Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:File Preview

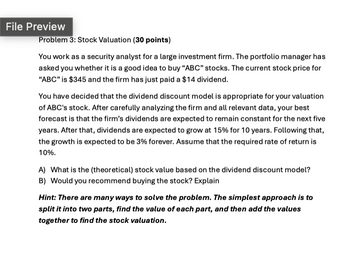

Problem 3: Stock Valuation (30 points)

You work as a security analyst for a large investment firm. The portfolio manager has

asked you whether it is a good idea to buy "ABC" stocks. The current stock price for

"ABC" is $345 and the firm has just paid a $14 dividend.

You have decided that the dividend discount model is appropriate for your valuation

of ABC's stock. After carefully analyzing the firm and all relevant data, your best

forecast is that the firm's dividends are expected to remain constant for the next five

years. After that, dividends are expected to grow at 15% for 10 years. Following that,

the growth is expected to be 3% forever. Assume that the required rate of return is

10%.

A) What is the (theoretical) stock value based on the dividend discount model?

B) Would you recommend buying the stock? Explain

Hint: There are many ways to solve the problem. The simplest approach is to

split it into two parts, find the value of each part, and then add the values

together to find the stock valuation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Similar questions

- Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the company's computer products and believes Hi-Tech is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.00. Mike has obtained the following price information for the period 2015 through 2018: Hi-Tech stock, being growth-oriented, did not pay any dividends during these 4 years. a. Calculate the rate of return for each year, 2015 through 2018, for Hi-Tech stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. c. Calculate the standard deviation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c…arrow_forwardChoose one appropriate statement. 1. The movement of stock prices have certain patterns, and investors can make profits by studying such patterns. 2. If a hedge fund manager believes that Toyota will going to outperform Honda she will short stocks of both companies. 3. When one share of Apple stock is being traded at $150, the stock market believes that you can always sell a share of Apple stock for at least $150 in the future. 4. O An undervalued stock should outperform the market in the long run. 5. O Diversification is not appropriate because it would prevent investors from capitalizing on the superior return that can result from a concentrated holding of the stock of one successful company.arrow_forwardYour stockbroker, John Smith, calls you with a hot stock tip to buy SMITH Inc. The stock is currently selling for $25 a share. You gather the following data to evaluate Smith's recommendation. The risk free rate is 3%, and you demand a 14% return on the market portfolio. SMITH's current dividend is $2.50 a share. You decide to get other necessary estimates from a third-party, Rocky Enterprises. Rocky has estimated that SMITH's beta is 2.0 and that the stock's dividend will grow at a constant 10 percent rate. Based on your estimates, is Smith's recommendation to buy SMITH a good one? What do you think the stock is worth?arrow_forward

- You have risen through the ranks of a coffee comany, from the lowly green-apron barista to the coveted black apron, and all the way to CFO. A quick internet check shows that your company's beta is 0.68. The risk-free rate is 5.8% and you believe the market risk premium to be 5.7%. What is your best estimate of investors' expected return on your company's stock (its cost of equity capital)? The expected return is %. (Round to two decimal places.)arrow_forwardCAN I GET HELP as soon as possible please Explain your answer for each of them. Show all your work. The required return on ABC stock is 14%. The risk-free rate of return is 4% and the real rate of return is 2%. How much are investors requiring as compensation for risk? A) 8% B) 10% C) 12% D) 14% The efficient market hypothesis suggests thatA) investors should not try to outguess the market by constantly buying and selling securities. B) investors do better on average if they adopt a "buy and hold" strategy.C) buying into a mutual fund is a sensible strategy for a small investor.D) all of the above are sensible strategies.E) only A and B of the above are sensible strategies.arrow_forwardSuppose the market risk premium is 6% and the risk-free interest rate is 5%. Using the data in the table, Starbucks Hershey Autodesk Beta 0.80 0.33 1.72 calculate the expected return of investing in A. Starbucks' stock (Round to two decimalplaces.). B. Hershey's stock. (Round to two decimal places.) C. Autodesk's stock (Round to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education