Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

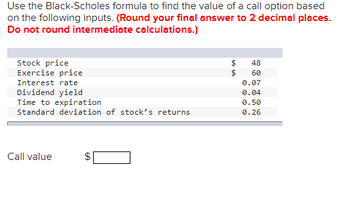

Transcribed Image Text:Use the Black-Scholes formula to find the value of a call option based

on the following inputs. (Round your final answer to 2 decimal places.

Do not round intermediate calculations.)

Stock price

Exercise price

Interest rate

Dividend yield

Time to expiration

Standard deviation of stock's returns

Call value

GA

$

$

$

48

60

0.07

0.04

0.50

0.26

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider two put options on different stocks. The table below reports the relevant information for both options: Put optionTime to maturityCurrent price of underlying stockStrike priceVolatility ( )X1 year$27$1830%Y1 year$25$2030%All else equal, which put option has a lower premium? A.Put option Y B.Put option Xarrow_forwardA stock with a current market price of $50 has an associated put option priced at $6.5. This put option has an exercise price of $48. The put option has an intrinsic value of ______ and a time value of ______. Select one: a. $0; $4.5 b. -$2; $8.5 c. $2; $4.5 d. $2; $6.5 e. $0; $6.5arrow_forwardsuppose that you have a call option that is at 1.30. it has a Delta of .35 a Gamma of .06 a Theta of .02 assume Vega is constant. today the stock moves from $45 to $46. the next day (day 2) the stock moves another dollar to $47. What is the value of your call option at the end of day two A. $2.02 B. $1.69 C. $1.73 D. $1.98arrow_forward

- Need asap... Suppose that you have a call option that is at 1.30. it has a Delta of .35 a Gamma of .06 a Theta of .02 assume Vega is constant. today the stock moves from $45 to $46. the next day (day 2) the stock moves another dollar to $47. What is the value of your call option at the end of day two? A. $2.02 B. $1.69 C. $1.73 D. $1.98arrow_forwardYou buy a put and a call on a stock that expire at time T. They are European options. Both the put and the call have an exercise price of $50. Plot the cash flows at the time of expiry. This strategy has a name. What is it?arrow_forwardYou buy a share of stock, write a one-year call option with X = $26, and buy a one-year put option with X = $26. Your net outlay to establish the entire portfolio is $24.60. What is the payoff of your portfolio? What must be the risk-free interest rate? The stock pays no dividends. (Do not round intermediate calculations. Round "risk-free rate" to 2 decimal places.)arrow_forward

- Nonearrow_forwardIn follow an Ito process with >0, a stock is worth $80 today, if the price of an option that pays the holder $2 exactly the first time the stock price reaches $200, what is the price of an option? Show all calculation.arrow_forwardWhat is the value of a call option if the underlying stock price is $112, the strike price is $105, the underlying stock volatility is 39 percent, and the risk-free rate is 6.1 percent? Assume the option has 128 days to expiration. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Call option $arrow_forward

- You are pricing options with the following characteristics: •Current stock price (St): $35.60 •Exercise price (X): $50 •Time to expiration (T-t): 9 months •Risk-free rate (rf): 3.25% •Volatility (0): 45% (a): What is the Black-Scholes value of call option? In your hand-written solution, provide the calculations of d1,d2, and the final call price. Use Excel or another spreadsheet program to compute the values of N(d1) and N(d2). See the notes for details. (b): Using put-call parity, what is the value of a put option? For this case, assume continuous compounding, which implies that PVt(X)=e-r(T-t).X.arrow_forwardIf the stock price increases, the price of a put option on that stock ________ and that of a call option _________. decreases, increases decreases, decreases increases, decreases increases, increasesarrow_forwardGiven the following information, predict the put option's new price after the stock's volatility changes. Initial put option price = $6 Initial volatility = 25% Vega = 13 New volatility = 18% (required precision 0.01 +/- 0.01) Greeks Reference Guide: Delta = ∂π/∂S Theta = ∂π/∂t Gamma = (∂2π)/(∂S2) Vega = ∂π/∂σ Rho = ∂π/∂rarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education