Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I don't need ai answer accounting questions

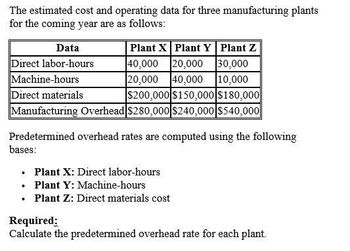

Transcribed Image Text:The estimated cost and operating data for three manufacturing plants

for the coming year are as follows:

Plant X Plant Y Plant Z

Data

Direct labor-hours

40,000

20,000

30,000

Machine-hours

20,000 40,000 10,000

Direct materials

$200,000 $150,000 $180,000

Manufacturing Overhead $280,000 $240,000 $540,000||

Predetermined overhead rates are computed using the following

bases:

⚫ Plant X: Direct labor-hours

⚫ Plant Y: Machine-hours

⚫ Plant Z: Direct materials cost

Required:

Calculate the predetermined overhead rate for each plant.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Plata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardA company estimates its manufacturing overhead will be $630,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 72,000 $______ per direct labor hour B. Budgeted direct labor expense: $1,800,000 $_____ per direct labor dollar C. Estimated machine hours: 120,000 $_____ per machine hourarrow_forwardA company estimates its manufacturing overhead will be $1,080,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 72,000 $fill in the blank 1 per direct labor hour B. Budgeted direct labor expense: $1,800,000 $fill in the blank 2 per direct labor dollar C. Estimated machine hours: 120,000 $fill in the blank 3 per machine hourarrow_forward

- Webber fabricating estimated the following solve this question ❓arrow_forwardAaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $770,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 17,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) A. $29.41 per labor hour B. $1.54 per labor hour C. $154.00 per machine hour D. $100.00 per machine hourarrow_forwardAt the beginning of a year, a company predicts total direct materials costs of $1,050,000 and total overhead costs of $1,180,000. If the company uses direct materials costs as its activity base to allocate overhead, what is the predetermined overhead rate it should use during the year? Choose Numerator: Predetermined overhead rate / Choose Denominator: 1 1 = = Rate Ratearrow_forward

- Need answerarrow_forwardAaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $760,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 16,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) OA. $1.52 per labor hour OB. $100.00 per machine hour OC. $152.00 per machine hour O D. $31.25 per labor hourarrow_forwardAaron Company estimates direct labor costs and manufacturing overhead costs for the coming year to $900,000 and $700,000, respectively. Aaron allocates overhead costs based on labor hours. the estimated total labor hours and machine hours for the coming year are 16,000 hours and 10,000 hours, respectively., What's the predetermined overhead allocation rate?arrow_forward

- What is the company's planwide overhead rate?arrow_forwardArchangel Manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on direct labor costs. The production details for the year are given below: Total manufacturing overhead costs estimated at the beginning of the year Total direct labor costs estimated at the beginning of the year Total direct labor hours estimated at the beginning of the year Actual manufacturing overhead costs for the year Actual direct labor costs for the year Actual direct labor hours for the year 11,000 di 10,000 di Calculate the manufacturing overhead allocation rate for the year based on the above data (Round your final answer to two decimal places.) A. 28.00% B. 11.43% OC. 43.75% OD. 264.29%arrow_forwardCompany LSD LTD has 4 types of overhead . The four categories and expected costs for each category for next year are listed below Company LSD LTD Activity cost Setups cost $150,000 Inspection cost $90,000 Maintenance cost $120,000 Material Handling cost $ 82,000 Actual overhead Cost $30,000 Estimates for the proposed job [Job #23] are as follows Direct Materials $6,000 DL (1000 hours) $10,000 Machine Hours [maintenance cost] 500 # of material moves 12 # of setups 5 # of inspections 10 Units produced 240 The company has been asked to submit a bid for a proposed job. The plant manager thinks getting this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 30%. In the past , full manufacturing cost has been calculated by allocating overhead using volume based cost driver [[DLH]. The plant manager has heard of a new way of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning