ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

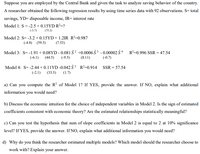

Transcribed Image Text:Suppose you are employed by the Central Bank and given the task to analyze saving behavior of the country.

A researcher obtained the following regression results by using time series data with 92 observations. S= total

savings, YD= disposable income, IR= interest rate

Model 1: S = -2.5 + 0.15YD R²=?

(-3.7)

(75.2)

Model 2: S= -3.2 + 0.15YD+ 1.2IR R²=0.987

(-4.8) (59.5)

(7.53)

Model 3: S= -1.91 + 0.08YD - 0.081 §² +0.0006 § 3 - 0.00002 § 4 R²=0.996 SSR = 47.54

(-6.1)

(44.5)

(-9.5)

(8.11)

(-0.7)

Model 4: S= -2.44 + 0.11YD -0.042 § ² R²=0.914 SSR = 57.54

(-2.1)

(33.3)

(1.7)

a) Can you compute the R? of Model 1? If YES, provide the answer. If NO, explain what additional

information you would need?

b) Discuss the economic intuition for the choice of independent variables in Model 2. Is the sign of estimated

coefficients consistent with economic theory? Are the estimated relationships statistically meaningful?

c) Can you test the hypothesis that sum of slope coefficients in Model 2 is equal to 2 at 10% significance

level? If YES, provide the answer. If NO, explain what additional information you would need?

d) Why do you think the researcher estimated multiple models? Which model should the researcher choose to

work with? Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 10 Answer questions 10 to 16 based on the regression outputs given in Table 1& 2. Table 1 DATA4-1: Data on single family homes in University City community of San Diego, in 1990. price - sale price in thousands of dollars (Range 199. 9 505) sqft - square feet of living area (Range 1065 - 3000) Table 2 Model 1: OLS, using observations 1-14 Dependent variable: price coefficient std. error t-ratio p-value 52. 3509 0.138750 37. 2855 0.0187329 0. 1857 8. 20e-06 *** const sqft 7. 407 Me dependent var Sun squared resid R-squared F(1, 12) Log-likelihood Schwarz criterion 317. 4929 18273. 57 0. 820522 54. 86051 -70. 08421 145. 4465 Hannan-Quinn S.D. dependent var S.E. of regression Adjusted R-squared P-value (F) Akaike criterion 88. 49816 39. 02304 0. 805565 8. 20e-06 144. 1684 144. 0501 There are observations included in this dataset. It is a. data. O 12; cross-sectional 13; time-series data 14; cross-sectional In this regression model, sale price of a single-family house is the. the…arrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Multicollinearity and give a reasonarrow_forwardq11-arrow_forward

- The data for this question is given in the file 1.Q1.xlsx(see image) and it refers to data for some cities X1 = total overall reported crime rate per 1 million residents X3 = annual police funding in $/resident X7 = % of people 25 years+ with at least 4 years of college (a) Estimate a regression with X1 as the dependent variable and X3 and X7 as the independent variables. (b) Will additional education help to reduce total overall crime (lead to a statistically significant reduction in crime)? Please explain. (c) Will an increase in funding for the police departments help reduce total overall crime (lead to a statistically significant reduction in total overall crime)? Please explain. (d) If you were asked to recommend a policy to reduce crime, then, based only on the above regression results, would you choose to invest in education (local schools) or in additional funding for the police? Please explain.arrow_forwardE3arrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. what are the implications of Heteroscedasticity if this potential issue in your model?arrow_forward

- You are given information on the use of public transportation in the data set within the image. Number of weekly riders y -variable Price per week (of using public transportation) x-variable Population of city x-variable Monthly income of riders x variable Average parking rates per month x-variable (a) Run a regression of the Number of weekly riders on Price per week, Population of city, Monthly income of riders, Average parking rates per month. Please copy and paste your regression results and do not submit your EXCEL worksheet. (b) If the average parking rates increase by $1, what will be the change in the number of weekly riders? Will this change be a statistically significant change? Please explain. (c) If the price per week (of using public transportation) increases by $1, what will be the change in the number of weekly riders? Will this change be…arrow_forwardThe following question refers to this regression equation (standard errors for each of the estimated coefficients are in parenthesis). Q=8,400-8" P+5" A+ 4** Px +0.05**1, (1,732) (2.29) (1.36) (1.75) (0.15) Q = Quantity demanded P = Price 1,100 Advertising expenditures, in thousands = 20 P = price of competitor's good = 600/= average monthly income 10,000 What is the advertising elasticity of demand? Round your answer to two decimal places. Your Answer: The t-statistic is computed by dividing the regression coefficient by the standard error of the coefficient. dividing the regression coefficient by the standard error of the estimate. dividing the standard error of the coefficient by the regression coefficient. dividing the R2 by the F-statistic. none of the specified answers are correct.arrow_forwardA finance manager employed by an automobile dealership believes that the number of cars sold in his local market can be predicted by the interest rate charged for a loan. Interest Rate (%) Number of Cars Sold (100s) 3 5 10 7 8 2 The finance manager performed a regression analysis of the number of cars sold and interest rates using the sample of data above. Shown below is a portion of the regression output. Regression Statistics Multiple R0.998868 R2 0.997738 Coefficient |14.88462 Interest Rate -1.61538 Intercept 1. Are there factors other than interest rate charged for a loan that the finance manager should consider in predicting future car sales? 2. Is interest rate charged for a loan the most important factor to be considered in predicting future car sales? Explain your reasoning.The dealership's vice- president of marketing has requested a sales forecast at the prevailing interest rate of 7%. 3. As finance manager, what reasons would you convey to the vice-president in recommending…arrow_forward

- A home appraisal company would like to develop a regression model that would predict the selling price of a house based on the age of the house in years (X1), the living area of the house in square feet (X2), and the number of bedrooms (X3). The following regression model was chosen using a data set of house statistics: y=88,399554791.3333x231,471.1372x3 The first house from the data set had the following values: Selling price $324,000 Age - 22 years Square Feet 2.000 Bedrooms 3 The residual for this house is 23,558 -41,480 10,216 -16,095 27arrow_forwardsolve within 30 mins.arrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Heteroscedasticity and give a reasonarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education