ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

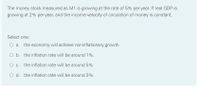

Transcribed Image Text:The money stock measured as M1 is growing at the rate of 5% per year. If real GDP is

growing at 2% per year, and the income velocity of circulation of money is constant,

Select one:

the economy will achieve noninflationary growth

O b. the inflation rate will be around 1%.

O c. the inflation rate will be around 5%

O d. the inflation rate will be around 3%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In the short run, if the central bank decreases the money supply, the currency will and output will O appreciate; rise O appreciate; fall O depreciate; rise O depreciate; fallarrow_forwardWhich of the following is NOT a function of money? O a. A unit of account O b. A store of value O c. An interest-earning asset O d. A medium of exchangearrow_forwardI’m confused on all three please help!arrow_forward

- The quantity theory of money begins with the equation of exchange, MV = PY, and then adds the assumptions that Select one: A. velocity and potential GDP are independent of the quantity of money. B. potential GDP and the price level are independent of the quantity of money. C. velocity and the price level are independent of the quantity of money. D. potential GDP and the quantity of money are independent of the price level. O E. velocity varies inversely with the interest rate, and the price level is independent of the quantity of money.arrow_forwardTyped plzzz And Asap Thanksarrow_forward. What is the opportunity cost of holding money? How is k related to the velocity of money? s. Use the Quantity Theory of Money to explain how long run inflation occurs. If the Federal Reserve Bank wishes to keep the inflation rate at zero percent, at what rate should the money supply grow? Why?arrow_forward

- In the country of Juventus, the money supply is equal to $52 (bilion), the velocity of circulation is 5, and real GDP is $100 (bilion) a. What is the price level in Juventus, and what is the valur of its nominal GDP? Round your price level to 2 decimal places Price level Nominal GDP b. If money supply increases by 20 percent, what will be the new values of the price level and nominal GDP, assuming that Vand real GDP remain constant? Round your price level to 2 decmal olaces Price levet Nominal GDP c What does this suggest about the connection between money supply atnd price level? The relationship between money supply and price level in this case is Cick to select)arrow_forward4. The U.S. Federal Reserve responded to the 2020 COVID-19 lockdowns by imple-menting an expansionary monetary policy, causing M2 money supply to rise from $15.33 trillion in December 2019 to $18.3 trillion in July 2020. Over the same period, real GDP fell by 5.1 percent. (a) Assuming that the velocity of money was constant over this period, what should theinflation rate be, based on the quantity equation? Show your work. (b) Why would you not expect inflation to be immediate, following the monetary ex-pansion?arrow_forward32arrow_forward

- Consider a situation where the central bank increases the money supply. All other things being equal, if nominal GDP increased by $800 billion during a time when velocity was 4, by how much did the central bank increase the money supply? O $200 million $400 billion $400 million $200 billionarrow_forward4. The U.S. Federal Reserve responded to the 2020 COVID-19 lockdowns by imple-menting an expansionary monetary policy, causing M2 money supply to rise from $15.33 trillion in December 2019 to $18.3 trillion in July 2020. Over the same period, real GDP fell by 5.1 percent. (b) Why would you not expect inflation to be immediate, following the monetary ex-pansion? 5. Inflation can cause increased wealth inequality through the Cantillion Effect. Essentially, this means that expansionary monetary policy benefits those who are initially given new money (usually those who are rich and well-connected), while the rest of the population suffers the effects of inflation. Using the quantity theory of money, explain why this is the case.arrow_forwardAsap plzzzzarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education