FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial accounting

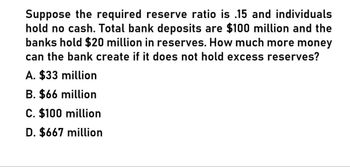

Transcribed Image Text:Suppose the required reserve ratio is .15 and individuals

hold no cash. Total bank deposits are $100 million and the

banks hold $20 million in reserves. How much more money

can the bank create if it does not hold excess reserves?

A. $33 million

B. $66 million

C. $100 million

D. $667 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume the required reserve ratio solve this general accounting questionarrow_forward4. If a deposit outflow of $50 million occurs, which bal- ance sheet would a bank rather have initially, the balance sheet in Question 3 or the following balance sheet? Why? Assets Liabilities Reserves $100 million Deposits $500 million Loans $500 million | Bank capital $100 million gucar Capital 3. The bank you own has the following balance sheet: Assets Liabilities Reserves $ 75 million Deposits $525 million Bank capital $100 million $500 million Loansarrow_forwardChallenge Problem. Assume that the public in the small country of Sylvania does not hold any cash. Commercial banks, however, hold 10 percent of their checking deposits as excess reserves, regardless of the interest rate. In the questions that follow, the "money multiplier" is given by 1/ (RR+ ER), where RR = the percentage of deposits that banks are required to keep as reserves ER = the percentage of deposits that banks voluntarily hold as excess reserves Consider the balance sheet of one of several identical banks Assets Liabilities and Net Worth Reserves 600 Checking Deposits 2,400 Loans 1,800 Net Worth Total Assets 2,400 Liabilities and Net Worth 2,400arrow_forward

- 1arrow_forwardAssume that a bank receives a deposit of $1,000 in cash, puts aside $200 as required reserves, and makes a loan of $800, these transactions imply that: the money multiplier is 10. the money multiplier is 5. the money multiplier is 4. the money multiplier is 2. the money multiplier is 2.arrow_forwardCan you help me with this question?arrow_forward

- a) Bank A has the following balance sheet (in millions): Assets Cash Securities Loans Total assets $70 The bank is expecting a $12 million net deposit drain. Liabilities and equity Deposits Equity Total liabilities and equity $5 10 55 $62 9 $70 ii) Show the new balance sheet if the bank uses stored liquidity management to offset the expected drain. Also, explain the effect on the size and composition of assets and liabilities.arrow_forwardBelow is the balance sheet for a bank. Under "Other" it has listed "$X" just think of this as the dollar amount needed to make the balance sheet balance. It is not important what that value is for this question. AssetsLiabilitiesReserves 40Deposits 215Loans 160 Securities 40Other $X Using the balance sheet above, find the level of excess reserves this bank is holding if the required reserve ratio = 8%(Give answers to 2 decimal places as needed)arrow_forwardIf a bank has $200,000 of checkable deposits, a required reserve ratio of 20 percent, and it holds $80,000 in reserves, then the maximum deposit outflow it can sustain without altering its balance sheet is A) $50,000. B) $40,000. C) $30,000. D) $25,000. Answer: A How to solve it?arrow_forward

- Assume that banks holds no excess reserves and the public holds no currency: A. If a bank receives a deposit inflow of $100,000 explain (using t-accounts) what happens to this bank and one additional round in the deposit creation process assuming the reserve requirement is 8%. B. How much do deposits and loans change for the banking system when the process is completed? Show computation and the entire banking system's final T-account. C. Suppose the Central Bank sells $5 billion to ABC Bank. Determine what happens to checkable deposits of the entire banking system after the sale and completion of the multiple deposit creation process. Determine the change in checkable deposit in the banking system and show the T-account of the banking system.arrow_forward2. Your bank has the following balance sheet: Assets Reserves Securities Loans Liabilities Checkable deposits $200 million Bank capital 50 million If the required reserve ratio is 10%, what actions should the bank manager take if there is an unexpected deposit outflow of $50 million? Make sure to show your work. $50 million 50 million 150 millionarrow_forwarda) Bank A has the following balance sheet (in millions): Assets Cash Securities Loans Total assets $5 10 55 $70 Liabilities and equity Deposits Equity Total liabilities and equity The bank is expecting a $12 million net deposit drain. $62 8 $70 i) Show the new balance sheet if the bank uses purchased liquidity management to offset the expected drain. Also, explain the effect on the size and composition of assets and liabilities ii) Show the new balance sheet if the bank uses stored liquidity management to offset the expected drain. Also, explain the effect on the size and composition of assets and liabilities.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education