ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

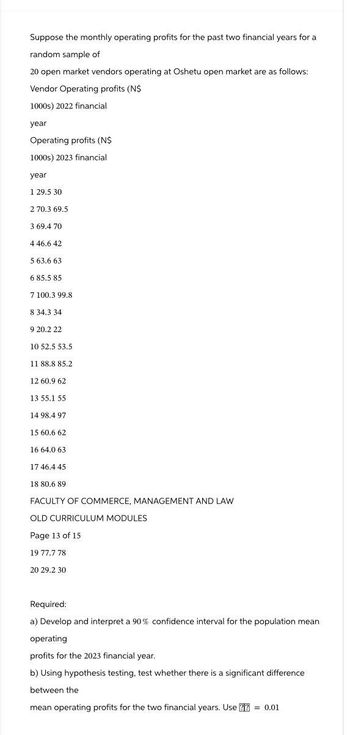

Transcribed Image Text:Suppose the monthly operating profits for the past two financial years for a

random sample of

20 open market vendors operating at Oshetu open market are as follows:

Vendor Operating profits (N$

1000s) 2022 financial

year

Operating profits (N$

1000s) 2023 financial

year

1 29.5 30

2 70.3 69.5

3 69.4 70

4 46.6 42

5.63.6 63

6 85.5 85

7 100.3 99.8

8 34.3 34

9 20.2 22

10 52.5 53.5

11 88.8 85.2

12 60.9 62

13 55.1 55

14 98.4 97

15 60.6 62

16 64.0 63

17 46.4 45

18 80.6 89

FACULTY OF COMMERCE, MANAGEMENT AND LAW

OLD CURRICULUM MODULES

Page 13 of 15

19 77.7 78

20 29.2 30

Required:

a) Develop and interpret a 90% confidence interval for the population mean

operating

profits for the 2023 financial year.

b) Using hypothesis testing, test whether there is a significant difference

between the

mean operating profits for the two financial years. Use ?? = 0.01

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- tise or nột to advertise Suppose that Fizzo and Pop Hop are the only two firms that sell orange soda. The following payoff matrix shows the profit (in millions of dollars) each company will earn depending on whether or not it advertises: Pop Hop Advertise Doesn't Advertise Advertise 8, 8 15, 2 Fizzo Doesn't Advertise 2, 15 11, 11 For example, the upper right cell shows that if Fizzo advertises and Pop Hop doesn't advertise, Fizzo will make a profit of $15 million, and Pop Hop will make a profit of $2 million. Assume this is a simultaneous game and that Fizzo and Pop Hop are both profit-maximizing firms. million if Pop Hop advertises and a profit of $ million if Pop Hop does not If Fizzo decides to advertise, it will earn a profit of $ advertise. million if Pop Hop does not million if Pop Hop advertises and a profit of $ If Fizzo decides not to advertise, it will earn a profit of $ advertise. TE Don Uenad orticoc Fizze makoc a hiabo nrefit RS R choeces acerarrow_forwardRMC, Inc., is a small firm that produces a variety of chemical products. In a particular production process, three raw materials are blended to produce two products: a fuel additive and a solvent base. Each ton of fuel additive is a mixture of 2/5 ton of material 1 and 3/5 ton of material 3. A ton of solvent base is a mixture of ½ ton of material 1, 1/5 ton of material 2, and 3/10 ton of, material 3. After deducting relevant costs, the profit contribution is $40 for every ton of fuel additive produced and $30 for every ton of solvent base produced. RMC’s production is constrained by a limited availability of the three raw materials. For the current production period, RMC has 20 tons of material 1, 5 tons of material 2, and 21 tons of material 3 that are available for production. Assuming that RMC is interested in maximizing the total profit contribution, answer the following: a. Find the optimal solution. How many tons of each product should be produced, and what…arrow_forwardHomework (Ch 08) * MindTap - Cengage Learning x + m/static/nb/ui/evo/index.html?deploymentld=58830023220612202193347127562&elSBN=9781337622349&id=908491119&snapshotld%3D19375308& * CENGAGE MINDTAP Homework (Ch 08) 2. The demand curve facing a price-taking firm Vesoro is one of more than a hundred competitive price-taking firms in San Francisco that produce extra-large cardboard boxes for moving. The following graph shows the daily market demand and supply curves facing the extra-large cardboard box industry. (?) 50 45 Supply 40 Demand 35 30 25 20 15 10 0 1 2 3 4 5 6 7 89 QUANTITY OF OUTPUT (Millions of extra-large boxes) 10 19 144 ho.. DII PDI f12 DDI delete hom $. %, & * 7. 8 9. %3D backspace R PRICE (Dollars per extra-large box)arrow_forward

