Rent Income 2,468 Common Stock 3,895 Notes Payable (short-term) 6,156 Income Tax Expense 2,461arrow_forwardThe data depicted in the table below were extracted from the annual financial reports of WBE enterprises for the 2021 and 2022 financial years. If all purchases are on credit, calculate the creditors payment period of WBE enterprises for the 2022 financial year. Sales (80% credit sales) Cost of sales Inventories Accounts receivable Accounts payable Cash and cash equivalents Other current liabilities OA. 214 days OB. 163 days OC. 66 days OD. 168 days 2022 R 480 000 264 000 270 000 204 000 177 000 45 750 82 500 2021 R 375 000 192 000 243 000 183 000 165 000 27 300 58 500arrow_forward

- The condensed financial statements of Ivanhoe Company for the years 2020-2021 are presented below: (See Images) Compute the following financial ratios by placing the proper amounts for numerators and denominators. (Round per unit answers to 2 decimal places, e.g. 52.75.) (a) Current ratio at 12/31/21 $ $ (b) Acid test ratio at 12/31/21 $ $ (c) Accounts receivable turnover in 2021 $ $ (d) Inventory turnover in 2021 $ $ (e) Profit margin on sales in 2021 $ $ (f) Earnings per share in 2021 $ (g) Return on common stockholders’ equity in 2021 $ $ (h) Price earnings ratio at 12/31/21 $ $ (i) Debt to assets at 12/31/21 $ $ (j) Book value per share at 12/31/21 $arrow_forwardPlease answer/explain in details. Thanksarrow_forwardN1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forward

- Liverton Co.’s income statement for the year ended 31 March 2019 and statements of financial position at 31 March 2019 and 2018 were as follows in the images. Calculate for the financial year ended 31 March 2019 and, where possible, for 31 March 2018, the following ratios: i) Gross profit marginii) Assets usageiii) Current ratioiv) Acid testv) Inventories holding periodvi) Debt to Equity ratioarrow_forwardGardner Clothiers reported the following selected items at March 31, 2024 (last year's-2023-amounts also given as needed): (Click the icon to view the financial data.) Compute Gardner's (a) acid-test ratio, (b) accounts receivable turnover ratio, and (c) days' sales in receivables for the year ending March 31, 2024. Evaluate each ratio value as strong or weak. Gardner sells on terms of net 30. (Round days' sales in receivables to a whole number.) (Ignore leap-years, using a 365-day where needed.) C (a) Compute Gardner's acid-test ratio. (Round your final answer to two decimal places. Abbreviation used: Avg. = Average; Invest. = Investment; Liab. = Liabilities; Merch. = Merchandise; Receiv. = Receivable; Rev. = Revenue.) Acid-test ratio Data table Accounts Payable Cash Merchandise Inventory: March 31, 2024 March 31, 2023 Net Credit Sales Revenue Long-term Assets Long-term Liabilities $ 330,000 358,800 270,000 240,000 3,285,000 430,000 90,000 Print Accounts Receivable, net: March 31,…arrow_forwardWhich of the following interprets the interest corage ratio of RED Merchandising?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College