ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

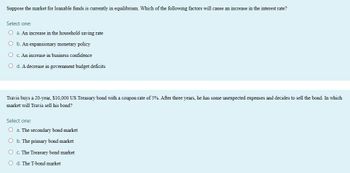

Transcribed Image Text:Suppose the market for loanable funds is currently in equilibrium. Which of the following factors will cause an increase in the interest rate?

Select one:

O a. An increase in the household saving rate

O b. An expansionary monetary policy

Oc. An increase in business confidence

O d. A decrease in government budget deficits

Travis buys a 20-year, $10,000 US Treasury bond with a coupon rate of 5%. After three years, he has some unexpected expenses and decides to sell the bond. In which

market will Travis sell his bond?

Select one:

O a. The secondary bond market

O b. The primary bond market

O c. The Treasury bond market

Od. The T-bond market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose you received a US savings bond as a gift, and the bond pays $100 at maturity, which is ten years from now. What happens to the present value of this bond payment if the interest rate increases? A. Present value increases B. Present value is not affected C. Present value declinesarrow_forward10. What is the present value of a perpetuity of $100 if the appropriate discount rate is 7%? If interest rates in general were to double and the appropriate discount rate rose to 14%, what would happen to the present value of the perpetuity?arrow_forward1. Assuming that the current interest rate is 3 percent, compute the present value (or price) of a five-year, 5 percent coupon bond with a face value of $1,000. What happens to the present value when the interest rate goes to 4 percent? Compute the new present value.arrow_forward

- Suppose that the demand for laonable funds for car in the Milwaukee area is $11million per month at an interest rate of 10 percent per year, $12million at an interest rate of 9 percent per year, $13million at an interest rate of 8 percent per year and so on. a. If the supply of loanable funds is fixed at $17million, what will be the equilibrium interest rate? b. If the government imposes a usury law and says that car loans cannot exceed 3 percent per year, how big will the monthly shortage (or excess demand) for car loans be? c. How big will the monthly shortage for car loans be if the usury limit is raised to 7 percent per year?arrow_forward4.5arrow_forwardIf the interest rates increase this will _____ the quantity of loanable funds demanded, and if the interest rates decrease this will______it. Select one: a. increase; reduce b. increase; increase c. reduce; increase Od. reduce; reducearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education