- Revenue and Costs ($) TC P61 Given TFC = $40.00 Q1 = 30.00 Q2 = 40.00 TR P6 P5 Q3 = 50.00 Q4 = 80.00 Q5 = 86.00 P4. P1 = $40.00 P2 = $50.00 P3 = $60.0o P4 = $150.00 P5 = $200.00 P6 = $210.00 P61 = $320.00 P3 P2 P1 Q1 Q2 Q4 Q5 Q3 Exhibit TR-TC Output (Q) Refer to Exhibit TR-TC for a typical competitive firm. At an output level of Q5, the firm's losses is about O $100.00 O $90.00 O $110.00 O $120.00arrow_forwardThe following are the P/E ratios (price of stock divided by projected earnings per share) for 20 banks. 50, 19, 22, 21, 25, 18, 31, 21, 19, 14, 15, 18, 17, 34, 29, 23, 14, 18, 22, 22 Send data to calculator Find 20" and 75" percentiles for these ratios. (a) The 20th percentile: (b) The 75th percentile:| Continue Cip 40 4- %23 %24 3. 6. 7. R. 00 %24arrow_forwardvate X Student Portal | Main CENGAGE MINDTAP gage.com/static/nb/ui/evo/index.html?deploymentid=57962518850017814342930411958eISBN=9781337106603&id=1810088554&snapshotid=3502477& Problems: Chapters 21 and 22 The cost the upstream mill incurs for producing enough paper (one "unit" of paper) to make one unit of boxes is $12.50. X Assume the two mills operate as separate profit centers, and the paper mill sets the price of paper. It follows that the marginal profitability of boxes represents the highest price that the box division would be willing to pay the paper division for boxes.. Furthermore, assume that fixed costs are $0 for the paper mill. Price (Marginal Profitability to the Box Mill) ($) The following table summarizes the quantity, total revenue, and marginal costs from the perspective of the paper mill for selling paper to the box mill at various prices. $40 $36 $32 $28 $24 $20 $16 $12 $8 $4 ECN-601 Class Resources In the following table, fill in the marginal revenue, total…arrow_forward

- Problem # 2 The University Eye Institute in upper New-York state is a state-of-the-art ophthalmology center that specializes in a sophisticated laser surgery to correct myopia. Current annual volume is 1000 operations. A major customer of the center is the United Health Insurance system. United currently sends the University Eye Institute 200 patients per year or 20% of the total. United pays $2,500 per operation as does every payor. The United Health Insurance Company is satisfied with the quality and service provided by the University Eye Institute and has proposed that they send the Center an additional 100 patients (operations) per year. United proposes that the fee be reduced to $2,000 for the additional 100 patients and for the prior 200 patients. Assume the fee paid by payors other than United Health remains the same. a) What is the marginal revenue per patient if the proposal is accepted? b) What is the marginal cost per patient if the proposal is accepted? Here are some cost…arrow_forwardI’m having trouble solving these two parts to the question. How do you arrive at the answer you do? Thanks!arrow_forwardWhat's the computation for this and explanation for the solution? Thanksarrow_forward

- A contract of sale under CIF port of Okinawa, Incoterm 2020, was entered between a seller based in Vietnam and a buyer in Japan, for the sale of 500 tons of coffee. The goods were transported and unloaded at the port and kept at customs shed for inspection and payment of duties. The buyer was notified of the arrival of the merchandise and its location. Before the buyer picked up the goods, the customs shed (including the merchandise in it) was destroyed by fire. The buyer claims refund of the purchase price stating that she did not receive the goods. Is the seller responsible?arrow_forwardAn electronics firm is currently manufacturing an item that has a variable cost Of .50 per unit. Please write the answers clearly I am 60 years old and hard for me to understand thank you. Please write out the stepsarrow_forwardThe following table shows a money demand schedule, which is the quantity of money demanded at various price levels (P). Fill in the Value of Money column in the following table. Quantity of Money Demanded Price Level (P) Value of Money (1/P) (Billions of dollars) 0.80 1.5 1.00 2.0 1.33 3.5 2.00 7.0 Now consider the relationship between the price level and the quantity of money that people demand. The lower the price level, the money the typical transaction requires, and the money people will wish to hold in the form of currency or demand deposits.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education