ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

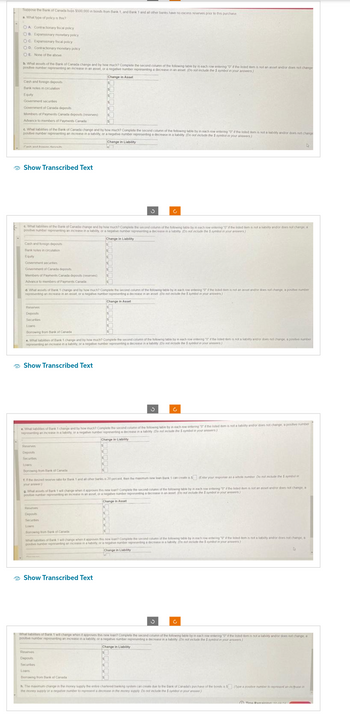

Transcribed Image Text:Suppose the Bank of Canada buys $500,000 in bonds from Bank 1, and Bank 1 and all other banks have no excess reserves prior to this purchase

a. What type of policy is this?

OA Contractionary fiscal policy

OB Expansionary monetary policy

OC Expansionary fiscal policy

OD Contractionary monetary policy

OE None of the above

b. What assets of the Bank of Canada change and by how much? Complete the second column of the following table by in each row entering "0" if the listod item is not an asset and/or does not change

positive number representing an increase in an asset, or a negative number representing a decrease in an asset (Do not include the $ symbol in your answers)

Change in Asset

Cash and foreign deposits

Bank notes in circulation

Equity

Government secunties

Government of Canada deposits

Members of Payments Canada deposits (reserves)

Advance to members of Payments Canada

c. What babilities of the Bank of Canada change and by how much? Complete the second column of the following table by in each row entering "0"d the listed dem is not a liability and/or does not change

positive number representing an increase in a hability, or a negative number representing a decrease in a lability (Do not include the $ symbol in your answers)

Change in Liability

Cash and finden

Show Transcribed Text

Cash and foreign deposits

Bank notes in orculation

Equity

c. What habites of the Bank of Canada change and by how much? Complete the second column of the following table by in each row entering "0" if the listed item is not a bability and or does not change, a

positive number representing an increase in a liability, or a negative number representing a decrease in a lability (Do not include the 5 symbol in your answers)

Change in Liability

Government securities

Goverment of Canada deposits

Members of Payments Canada deposits (reserves)

Advance to members of Payments Canada

d. What assets of Bank 1 change and by how much? Complete the second column of the following table by in each row entering "0" if the listed item is not an asset and/or does not change, a positive number

representing an increase in an asset, or a negative number representing a decrease in an asset (Do not include the $ symbol in your answers)

Change in Asset

Reserves

Deposits

Securtos

Loans

Borrowing from Bank of Canada

e. What liabilities of Bank 1 change and by how much? Complete the second column of the following table by in each row entering "0" if the listed dem is not a lab

representing an increase in a liability, or a negative number representing a decrease in a lability (Do not include the $ symbor in your answers)

Show Transcribed Text

Reserves

Deposits

Securities

Loans

Bonowing from Bank of Canada

e. What ablities of Bank 1 change and by how much? Complete the second column of the following table by in each row entering "0" if the listed item is not a liability and/or does not change, a positive number

representing an increase in a liability, or a negative number representing a decrease in a kability (Do not include the S symbol in your answers)

Change in Liability

Ĉ

S

t. If the desired reserve ratio for Bank 1 and all other banks is 20 percent, then the maximum new loan Bank 1 can create is $ (Enter your response as a whole number. Do not include the $ symbol in

your answer)

Reserves

Deposits

Secuntes

Loans

Bonowing from Bank of Canada

g. What assets of Bank 1 will change when it approves this new loan? Complete the second column of the following table by in each row entering "0" the listed item is not an asset and/or does not change, a

positive number representing an increase in an asset, or a negative number representing a decrease in an asset (Do not include the $ symbol in your answers)

Change in Asset

Palm

the following t

What

when

not include symbol your answers)

positive number representing an increase in a babuity, or a negative number representing a decrease in a habily (Doy in each now entering at the listed dem es not a lability and or does not change, a

