Accounting Information Systems

10th Edition

ISBN: 9781337619202

Author: Hall, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give me accurate answer

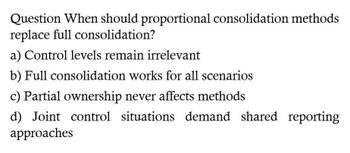

Transcribed Image Text:Question When should proportional consolidation methods

replace full consolidation?

a) Control levels remain irrelevant

b) Full consolidation works for all scenarios

c) Partial ownership never affects methods

d) Joint control situations demand shared reporting

approaches

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Problemarrow_forward?arrow_forwardWhich circumstances prompt modified attribution analysis? a) Attribution never needs modification b) Standard attribution works universally c) Ownership always follows simple patterns d) Complex ownership structures require specialized allocation methodsarrow_forward

- Briefly state how FASB efforts to improve Consolidation accountingarrow_forwardWhich of the following is not an advantage of establishing a special purpose entity (SPE)? O a. avoiding consolidation O b. low cost of financing O c. use of governing agreements to restrict the SPE's activities O d. can currently be used as a way to provide off balance sheet financingarrow_forwardDifference between Internal reconstruction and External reconstruction (Merger and acquisition)?arrow_forward

- Whats a good response to? Why must the eliminating entries be entered in the consolidation worksheet each time consolidated statements are prepared? Eliminating entries are pivotal in the consolidation process, ensuring intercompany transactions and balances are stripped away to reflect an accurate and transparent picture of the consolidated entity's financial standings and performance. Here are the essential reasons why these entries must be made with each preparation of consolidated statements: Preventing Double Counting: Intercompany deals, like sales and purchases between the parent company and its subsidiaries, need to be removed to avoid counting revenues and expenses twice. Without elimination, figures could be overstated, misrepresenting the consolidated entity's economic reality. Displaying True Financial Health: Intercompany balances, like receivables and payables, should be eradicated to convey a genuine financial position. These do not mirror real obligations or assets from…arrow_forwardWhen is consolidation not required?arrow_forwardHow would you describe the competitive landscape and fragmentation levels? I understand the competitive landscape but not fragmentation Levelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College