Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please given correct answer general accounting

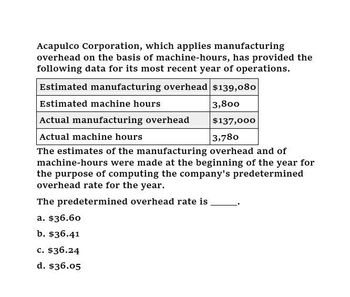

Transcribed Image Text:Acapulco Corporation, which applies manufacturing

overhead on the basis of machine-hours, has provided the

following data for its most recent year of operations.

Estimated manufacturing overhead $139,080

Estimated machine hours

Actual manufacturing overhead

Actual machine hours

3,800

$137,000

3,780

The estimates of the manufacturing overhead and of

machine-hours were made at the beginning of the year for

the purpose of computing the company's predetermined

overhead rate for the year.

The predetermined overhead rate is

a. $36.60

b. $36.41

c. $36.24

d. $36.05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardThe actual overhead for a company is $74,539. Overhead was based on 6,000 direct labor hours and was $2,539 under applied for the year. What is the overhead application rate per direct labor hour? What is the journal entry to dispose of the under applied overhead?arrow_forwardCoops Stoops estimated its annual overhead to be $85,000 and based its predetermined overhead rate on 24,286 direct labor hours. At the end of the year, actual overhead was $90,000 and the total direct labor hours were 24,100. What is the entry to dispose of the over applied or under applied overhead?arrow_forward

- Queen Bees Honey, Inc., estimated its annual overhead to be $110,000 and based its predetermined overhead rate on 27,500 direct labor hours. At the end of the year, actual overhead was $106,000 and the total direct labor hours were 29,000. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardThe following data summarize the operations during the year. Prepare a journal entry for each transaction. A. Purchase of raw materials on account: $1,500 B. Raw materials used by Job 1: $400 C. Raw materials used as indirect materials: $50 D. Direct labor for Job 1: $200 E. Indirect labor Incurred for Job 1: $30 F. Factory utilities Incurred on account: $500 G. Adjusting entry for factory depreciation: $200 H. Manufacturing overhead applied as percent of direct labor: 100% I. Job 1 is transferred to finished goods J. Job 1 is sold: $1,000 K. Manufacturing overhead is under applied: $100arrow_forwardThe books of Petry Products Co. revealed that the following general journal entry had been made at the end of the current accounting period: The total direct materials cost for the period was $40,000. The total direct labor cost, at an average rate of $10 per hour for direct labor, was one and one-half times the direct materials cost. Factory overhead was applied on the basis of $4 per direct labor hour. What was the total actual factory overhead incurred for the period? (Hint: First solve for direct labor cost and then for direct labor hours.)arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardActon Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations. Estimated manufacturing overhead Estimated machine-hours Actual manufacturing overhead Actual machine-hours $139,080 3,838 $137,000 3,800 The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year. The predetermined overhead rate is closest to:arrow_forward

- Acheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations. Estimated manufacturing overhead Estimated machine-hours Actual manufacturing overhead Actual machine-hours $ 157,700 4,630 $ 157,300 4,840 The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year. The predetermined overhead rate is closest to: Multiple Choice O $32.50 $34.06 $33.97 $41.62arrow_forwardAcheson Corporation, which applies manufacturing overhead on the basis of machine-hours, has provided the following data for its most recent year of operations. Estimated manufacturing overhead $ 157,950 Estimated machine-hours 4,680 Actual manufacturing overhead $ 157,800 Actual machine-hours 4,940 The estimates of the manufacturing overhead and of machine-hours were made at the beginning of the year for the purpose of computing the company's predetermined overhead rate for the year. The predetermined overhead rate is closest to: $31.94 $33.75 $33.72 $44.52arrow_forwardPlease Need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub