Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

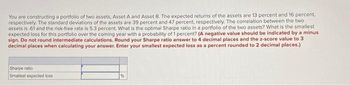

Transcribed Image Text:You are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the assets are 13 percent and 16 percent,

respectively. The standard deviations of the assets are 39 percent and 47 percent, respectively. The correlation between the two

assets is 61 and the risk-free rate is 5.3 percent. What is the optimal Sharpe ratio in a portfolio of the two assets? What is the smallest

expected loss for this portfolio over the coming year with a probability of 1 percent? (A negative value should be indicated by a minus

sign. Do not round intermediate calculations. Round your Sharpe ratio answer to 4 decimal places and the z-score value to 3

decimal places when calculating your answer. Enter your smallest expected loss as a percent rounded to 2 decimal places.)

Sharpe ratio

Smallest expected loss

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer fast i give you upvote.arrow_forwardUsing the data in the following table, consider a portfolio that maintains a 60% weight on stock A and a 40% weight on stock B. a. What is the return each year of this portfolio? b. Based on your results from part (a), compute the average return and volatility of the portfolio. c. Show that (i) the average return of the portfolio is equal to the (weighted) average of the average returns of the two stocks, and (ii) the volatility of the portfolio equals the same result as from the calculation in Eq. 11.9. d. Explain why the portfolio has a lower volatility than the average volatility of the two stocks. a. What is the return each year of this portfolio? Enter the return of this portfolio for each year in the table below: (Round to two decimal places.) Year 2012 Portfolio % 2010 % 2011 % b. Based on your results from part (a), compute the average return and volatility of the portfolio. The average return of the portfolio is%. (Round to two decimal places.) 2013 % 2014 % 2015 % The…arrow_forwardSuppose the average return on Asset A is 6.6 percent and the standard deviation is 8.6 percent and the average return and standard deviation on Asset B are 3.8 percent and 3.2 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 11 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.25 percent. How likely is it that such a low return will recur at some point in the future? (Do…arrow_forward

- This question requires you to consider a three-asset portfolio valued at 10 million AUD. The portfolio consists of the following assets: AMP, Commonwealth Bank (CBA) and QBE. The variance covariance matrix of 5 day continuously compounded returns is equal to (a) Define the Value at Risk (VAR) for a portfolio. (b) Assuming portfolio weights of AMP (40%), CBA (30%), QBE (30%), calculate the 99 % 5 day relative VaR estimate (employ a z score measured to 2 decimal places) (c) Calculate the VaR diversification benefit of the portfolio.arrow_forwardYou are going to invest in Asset J and Asset S. Asset J has an expected return of 13.6 percent and a standard deviation of 54.6 percent. Asset S has an expected return of 10.6 percent and a standard deviation of 19.6 percent. The correlation between the two assets is 0.50. What are the standard deviation and expected return of the minimum variance portfolio? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Expected return Standard deviation % %arrow_forwarduppose the average return on Asset A is 7.1 percent and the standard deviation is 8.3 percent, and the average return and standard deviation on Asset B are 4.2 percent and 3.6 percent, respectively. Further assume that the returns are normally distributed. Use the NORMDIST function in Excel® to answer the following questions. a. What is the probability that in any given year, the return on Asset A will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the probability that in any given year, the return on Asset B will be greater than 12 percent? Less than 0 percent? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. In a particular year, the return on Asset A was −4.38 percent. How likely is it that such a low return will recur at some point in the future? (Do not round…arrow_forward

- Suppose the risk free rate is 5% and the market portfolio has an expected return of 10%. Portfolio Z has a correlation coefficient with the market of 0.1 and a variance of 0.16. The market portfolio has a variance of 0.09. According to the CAPM, what is the beta of portfolio Z?arrow_forwardAsset K has an expected return of 10 percent and a standard deviation of 28 percent. Asset L has an expected return of 7 percent and a standard deviation of 18 percent. The correlation between the assets is .40. What are the expected return and standard deviation of the minimum variance portfolio?arrow_forwardYou are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the assets are 12 percent and 16 percent. respectively. The standard deviations of the assets are 29 percent and 37 percent, respectively. The correlation between the two assets is 41 and the risk-free rate is 3.4 percent. What is the optimal Sharpe ratio in a portfolio of the two assets? What is the smallest expected loss for this portfolio over the coming year with a probability of 2.5 percent? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your Sharpe ratio answer to 4 decimal places and the z-score value to 3 decimal places when calculating your answer. Enter your smallest expected loss as a percent rounded to 2 decimal places.) Sharpe ratio Smallest expected loss %arrow_forward

- You invest $96 in a risky asset and the T-bill. The risky asset has an expected rate of return of 19% and a standard deviation of 0.22, and a T-bill with a rate of return of 4%. A portfolio that has an expected outcome of $110 is formed by investing what dollar amount in the risky asset? Round your answer to the nearest cent (2 decimal places).arrow_forwardState the return rate (in %) for your optimal portfolio.arrow_forwardTwo risky assets: A and B. The expected return for A is 15% and for B 30%. The variance for returns for A is 200(%2) and for B is 800(%2). The covariance between A and B returns is -0.05. T-bills give a return of 5% with a standard deviation of 0%. The investor has a risk aversion index, A=5.0. Show all work. 1. calculate the correlation between A and B 2. calculate portfolio return / standard deviation for global mvp 3. optical risky portfolio, P (expected return and SD) 4. slope of CAL 5. how much will the investor invest (A=4) in T-bills, assets A and B?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education