Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

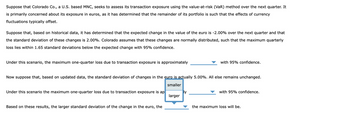

Transcribed Image Text:Suppose that Colorado Co., a U.S. based MNC, seeks to assess its transaction exposure using the value-at-risk (VaR) method over the next quarter. It

is primarily concerned about its exposure in euros, as it has determined that the remainder of its portfolio is such that the effects of currency

fluctuations typically offset.

Suppose that, based on historical data, it has determined that the expected change in the value of the euro is -2.00% over the next quarter and that

the standard deviation of these changes is 2.00%. Colorado assumes that these changes are normally distributed, such that the maximum quarterly

loss lies within 1.65 standard deviations below the expected change with 95% confidence.

Under this scenario, the maximum one-quarter loss due to transaction exposure is approximately

with 95% confidence.

Now suppose that, based on updated data, the standard deviation of changes in the euro is actually 5.00%. All else remains unchanged.

Under this scenario the maximum one-quarter loss due to transaction exposure is ap

smaller

larger

with 95% confidence.

Based on these results, the larger standard deviation of the change in the euro, the

the maximum loss will be.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Cray Research sold a supercomputer to the Max Planck Institute in Germany on credit and invoiced €11.00 million payable in six months. Currently, the six-month forward exchange rate is $1.15 per euro and the foreign exchange adviser for Cray Research predicts that the spot rate is likely to be $1.10 per euro in six months. Required: a. What is the expected gain/loss from a forward hedge? Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions. b. If you were the financial manager of Cray Research, would you recommend hedging this euro receivable? c. Suppose the foreign exchange adviser predicts that the future spot rate will be the same as the forward exchange rate quoted today. Would you recommend hedging in this case? d. Suppose now that the future spot exchange rate is forecast to be $1.22 per euro. Would you recommend hedging? a. b. Would you recommend hedging this euro…arrow_forwardSuppose that in 2020, the rate of inflation in Denmark was 0.6%, and the rate of inflation in the Euro area was 2.2%. If the Euro depreciated relative to the Danish Krone by 0.75% in the same year, what would be the magnitude of the movement of the real exchange rate (RER) of the Euro relative to the Danish Krone? Euro appreciated in real terms by 2.35 percent. Euro depreciated in real terms by 2.30 percent. Euro appreciated in real terms by 100.83 percent. O d. Euro appreciated in real terms by 0.83 percent. O c.arrow_forward(Transaction Exposure)Trident — A U.S.-based company, has concluded a sale of telecommunications equipment to Regency (U.K.). A total payment of £2,000,000 is due in 90 days. Given the following exchange rates and interest rates, the break-even investment rate (for money market hedge) is _________% when comparing the forward hedge and the money market hedge. Assumptions Value 90-day A/R in pounds £2,000,000.00 Spot rate, US$ per pound ($/£) $1.5610 90-day forward rate, US$ per pound ($/£) $1.544 3-month U.S. dollar investment rate 14.000% 3-month U.S. dollar borrowing rate 12.000% 3-month UK investment interest rate 7.500% 3-month UK borrowing interest rate 10.000% Put options on the British pound: Strike rates, US$/pound ($/£) Strike rate ($/£) $1.55 Put option premium 1.2% Strike rate ($/£) $1.54 Put option premium 1.1% Strike rate ($/£) $1.55 Call option premium 2.1%…arrow_forward

- (C) US Bank is considering investing in a three years' project in Europe country. The project would require an initial investment of $750,000 and it is expected to generate €80,000, €100,000 and €150,000 in year one until three, respectively. The business risk will be identical to the firm's existing line of business in the euro-zone, the required rate of return in the euro-zone is 18 percent. The exchange rate is $1.20/€ where the dollar also shows appreciating by one percent for every year. Determine the Net Present Value (NPV) in dollar currency for this project and justify.arrow_forwardThe US 1 year spot rate is 3.61% and the Mexican 1 year spot rate is 7.44%. A US investor purchases a Mexican corporate bond with an expected 1 year return of 9.76%, as measured in Mexican peso. The current USD/MXP exchange rate is 0.18. If the investor decides to hedge the currency risk exposure in the forward market, what would be the expected return on this portfolio, if interest rate parity holds?arrow_forwardLakonishok Equipment has an investment opportunity in Europe. The project costs €18,406,730 and is expected to produce cash flows of €3,681,369 in Year 1, €4,992,682 in Year 2, and €6,337,782 in Year 3. The current spot exchange rate is $1.23/€ and the current risk-free rate in the United States is 3.71%, compared to that in Europe of 3.03%. The appropriate discount rate for the project is estimated to be 10.55%, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €12,529,609. What is the NPV of the project?arrow_forward

- Assume that interest rate parity holds and that 90-day risk-free securities yield 3% in the United States and 3.3% in Germany. In the spot market, 1 euro equals $1.50. What is the 90-day forward rate?arrow_forwardIf the U.S. interest rate is higher than the U.K. interest rate, will the U.K. investors place short-term funds in the U.S.? Explain. Assume the investment is covered. If the rate of inflation in the European Union (EU) is above the rate of inflation in the U.S., by 4 percentage points and the dollar depreciates against the euro by 5% during the same time period, what is expected to happen to the real exchange rate? The e exchange rate is defined as the dollar price of euro($/€).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education