ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

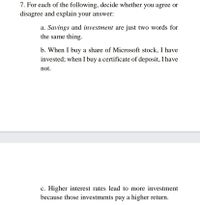

Transcribed Image Text:7. For each of the following, decide whether you agree or

disagree and explain your answer:

a. Savings and investment are just two words for

the same thing.

b. When I buy a share of Microsoft stock, I have

invested; when I buy a certificate of deposit, I have

not.

c. Higher interest rates lead to more investment

because those investments pay a higher return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Suppose you are looking to buy a bond that promises to pay $600,000 on the date of maturity in one year. A. If you bid for the bond and wind up paying a price of $590,000, solve for the interest rate on this bond. Round your answer to four decimal places. b. If on the next day, you bid for the bond and pay a price of $575,000, solve for the interest rate on the bond now. Round your answer to four decimal places. C. What is the relationship between the bond price and the interest rate on the bond?arrow_forwardTom and Sue had W-2 earnings of $100,000 last year. They deposited $5,000 into each of their IRAs from money that was in their checking account. They also sold their five year old car for $1,000 less than it was worth. Due to a slow down in the housing market, the value of their home decreased by $25,000. What is their change in net worth? a. No change b. Minus $19,000 c. Minus $26,000 d. Plus $9,000 e. Plus $74,000arrow_forward10. What is the present value of a perpetuity of $100 if the appropriate discount rate is 7%? If interest rates in general were to double and the appropriate discount rate rose to 14%, what would happen to the present value of the perpetuity?arrow_forward

- 1. Assuming that the current interest rate is 3 percent, compute the present value (or price) of a five-year, 5 percent coupon bond with a face value of $1,000. What happens to the present value when the interest rate goes to 4 percent? Compute the new present value.arrow_forwardQuestion 4. Working with Numbers and Graphs Q4 The face value of a bond is $6,000, and the annual coupon payment is $180. The coupon rate is_arrow_forwardIf the price of a government bond (gilt) traded on the stock market rises above its nominal value, which of the following statement must be true? 1 -The bond's coupon falls below the yield 2 - The bond's coupon rises above the yield 3-the bond's yield rises above the coupon 4 - the bond's yield falls below the couponarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education