Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

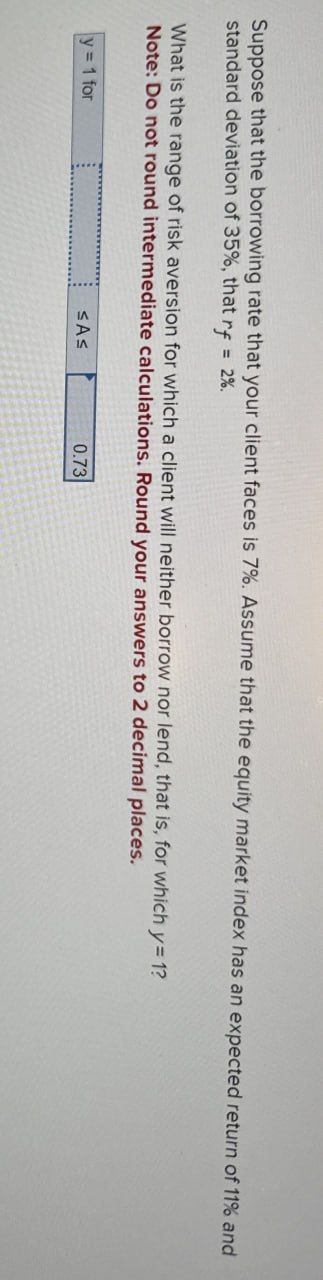

Transcribed Image Text:Suppose that the borrowing rate that your client faces is 7%. Assume that the equity market index has an expected return of 11% and

standard deviation of 35%, that rf=2%

What is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y=1?

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

y= 1 for

≤A≤

0.73

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that the borrowing rate that your client faces is 5%. Assume that the equity market index has an expected return of 8% and standard deviation of 24%, that r = 28. What is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y=1? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. y = 1 for 9.60 SAS 0.48arrow_forwardSuppose that the borrowing rate that your client faces is 8% Assume that the equity market index has an expected return of 12% and standard deviation of 28%, that ry - What is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y-1? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. y=1 for SASarrow_forwarda. Fill in the missing values in the table. (Leave no cells blank - be certain to enter O wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Security Firm A Expected Return Standard Deviation Correlation Beta 0.119 0.22 0.95 Firm B 0.131 0.41 1.50 Firm C 0.112 0.75 0.26 The market portfolio 0.12 0.19 The risk-free asset 0.05 * With the market portfolio b-1. What is the expected return of Firm A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %arrow_forward

- Suppose that the borrowing rate that your client faces is 9%. Assume that the equity market index has an expected return of 13% and standard deviation of 25%, that rf = 5%. What is the range of risk aversion for which a client will neither borrow nor lend, that is, for which y = 1?arrow_forwardSuppose the nominal rate of return is 0.085 and the risk-free rate is 0.010. What is the risk premium? Instruction: Round to two decimal places. E.g., if your answer is 0.0106465 or 1.06465%, you should type ONLY the number .01, neither 0.0106465, 0.0106, nor 1.065. Otherwise, Blackboard will treat it as a wrong answer.arrow_forwardThe following numbers were randomly generated from a standard normal distribution:0.5 − 0.75 1.1i). Given interest rate r = 0.01 and volatility parameter σ = 0.2, compute the drift parameter µ of asecurity following a risk-neutral geometric Brownian motion.ii). Suppose security ABC follows a geometric Brownian motion with the parameters given above. Ifthe initial closing price of ABC is S0 = s = 10, compute 3 more simulated daily closing prices forABC using the random numbers above.arrow_forward

- Suppose the CAPM holds. You know that the average investor has a degree risk aversion of 3.3. The current risk free rate is 0.012, the inflation is estimated 0.017, and the volatility of the market is 0.17. What is the market risk premium? [*.000]arrow_forwardAssume that security returns are generated by the single-index model,Ri = αi + βiRM + eiwhere Ri is the excess return for security i and RM is the market’s excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security βi E(Ri) σ(ei) A 0.7 7 % 20 % B 0.9 9 6 C 1.1 11 15 a. If σM = 16%, calculate the variance of returns of securities A, B, and C. b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)arrow_forwardAssume that security returns are generated by the single-index model, Ri a BiRM + ei where R₁ is the excess return for security /and Ry is the market's excess return. The risk-free rate is 3%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security Bi E(Ri} #{@į) A 1.5 61 298 B 1.7 8 15 C 1.9 10 24 a. If oy 26%, calculate the variance of returns of securities A, B, and C. Answer is complete but not entirely correct. Variance Security A 1,521 Security B 1,609 Security C 2,440 b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)arrow_forward

- Use the following information on states of the economy and stock returns to calculate the expected return for Dingaling Telephone: (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Probability of State of Security Return if State Occurs State of Economy Recession Economy 0.30 Normal Вoom -6.5% 9.0 16.6 0.55 0.15arrow_forwardAssume that security returns are generated by the single-index model, Ri = alphai + BetaiRM + ei where Ri is the excess return for security i and RM is the market's excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and C, characterized by the following data. Security Betai E(Ri) sigma(ei) A 1.4 15% 28% B 1.6 17% 14% C 1.8 19% 23% a. If simaM = 24%, calculate the variance of returns of securities A, B, and C (round to whole number). Variance Security A Security B Security C b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C (enter the variance answers as a whole number decimal and the mean as a whole number percentage)? Mean Variance Security A ?% Security B ?% Security C ?%arrow_forwardSuppose that the Treasury bill rate is 6% rather than 3%, as we assumed in Table 12.1, and the expected return on the market is 9%. Use the betas in that table to answer the following questions. a. When you assume this higher risk-free interest rate, what makes sense for how you should modify your assumption about the rate of return on the market portfolio? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) b. Recalculate the expected return on the stocks in Table 12.1. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) c. Suppose now that you continued to assume that the expected return on the market remained at 9%. Now what would be the expected returns on each stock? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)d. Ford offer a higher or lower expected return if the interest rate is 6% rather than 3%? e. Walmart offer a higher or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education