EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I don't need ai answer general accounting question

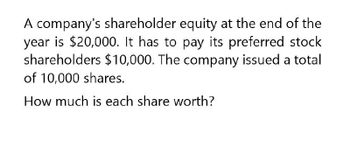

Transcribed Image Text:A company's shareholder equity at the end of the

year is $20,000. It has to pay its preferred stock

shareholders $10,000. The company issued a total

of 10,000 shares.

How much is each share worth?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Longmont Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the numerator of the EPS calculation for Longmont?arrow_forwardErrol Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?arrow_forwardHi, If a company has 32,000 common stock shares outstanding $10 par value, then purchases 2,300 shares of treasury stock at $25 per share. How would this be jouralized? Also, after those transaction the same company declared a $0.10 per share cash dividend on the common stock outstanding. How would this be jouralized?arrow_forward

- A share holder purchased 1000 shares in SJG co on January 1 at a market value of 2.82 per share. The dividend paid during the period was o.27 per share. What is the total shareholder return?arrow_forwardA company’s preferred stock pays an annual dividend of 4.5 percent and is currently selling for $60, and there are 100,000 shares outstanding. 1. determine the company preferred stocks and the cost of preferred stocks.arrow_forwardSuppose a company declares a dividend of $0.50 per share. At the time of declaration, the company has 100,000 shares issued and 90,000 shares outstanding. On the declaration date, Dividends would be recorded for a. $0. b. $50,000. c. $45,000. d. $95,000.arrow_forward

- A stock pays an annual dividends of $0.33 per share. Determine the dividends paid to a shareholder who has 1 200 shares of the company's stock. a. $358b. $396c. $302d. $206arrow_forward8. Given the following information answer the three questions below. Brunleigh Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is Brunleigh Corporation’s weighted average number of shares for the year? Shares. Input number only and use comma placement as needed. What is the numerator of the EPS calculation for Brunleigh Corporation? All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). What is the EPS for the year for Brunleigh Corporation? Your answer will be rounded to two decimal places and in proper format as shown in the textbook.arrow_forwardIf a company declares a $0.30 dividend and you own 100 shares, how much dividends will you receive?arrow_forward

- CBA Inc. has 400,000 shares outstanding with a $5 par value. The shares were issued for $12. The stock is currently selling for $34. CBA has $5,000,000 in retained earnings and has declared a stock dividend that will increase the number of outstanding shares by 6%. How many shares will be outstanding after the stock dividend?arrow_forwardFirm A has a 20,000 authorized ordinary shares which have a par value of P15 per share. Initially, it issued 2,500 of its share for cash at P17.50 per share. On another day, it issued additional 1,750 shares at P18 per share. It has an income of P50,000, 64.30% of which is set aside for inventory build up. What is the upper limit of dividend per share can the BOD declare?arrow_forwardThe Chris Clapper Copper Company declared a 25 percent stock dividend on March 10 to shareholders of record on April 1. The market price of the stock is $50 per share. You own 160 shares of the stock. A.What will be the total value of your holdings before the stock dividend, all other things the same? Format: 1,111 B. What will be the total value of your holdings after the stock dividend, all other things the same? Format: 1,111arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College