ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question

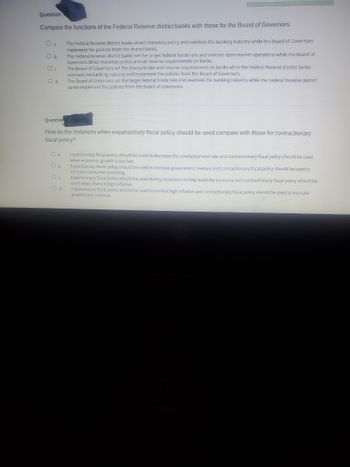

Compare the functions of the Federal Reserve district banks with those for the Board of Governors.

O a

Ob

O c

Od

O a

Ob

The Federal Reserve district banks direct monetary policy and overlook the banking industry while the Board of Governors

Implement the policies from the district banks.

The Federal Reserve district banks set the target federal funds rate and oversee open market operations while the Board of

Governors direct monetary policy and set reserve requirements on banks.

Question

How do the instances when expansionary fiscal policy should be used compare with those for contractionary

fiscal policy?

Od

The Board of Governors set the discount rate and reserve requirements on banks while the Federal Reserve district banks

overlook the banking industry and implement the policies from the Board of Governors.

The Board of Governors set the target federal funds rate and overlook the banking industry while the Federal Reserve district

banks implement the policies from the Board of Governors.

Expansionary fiscal policy should be used to decrease the unemployment rate and contractionary fiscal policy should be used

when economic growth is too fast.

Expansionary fiscal policy should be used to increase government revenue and contractionary fiscal policy should be used to

increase consumer spending.

Expansionary fiscal policy should be used during recessi to help build the economy and contractionary fiscal policy should be

used when there is high inflation.

Expansionary fiscal policy should be used to combat high inflation and contractionary fiscal policy should be used to increase

government revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- view picturearrow_forwardCompare the functions of the federal reserve district banksarrow_forwardClassify each of these transactions as an asset, a liability,or neither for each of the “players” in the money supplyprocess—the Federal Reserve, banks, and depositors.d. A bank borrows $500,000 in overnight loans fromanother bank.arrow_forward

- 1. Subject to the approval of the board of Governors, the decision of choosing the president of a district Federal Reserve bank is made by: A. All 9 district bankers B. The 6 district bank directors elected by the member banks C. 3 district bank directors who are professional bankers D. Class B and Class C directors 2. Assuming initially that the required reserve ratio = 10%, the currency-deposit ratio = 40%, and the excess reserve ratio = 0, a decrease in the required reserve ratio to 5% causes the M1 money multiplier to everything else held constant. A. Increase from 2.8 to 3.11 B. Decrease from 3.11 to 2.8 C. Increase from 2 to 2.22 D. Decrease from 2.22 to 2 %3Darrow_forwardWhy do you think the Fed maintains 5-year terms for Federal Reserve district bank presidents? O The terms are 5 years or less depending on when the district bank president in question reaches age 65. O Maintaining the 5-year terms helps ensure that the presidents are not unduly influenced by politicians. O Maintaining the 5-year terms helps to achieve the Fed's aim of confusing market participants about the stance of policy. O There is no deliberate strategy behind maintaining the 5-year terms.arrow_forwardI need answer typing clear urjent no chatgpt i will give upvotearrow_forward

- The Federal Reserve System and Open Market Operations_ Ask FRED The accompanying graph depicts the value of mortgage-backed securities held by the Federal Reserve over time. ALFRED IlMorgage-backed securities held by the Federal Reserve: All Maturities Vintage 2018-02-08 1,800,000 1,600,000 1,400,000 1,200,000 O 1.000,000 800,000 600,000 400,000 200,000 -200,000 2004 2006 2008 2010 2012 2014 2016 2005 Source: Board of Governors of the Federal Reserve System (US) a. What was the value of mortgage-backed securities the Fed held prior to 2009? Enter your answer in millions of dollars millionarrow_forwardJohn is writing a research paper and needs to know what determines the value of a bank's loans. By law, banks are permitted to lend: O their deposits O all of their reserves O their required reserves O their excess reserves « Previoùs Next » W ASUS 16 18 5 8 Rarrow_forwardWhich of the current parts of the Federal Reserve System was not a part of the Federal Reserve Act of 1913? O a. State chartered banks who choose to be members of the System O b. Nationally chartered banks Oc. Reserve Banks Od. Board of Governorsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education