Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer? ? financial accounting

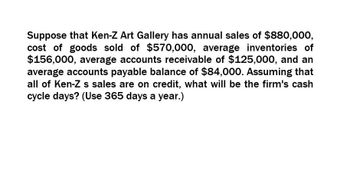

Transcribed Image Text:Suppose that Ken-Z Art Gallery has annual sales of $880,000,

cost of goods sold of $570,000, average inventories of

$156,000, average accounts receivable of $125,000, and an

average accounts payable balance of $84,000. Assuming that

all of Ken-Z s sales are on credit, what will be the firm's cash

cycle days? (Use 365 days a year.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that Ken-Z Art Gallery has annual sales of $870,000, cost of goods sold of $560,000, average inventories of $244,500, average accounts receivable of $265,000, and an average accounts payable balance of $79,000. Assuming that all of Ken-Z's sales are on credit, what will be the firm's cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardSuppose that LilyMac Photography has annual sales of $230,000, cost of goods sold of $165,000, average inventories of $4,500, average accounts receivable of $25,000, and an average accounts payable balance of $7,000.Assuming that all of LilyMac’s sales are on credit, what will be the firm’s cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardSuppose that LilyMac Photography has annual sales of $233,000, cost of goods sold of $168,000, average inventories of $4,800, average accounts receivable of $25,600, and an average accounts payable balance of $7,300. Assuming that all of LilyMac's sales are on credit, what will be the firm's cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.) What will be the firm's operating cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- Need helparrow_forwardNeed answer pleasearrow_forwardA company has just sold a product with the following payment plan: $75, 000 today, $50, 000 at the end of year 1. and $25, 000 at the end of year two. If the payments are deposited into an account earning 4.5% per year, calculate the present value for the cash flow. Show steps using ONLY a financial calculator. The answer should be 145,740.arrow_forward

- Leyton Lumber Company has sales of $12 million per year, all oncredit terms calling for payment within 30 days, and its accounts receivable are $1.5 million.What is Leyton’s DSO, what would it be if all customers paid on time, and how much capitalwould be released if Leyton could take action that led to on-time payments?arrow_forwardIf a firm has sales of $23,920,000 a year, and the average collection period for the industry is 60 days, what should this firm’s accounts receivable be if the firm is comparable to the industry? Assume there are 365 days in a year. Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forwardThe company has sales of $ 10 million per year, all of which are from credit terms that require payment to be made within 30 days, and the company's account receivables amount to $ 2 million. What is the DSO of the company, what is the value if all borrowers pay on time, and how much capital will be released if the company takes actions that lead to timely payment?arrow_forward

- Please need answer the accounting questionarrow_forwardPlease see image to solve question.arrow_forwardC. Exodus Corp. is analyzing the performance of its cash management. On the average, the firm holds inventory 65 days, pays its suppliers in 35 days, and collects its receivables in 15 days. The firm has a current annual outlay of P1,960,000 on operating cycle investments. Exodus currently pays 10 percent for its negotiated financing. (Assume a 360-day year.) Calculate the following: a. Cash conversion cycle b. Operating cycle. c. Daily expenditure and the firm's annual savings if the operating cycle is reduced by 15 days.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT