Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need answer please

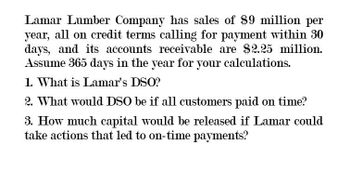

Transcribed Image Text:Lamar Lumber Company has sales of $9 million per

year, all on credit terms calling for payment within 30

days, and its accounts receivable are $2.25 million.

Assume 365 days in the year for your calculations.

1. What is Lamar's DSO?

2. What would DSO be if all customers paid on time?

3. How much capital would be released if Lamar could

take actions that led to on-time payments?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The company has sales of $ 10 million per year, all of which are from credit terms that require payment to be made within 30 days, and the company's account receivables amount to $ 2 million. What is the DSO of the company, what is the value if all borrowers pay on time, and how much capital will be released if the company takes actions that lead to timely payment?arrow_forwardLeyton Lumber Company has sales of $11 million per year, all on credit terms calling for payment within 30 days, and its accounts receivable are $1.43 million. Assume 365 days in year for your calculations. What is Leyton's DSO? Round your answer to two decimal places. days What would DSO be if all customers paid on time? Do not round intermediate calculations. Round your answer to two decimal places. days How much capital would be released if Leyton could take actions that led to on-time payments? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest cent.$arrow_forwardLeyton Lumber Company has sales of $10 million per year, all on credit terms calling for payment within 30 days, and its accounts receivable are $2.25 million. Assume 365 days in year for your calculations. What is Leyton's DSO? Do not round intermediate calculations.Round your answer to two decimal places. days What would DSO be if all customers paid on time? Do not round intermediate calculations. Round your answer to two decimal places. days How much capital would be released if Leyton could take actions that led to on-time payments? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest cent.$arrow_forward

- A business is planning to purchase a piece of equipment that will produce a continuous stream of income for 8 years with rate of flow f(t) = 9,000. If the continuous income stream earns 6.9%, compounded continuously, what single deposit into an account earning the same interest rate will produce the same future value as the continuous income stream? (This deposit is called the present value of the continuous income stream.) What is the future value of the investment? (Round to the nearest dollar as needed.)arrow_forwardWhat's the rate of return you would earn if you paid $2,880 for a perpetuity that pays $65 per year? X-1 Corp's total assets at the end of last year were $425,000 and its EBIT was $52,500. What was its basic earning power (BEP) ratio?arrow_forwardMason, Inc., is considering the purchase of a patent that has a cost of $85000 and an estimated revenue producing lite of 4 years. Mason has a required rate of return that is 12% and a cost of capital of 11%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forward

- Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardAssume a firm makes a $ deposit into a short-term investment account. If this account is currently paying %, (yes, that's right, less than 1% !), what will the account balance be after 1 year?arrow_forwardSuppose you save $2,800 ayear for 43 years into an investment account that earns 8.5% return, how much will you have at the end of the periods? Formula? Excel Function?arrow_forward

- A firm has borrowed $5,000,000 for 5 years at 10% per year compound interest. The firm will make no payments until the loan is due, when it will pay off the interest and principal in one lump sum. What is the total payment?arrow_forwardA manufacturer needs to borrow money to purchase a building. The purchase price of thebuilding is $1.5 million, and the company will put $300,000 in cash down at closing. If thecompany can borrow the difference from its bank at 4.85% for 20 years, what will the monthlyprincipal and interest payment of the loan be? Create an amortization schedule also. Solved in excelarrow_forwardYou are thinking of making an investment in a new factory. The factory will generate revenues of $1,960,000 per year for as long as you maintain it. You expect that the maintenance costs will start at $90,160 per year and will increase 5% per year thereafter. Assume that all revenue and maintenance costs occur at the end of the year. You intend to run the factory as long as it continues to make a positive cash flow (as long as the cash generated by the plant exceeds the maintenance costs). The factory can be built and become operational immediately and the interest rate is 6% per year. a. What is the present value of the revenues? - b. What is the present value of the maintenance costs? c. If the plant costs $19,600,000 to build, should you invest in the factory? EIERarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College