Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

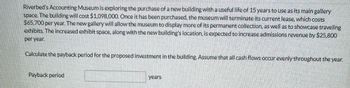

Transcribed Image Text:Riverbed's Accounting Museum is exploring the purchase of a new building with a useful life of 15 years to use as its main gallery

space. The building will cost $1,098,000. Once it has been purchased, the museum will terminate its current lease, which costs

$65,700 per year. The new gallery will allow the museum to display more of its permanent collection, as well as to showcase traveling

exhibits. The increased exhibit space, along with the new building's location, is expected to increase admissions revenue by $25,800

per year.

Calculate the payback period for the proposed investment in the building. Assume that all cash flows occur evenly throughout the year.

Payback period

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- The Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. Calculate the NPV, IRR, and MIRR of the new equipment. Is the project acceptable?arrow_forwardThe college is considering funding options for new engineering building on campus. The money has been raised for the construction costs and now the focus is raising funds for the annual upkeep and maintenance (U&M) expenses. For this building, contractors will be hired with a series of 3-year agreements over the 30 years. Under each contract the university will pay $125,000 at the beginning of each 3-year agreement to cover all U&M building expenses over that 3-year period. The first 3-year agreement begins when the building opens. A wealthy alumnus (you one day) has agreed to donate enough at the building opening to cover the U&M expenses over the 30- year term. If money invested by the school's engineering foundation earns 6% interest compounded quarterly, how much must be donated. (Hint: Build a spreadsheet like the one below) Year 0 3 6 9 12 15 18 21 24 27 Cost Rate Cash Flow FERH $125,000 $ 125,000.00 Present Worth 6% $125,000 3 year U&M Contract Cost Annual Interest Rate…arrow_forwardA new solid waste treatment plant is to be constructed in Washington County. The initial installation will cost $35 million (M). After 10 years, minor repair and renovation (R&R) will occur at a cost of $14M will be required; after 20 years, a major R&R costing $20M will be required. The investment pattern will repeat every 20 years. Each year during the 20-year period, operating and maintenance (O&M) costs will occur. The first year, O&M costs will total $2M. Thereafter, O&M costs will increase at a compound rate of 4% per year. Based on a 4% MARR, what is the capitalized cost for the solid waste treatment plant?arrow_forward

- The Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. a. Calculate the initial outlay, annual after-tax cash flow for each year, and the terminal cash flow.arrow_forwardTemporary Housing Services Incorporated (THSI) is considering a project that involves setting up a temporary housing facility in an area recently damaged by a hurricane. THSI will lease space in this facility to various agencies and groups providing relief services to the area. THSI estimates that this project will initially cost $4 million to set up and will generate $20 million in revenues during its first and only year in operation (paid in one year). Operating expenses are expected to total $8 million during this year and depreciation expense will be another $2 million. THSI will require no working capital for this investment. THSI's tax-rate is 20% Assume that THSI's cost of capital for this project is 15%. The net present value (NPV) of this temporary housing project is closest to:arrow_forwardThe Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. Using Goal Seek, calculate the minimum ticket price that must be charged in the first year in order to make the project acceptable.arrow_forward

- On April 30, 2020, Flounder Corporation ordered a new passenger ship, which was delivered to the designated cruise port and available for use as of June 30, 2020. Overall, the cost of the ship was $93 million, with an estimated useful life of 12 years and residual value of $30 million. Flounder expects that the new ship, as a whole, will provide its greatest economic benefits in its early years of operation. After further research and discussion with management, it is determined that the ship consists of major parts with differing useful lives, residual values, and patterns of providing economic benefits: Part Cost Useful life Residual value Pattern ofbenefits Total output(nautical miles) Engines (6) $975,000 per engine 8 years $100,000 per engine Varies with activity 7 million Hull $3,900,000 10 years $503,000 Highest in early years 7.90 million Body $83.25 million 15 years $15.21 million Evenly over life of body 12.30…arrow_forwardFish-or-Cut-Bait excursion boats has just purchased a new 22 passenger skimmer for use over the next 10 years. The cost of the boat was $80,000. The income associated with the boat is expected to be $15,000 each year and the costs are estimated to be $2,000 the first year and increase by $500 per year each year thereafter. The salvage value of the boat is estimated to be $5,000. If the MARR is 5%, what is the payback for the boat?arrow_forwardA construction company is considering acquiring a new earthmover. The purchase price is $110,000, and an additional $25,000 is required to modify the equipment for special use by the company. The equipment falls into the MACRS seven-year classification (the tax life), and it will be sold after five years (the project life) for $50,000. The purchase of the earthmover will have no effect on revenues, but the machine is expected to save the firm $68,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 25%. Assume that the initial investment is to be financed by a bank loan at an interest rate of 10% payable annually. Determine the after-tax cash flows by using the generalized cash flow approach and the worth of the investment for this project if the firm's MARR known to be 12%. Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when /= 10% per year. Click the icon to view the…arrow_forward

- Assume that Walmart Inc. has decided to surface and maintain for 10 years a vacant lot next to one of its stores to serve as a parking lot for customers. Management is considering the following bids involving two different qualities of surfacing for a parking area of 11,300 square yards. Bid A: A surface that costs $5.25 per square yard to install. This surface will have to be replaced at the end of 5 years. The annual maintenance cost on this surface is estimated at 25 cents per square yard for each year except the last year of its service. The replacement surface will be similar to the initial surface. Bid B: A surface that costs $10.75 per square yard to install. This surface has a probable useful life of 10 years and will require annual maintenance in each year except the last year, at an estimated cost of 12 cents per square yard. Click here to view factor tables. Compute present value of the bids. You may assume that the cost of capital is 12%, that the annual maintenance…arrow_forwardThe city council is considering a proposal about purchasing a new landfill site. Both the current landfill and new landfill would be usable for the next 10 years. The purchase price is $279,000 and the preparatory work will cost $77,800. It is estimated that the new landfill will cost $51,000 less per year to operate than the current landfill. Assume a hurdle rate of 8%. Ignore tax impacts. Required: Calculate the net present value of the new landfill. Should the city council approve the project on financial grounds? Calculate the internal rate of return for the new landfill. Should the city council approve the project on financial grounds?arrow_forwardBenford Inc. is planning to open a new sporting goods store in a suburban mall. Benford will lease the needed space in the mall. Equipment and fixtures for the store will cost $450,000 and be depreciated to $0 over a 5-year period on a straight-line basis. The new store will require Benford to increase its net working capital by $450,000 at time 0.First-year sales are expected to be $1.05 million and to increase at an annual rate of 8 percent over the expected 10-year life of the store. Operating expenses (including lease payments but excluding depreciation) are projected to be $850,000 during the first year and to increase at a 7 percent annual rate. The salvage value of the store’s equipment and fixtures is anticipated to be $13,000 at the end of 10 years. Benford’s marginal tax rate is 40 percent. Calculate the store’s net present value, using an 18 percent required return. Use Table II to answer the question. Round your answer to the nearest dollar.$ Should Benford accept the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education