Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

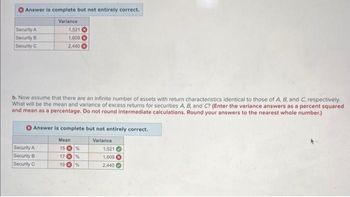

Transcribed Image Text:Answer is complete but not entirely correct.

Variance

Security A

1,521

Security B

Security C

1,609

2,440

b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively.

What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared

and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)

Answer is complete but not entirely correct.

Mean

Variance

Security A

15%

1,521

Security B

17%

1,609

Security C

19%

2,440

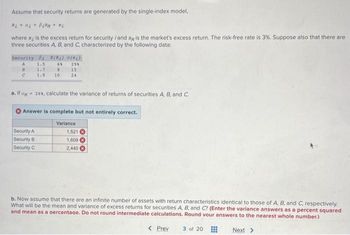

Transcribed Image Text:Assume that security returns are generated by the single-index model,

Ri a BiRM + ei

where R₁ is the excess return for security /and Ry is the market's excess return. The risk-free rate is 3%. Suppose also that there are

three securities A, B, and C, characterized by the following data:

Security Bi E(Ri} #{@į)

A

1.5

61 298

B

1.7

8

15

C

1.9

10

24

a. If oy 26%, calculate the variance of returns of securities A, B, and C.

Answer is complete but not entirely correct.

Variance

Security A

1,521

Security B

1,609

Security C

2,440

b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively.

What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared

and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)

< Prev 3 of 20

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider two assets. Suppose that the return on asset 1 has expected value 0.05 and standard deviation 0.1 and suppose that the return on asset 2 has expected value 0.02 and standard deviation 0.05. Suppose that the asset returns have correlation 0.4.Consider a portfolio placing weight w on asset 1 and weight 1-w on asset 2; let Rp denote the return on the portfolio. Find the mean and variance of Rp as a function of w.arrow_forward3) If two securities are perfectly negatively correlated then the global-minimum variance portfolio has a standard deviation that is always A) greater than zero. B) equal to zero. C) equal to the sum of the securities' standard deviations. D) equal to −1. Choose the correct answer and justify it.arrow_forwardA change in the risk premium, E(Rm) - Rf, results in... a) A change in the vertical intercept of the Security Market Line (SML) b) No change in the return/beta relationship. c)A change in the horizontal intercept of the Security Market Line (SML) d)A change in the slope of the Security Market Line (SML)arrow_forward

- Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA = 2.60% + 0.90RM + eA RB = -2.00% + 1.20RM + eB OM = 26%; R-squarea = 0.21; R-squareg = 0.12 Assume you create portfolio P with investment proportions of 0.70 in A and 0.30 in B.arrow_forwardRead the box “The ‘Beta’ of a Stock” in the attachment.a. Suppose that the value of β is greater than 1 for a particular stock.Show that the variance of (R - Rf) for this stock is greater than thevariance of (Rm - Rt).b. Suppose that the value of β is less than 1 for a particular stock. Is itpossible that variance of (R - Rf) for this stock is greater than thevariance of (Rm - Rt)? (Hint: Don’t forget the regression error.) c. In a given year, the rate of return on 3-month Treasury bills is 2.0%and the rate of return on a large diversified portfolio of stocks (theS&P 500) is 5.3%. For each company listed in the table in the box,use the estimated value of β to estimate the stock’s expected rate ofreturn.arrow_forwardA coefficient of determination of 0.6 means that \\( 40 \\% \\) of the variation in a security's return is related to factors other than the security's relationship to the market. True Falsearrow_forward

- (Singular) Suppose there are two stocks that are uncorrelated. Each of these has variance of 1, and there are expected returns are 7₁ and 72, respectively. The risk-free rate is rf. Find the portfolio of weights w₁ and w2 for the Markowitz (market) portfolio. Show that for some value of rf there is no Markowitz portfolio.arrow_forwardConsider the expected return and standard deviation of the following two assets: Asset 1: E[r1]=0.1 and σ1=0.2 Asset 2: E[r2]=0.3 and σ2=0.4 (a) Draw (e.g. with Excel) the set of achievable portfolios in mean-standard deviation space for the cases: (i) ρ12= -1, (ii) ρ12=0. (b) Suppose ρ12=-1. Which portfolio has the minimal variance? What is the variance and expected return of that portfolio? (c) Derive the formula for the variance of a portfolio with four assets.arrow_forwardIf you plot the relationship between portfolio expected return and portfolio beta, what is the slope of the line that results? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) | Slope of the line %arrow_forward

- The following expected return and the standard deviation of current returns are known: Security (i) Expected Return Standard Deviation βi A 0.20 0.12 1.1 B 0.12 0.10 0.8 T-Bills 0.05 0 0 Market Portfolio 0.20 0.15 1 Required: Determine which of A or B is over-valued or undervalued.arrow_forwardConsider the following single factor specification: R₁ = a¡ + ßi, Rµ + €i. Where R; is the return on security i, RM is the return on index M (a broad market index) and e, is a zero- mean white noise random variable not correlated with anything. Assume that the single factor specification above correctly describes the return generating processes of all securities. Furthermore, you have the following descriptive statistics for returns of well-diversified Portfolios X, Y, and index M. Portfolio X Portfolio Y Index M Risk-Free Expected return 14% 17% ?? ?? B₁ 1.2 1.6 1 0 a. Assume that the corresponding single factor APT correctly prices Portfolios X and Y. In other words, the expected returns of Portfolios X and Y shown above - 14% and 17% respectively - are equal to their APT-predicted expected returns. Calculate the expected return of Index M and risk-free rate. b. Another well-diversified portfolio Z has a beta, ßz, of 0.8 while its expected return is 10%. Form a portfolio consisting…arrow_forwardThe lower the standard deviation of returns on a security, the _____ the expected rate of return and the _____ the risk. Multiple Choice lower; lower lower; higher higher; lower higher; higherarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education