ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

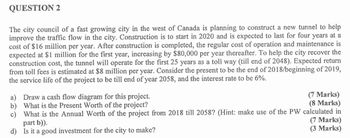

Transcribed Image Text:QUESTION 2

The city council of a fast growing city in the west of Canada is planning to construct a new tunnel to help

improve the traffic flow in the city. Construction is to start in 2020 and is expected to last for four years at a

cost of $16 million per year. After construction is completed, the regular cost of operation and maintenance is

expected at $1 million for the first year, increasing by $80,000 per year thereafter. To help the city recover the

construction cost, the tunnel will operate for the first 25 years as a toll way (till end of 2048). Expected return

from toll fees is estimated at $8 million per year. Consider the present to be the end of 2018/beginning of 2019,

the service life of the project to be till end of year 2058, and the interest rate to be 6%.

a) Draw a cash flow diagram for this project.

b) What is the Present Worth of the project?

(7 Marks)

c) What is the Annual Worth of the project from 2018 till 2058? (Hint: make use of the PW calculated in

part b)).

(8 Marks)

d) Is it a good investment for the city to make?

(7 Marks)

(3 Marks)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The consultancy Imagination Inc. is working with its manufacturing client Parts-R-Us to improve their on-time performance. The firm can earn a bonus of up to $1,000,000 based on how much the on-time performance actually improves. It's current (baseline) on-time performance is 90%. The company typically completes approximately 1,000 orders per month, with approximately 100 orders delayed. The bonus payment is prorated according to the following criteria: · The on-time performance improvement is calculated based on a reduction in late events or an improvement in on-time performance. · No bonus is earned for the first 25% reduction in late events, say from 100 to 75. Maximum bonus is earned once Parts-R-Us achieves 95% on-time performance. Please answer the following: Write down a formula to determine the total bonus amount to be received Using your formula, show how much bonus would be paid if Parts-R-Us achieves 94% on-time performance.arrow_forwardPlease answer fastarrow_forwardElectricity is produced with water according to the function: E = 5 + 5W-1W² where E = kilowatt-hour and W = gallons of water. Water costs $0.02 per gallon. Electricity can be sold on the grid for $0.10 per kWh (kilowatt-hour). How much water should be purchased?arrow_forward

- Waller County is planning to construct a Dam some tens of miles away from the Hempstead Recreation center to facilitate fishing in the El Manny River Basin and Power Generation. The first cost for the Dam will amount to $6,500,000. Annual maintenance and repairs will amount to $24,000 for the first four years, to $28,000 for each year in the next eight years, and to $32,000 per year for the next four years. At the end of the 16th year, $25,000 is estimated to be deposited into Waller county account as tax credits earned for its environmental compliance in the construction and operation of the Dam. In addition a major overhaul costing $650,000 will be required at the end of the seventh year. Use an interest rate of 10% and : a) Determine the engineering economy symbols and their value for each option. b) Construct the cash flow diagram c) Calculate the Capital Recovery for the projectarrow_forwardSolve and show solutions completely. Draw the cash flow diagrams. The engineer of a medium scale industry was instructed to prepare two plans to be considered by management to improve their operations. Plan A calls for an initial investment of P200,000 now with an expected salvage of 20% of the first cost 20 years hence. The operation and maintenance disbursements are estimated to be P15,000 each year and taxes will be 2% of the first cost. Plan B calls for an immediate investment of P140,000 and a second investment of P160,000 eight years later. The operation maintenance disbursements will be P9,000 a year for the initial installation and P8,000 a year for the second installation. At the end of 20 years, the salvage value will be 20% of the investments. Taxes will be 2% of first cost. If money is worth12%, which plan will you recommend using present worth cost method.arrow_forwardA new baseball stadium is being considered to be built in a metropolitan area by High Tech, Inc., at a cost of $50M. It is estimated that the annual maintenance cost will be $100K. The construction company recommends a major renovation every 50 years at a cost of $10M. If the corporation wants to set up a trust fund to pay for the stadium, its maintenance, and periodic renovations for an undefined number of years to come, what amount should be invested in the trust fund if the fun earns an annual interest rate of 6%? Group of answer choices $52,223,000 $60,566,667 $60,666,667 $73,500,429 $58,600,000arrow_forward

- Question 4 You are part of the Project Evaluation Committee in ProTiga Bhd., one of the automotive manufacturer in South East Asia. The manufacturer is shifting the focus of its previous "Number One Choice for Local" to "A Leading Electric Vehicle Company in South East Asia". Below are the projects to evaluate under the responsibility of Project Evaluation Committee. a) b) Acquire an existing RM1,3 billion Electric Vehicle Company from China for technology transfer purpose with the annual saving of RM200 million for 10 years. Assemble professional manpower to strengthen the ProTiga Racing Team with investment of RM700,000 and annual saving of RM150,000 for 5 years. The management has considered the expenses required to continue the business of ProTiga Berhad in coming 10 years. Thus, the management has to consider the additional expenses in the annual income with 5% discount rate. Using Net Present Value (NPV) method, determine which project between (a) and (b) that should be given…arrow_forwardThe Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $265,000 at the end of each of the next two years. At the end of the third year, the company will receive payment of $625,000. The company can speed up construction by working an extra shift. In this case, there will be a cash outlay of $575,000 at the end of the first year followed by a cash payment of $625,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift Please answer fast I give you upvotearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education