Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

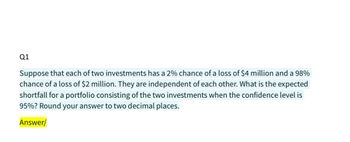

Transcribed Image Text:Q1

Suppose that each of two investments has a 2% chance of a loss of $4 million and a 98%

chance of a loss of $2 million. They are independent of each other. What is the expected

shortfall for a portfolio consisting of the two investments when the confidence level is

95%? Round your answer to two decimal places.

Answer/

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- State the return rate (in %) for your optimal portfolio.arrow_forwardSuppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below (Attached image). Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?arrow_forwardStart with A-C and I will submit seperately for D! Thank you :)arrow_forward

- Parts A-C have already been answered, looking for answer D.arrow_forwardWhich of the following investments will experience the largest change in its market value as a result of changes in the level of interest rates (we are talking about the absolute value of the change, up or down)? Suppose interest rates go up or down by 50 basis points (0.5%). Rank the investments from 1 to 4 where a 1 is the most affected (largest absolute change in value) while a 4 is the least affected (smallest absolute change in value). A: $1 million invested in 3-month Treasury bills. 请选择~ B: $1 million invested in STRIPS (zero coupons) maturing in three years. |请选择 C: $1 million invested in a Treasury note maturing in three years. The note pays a 5% annual coupon. |请选择︾ D: $1 million invested in a Treasury note maturing in three years. The note pays a 10.0% annual coupon. |请选择arrow_forwardYou are evaluating various investment opportunities currently available and you have the fol-lowing information about five different well-diversified portfolios of risky assets. Interest raterf = 3% a) Calculate the Sharpe ratio for each portfolio. (b) Explain which of these five portfolios is most likely to be the optimal risky portfolio. (c) Suppose you are willing to invest with an expected return of 6%. What would be theinvestment proportions in the riskless asset and the optimal risky portfolio? What is thestandard deviation of the return for this investment?arrow_forward

- Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below. A B C Probabilities return 0.05 0.50% -3.60% 3.60% 0.35 0.60% 2.75% 0.15% 0.45 3.66% 1.45% 0.45% 0.15 -4.80% -0.60% 6.30% Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?arrow_forward1. A stock has a beta of 1.15 and an expected return of 14 percent. A risk-free asset Currently earns 4.2 percent. a . What is expected return on a portfolio that is equally in inverted assets? b. if portfolio of the two assets has beta of 75, what are the portfolio weights? C. if a portfolio of the two assets has an expected return of 8 percent .what is its beta? the twoarrow_forward1. Suppose you have n risky assets you can combine in a portfolio. Each risky asset has an expected return of 8% and a standard deviation of 30%. The risky assets are uncorrelated with each other. (a) Consider an equally weighted portfolio of 2 of these securities. What is its expected return? What will its standard deviation be? (b) Consider an equally weighted portfolio of 30 of these securities. What is its expected return? What will its standard deviation be? (c) Suppose we let the number of these securities increase without bound. That is, n→ ∞o. What happens to the standard deviation of an equally weighted portfolio of these securities as the number of assets in the portfolio becomes extremely large? What will the riskless rate be in this case, and why? -int IDEarrow_forward

- Consider the following two assets: Asset Expected return Standard deviation of returns 1 18% 30% 2 8% 10% The returns on the two assets are perfectly negatively correlated (i.e. coefficient of -1). Calculate the proportions of assets 1 and 2 that generate a portfolio with a standard deviation of zero. What is the expected return of that portfolio Calculate the expected returns and standard deviations of three other portfolios with weightingsof your choice. Present a graph of your results.arrow_forwardSuppose that you have found the optimal risky combination using all risky assets available in the economy, and that this optimal risky portfolio has an expected return of 0.19 and standard deviation of 0.24. The T-bill rate is 0.05. What fraction of your money must be invested in the optimal risky portfolio in order to form a complete portfolio with an expected return of 0.09? Round your answer to 4 decimal places. For example, if your answer is 3.205 %, then please write down 0.0321..arrow_forwardYou have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data:. You have been told that you can create two portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, Sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education