Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

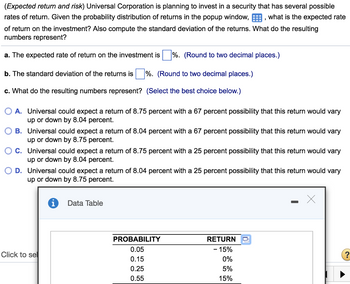

Transcribed Image Text:(Expected return and risk) Universal Corporation is planning to invest in a security that has several possible

rates of return. Given the probability distribution of returns in the popup window,

, what is the expected rate

of return on the investment? Also compute the standard deviation of the returns. What do the resulting

numbers represent?

a. The expected rate of return on the investment is ☐ %. (Round to two decimal places.)

b. The standard deviation of the returns is

%. (Round to two decimal places.)

c. What do the resulting numbers represent? (Select the best choice below.)

○ A. Universal could expect a return of 8.75 percent with a 67 percent possibility that this return would vary

up or down by 8.04 percent.

B. Universal could expect a return of 8.04 percent with a 67 percent possibility that this return would vary

up or down by 8.75 percent.

C. Universal could expect a return of 8.75 percent with a 25 percent possibility that this return would vary

up or down by 8.04 percent.

D. Universal could expect a return of 8.04 percent with a 25 percent possibility that this return would vary

up or down by 8.75 percent.

Data Table

PROBABILITY

RETURN

0.05

-15%

Click to sel

0.15

0%

0.25

5%

0.55

15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Two investments generated the following annual returns: % -Select- a. What is the average annual return on each investment? Round your answers to one decimal place. The average annual rate of return on X: The average annual rate of return on Y: b. What is the standard deviation of the return on investments X and Y? Round your answers to two decimal places. Standard deviation of X: % Standard deviation of Y: c. Based on the standard deviation, which investment was riskier? was riskier. 20X0 20X1 20X2 20X3 20X4 Investment X 11% 22 30 16 9 Investment Y 22% 24 10 13 12arrow_forwardPlease answer thearrow_forwardAssume that security returns are generated by the single-index model, Ri a BiRM + ei where R₁ is the excess return for security /and Ry is the market's excess return. The risk-free rate is 3%. Suppose also that there are three securities A, B, and C, characterized by the following data: Security Bi E(Ri} #{@į) A 1.5 61 298 B 1.7 8 15 C 1.9 10 24 a. If oy 26%, calculate the variance of returns of securities A, B, and C. Answer is complete but not entirely correct. Variance Security A 1,521 Security B 1,609 Security C 2,440 b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and C, respectively. What will be the mean and variance of excess returns for securities A, B, and C? (Enter the variance answers as a percent squared and mean as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number.)arrow_forward

- Suppose you create a portfolio with two securities: Security Security Weight (%) Security Variance (%) X 70 18 Y 30 22 If the correlation coefficient between the two securities is -0.2, what is the standard deviation of the portfolio?arrow_forwardSuppose the risk-free rate is 5%. The expected return and standard deviation of a risky asset are 10% and 20%, respectively. a. What is the slope of the capital allocation line (CAL) constructed using the risk-free asset and the risky asset? A. 0.30 B. 0.15 C. 0.25 D. 0.20 b. If an investor has a risk aversion coefficient of A=2, what is the optimal fraction of the money that she invests in the risky asset? A. 62.5% B. 42.5% C. 30% D. 20% c. If an investor invest 25% of her money in the risky asset, which is the investor’s risk aversion coefficient? a. 5 b. 1 c. 3 d. 4arrow_forwardConsider the following information (Assume that Security M and Security N are in the same financial market and the market is efficient): Standard Deviation BetaSecurity M 20% 1.25Security N 30% 0.80 Which security has more systematic risk? Group of answer choices Security M Security N Equalarrow_forward

- Consider the following table, which gives a security analyst's expected return on two stacks and the market i Aggressive Defensive Scenario Probability Market Return Stack Stock 1 0.5 0.5 2.6% 4.4% 16 27 Required: a. What are the belas of the two storks? (Round your answers to 2 decimal places.) Beta A Beta D b. What is the expected rate of return on each stack? (Round your answers to 2 decimal places.) Rate of return on A Rata of return on D % %arrow_forwardHelp me pleasearrow_forwardAsset A has a standard deviation of 0.17, and asset B has a standard deviation of 0.52. Assets A and B have a correlation coefficient of 0.44. What is the standard deviation of a portfolio consisting with a weight of 0.40 in asset A, a weight of 0.24 in asset B, and the remainder invested in a risk-free asset? Give your answer to four decimal places.arrow_forward

- Security A has an expected return of 12.4% with a standard deviation of 15%, and a correlation with the market of 0.85. Security B has an expected return of -0.73% with a standard deviation of 20%, and a correlation with the market of -0.67. The standard deviation of rM is 12%. a. To someone who acts in accordance with the CAPM, which security is more risky, A or B? Why? (Hint: No calculations are necessary to answer this question; it is easy.) b. What are the beta coefficients of A and B? Calculations are necessary. c. If the risk-free rate is 6%, what is the value of rM?arrow_forwardAssume that the following two assets are priced according to the zero-beta security market line: asset 1 has expected return of 6% and beta 0.5; asset 2 has expected return 14% and beta 2. (i) A third asset is mispriced by the market: it has beta 1.5 and expected return of 8%. Explain how you can set up a portfolio to exploit the arbitrage opportunity. What is the expected return of such portfolio? [33%] (ii) A fourth asset is mispriced by the market: it has beta 1.2 and expected return of 18%. Explain how you can set up a portfolio to exploit the arbitrage opportunity. What is the expected return of such portfolio? [33%] (iii) What should be the expected return for an asset with beta 0.8?arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education