Show Transcribed Text

does not change, a postive number

Change in Liability

tar

Reserves

Deposts

Secunbes

Loans

Borrowing from Bank of Canada)

3

D

D

What labites of Bank 11

1 will change when it approves this new loan? Complete the second column of the following table by in each row entering "0" if the listed dem is not a liability and or does not change, a

positive number representing an increase in a liability, or a negative number representing a decrease in a liability (Do not include the 5 symbol in your answers)

Change in Liability

h. The maximum change in the money supply the entre chartered banking system can create due to the bank of Canada's purchase of the bonds a $ (Type a positive number to represent an inca in

the money supply or a negative number to represent a decrease in the money supply Do not include the 5 symbol in your answer)

A Time Damsinin ene

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Create the T-entry for the Fed that goes together with the choice in the question abovearrow_forwardQuestion 3 In the market for reserves, suppose that the federal funds rate and discount rate are both at 7%. If the Federal Reserve Bank sells securities in the open market, then the equilibrium rate for reserves will and the amount of borrowed reserves will O not change; decrease O not change; increase O rise; increase O rise; decrease Question 4 When the Federal Reserve Bank lowers the reserve requirements for commercial banks in the economy, this causes the curve for reserves to decrease and so the curve shifts to the ----- O demand; right O demand: left O supply; right O supply; leftarrow_forwardThe money stock measured as M1 is growing at the rate of 5% per year. If real GDP is growing at 2% per year, and the income velocity of circulation of money is constant, Select one: the economy will achieve noninflationary growth O b. the inflation rate will be around 1%. O c. the inflation rate will be around 5% O d. the inflation rate will be around 3%.arrow_forward

- If the Fed decided to decrease the Federal Funds Rate, (*the overnight rate that they lend to other banks) This means they are attempting to.. O Decrease the supply of money O Slow the economy because inflation is escalating O React to the trade war with China and restrict imports O Increase the supply of moneyarrow_forwardWhich of these statements are true? The discount rate is normally equal to the federal funds rate. The federal funds ratre is normall higher than the discount rate. The Federal Funds rate is the rate that banks are charged when they borrow from the Fed. O The discount rate is normally higher than the federal funds rate.arrow_forwardIn the country of Juventus, the money supply is equal to $52 (bilion), the velocity of circulation is 5, and real GDP is $100 (bilion) a. What is the price level in Juventus, and what is the valur of its nominal GDP? Round your price level to 2 decimal places Price level Nominal GDP b. If money supply increases by 20 percent, what will be the new values of the price level and nominal GDP, assuming that Vand real GDP remain constant? Round your price level to 2 decmal olaces Price levet Nominal GDP c What does this suggest about the connection between money supply atnd price level? The relationship between money supply and price level in this case is Cick to select)arrow_forward

- N @ # $ % & 2 3 4 5 6 7 8arrow_forwardConsider the following table: Interest rate % Asset demand for Money supply $460 460 220 460 220 460 220 460 The transactions demand for money in this money market would graph as a: 2 4 6 8 Transaction demand for money 10 vertical line $220 220 horizontal line money $300 280 260 240 220 Oline sloping downward and to the right single point line sloping upward and to the rightarrow_forwardMacmillan Learning b. A central bank reduces the rate of interest that it charges to commercial banks on loans. expansionary c. The Federal Reserve purchases bonds on the open market. O expansionary d. The Federal Reserve decreases the discount rate. expansionary O contractionary expansionary contractionary contractionary e. A central bank increases the percentage of deposits that banks are required to keep in vaults. O contractionary.arrow_forward

- Expansionary monetary policy is when: None of the statements are correct. The president and congress agree to lower interest rates. The president orders the Federal Reserve to cut income taxes. The Federal Reserve reduces the regulations hindering our business community. The Federal Reserve increases the nation's money and credit supply and raises interest rates. Moving to the next question prevents changes to this answer. O JUL 21 tv 10 ^ Oarrow_forwardTyped plzzz And Asaparrow_forwardSuppose that commercial banks do NOT hold excess reserves. When the Federal Reserve raises the reserve requirement, the money supply will because commercial banks can make loans. O shrink; more O shrink; fewer O grow; more O grow; fewerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education