Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

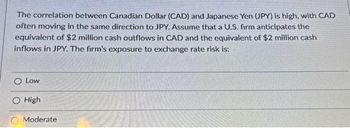

Transcribed Image Text:The correlation between Canadian Dollar (CAD) and Japanese Yen (JPY) is high, with CAD

often moving in the same direction to JPY. Assume that a U.S. firm anticipates the

equivalent of $2 million cash outflows in CAD and the equivalent of $2 million cash

inflows in JPY. The firm's exposure to exchange rate risk is:

O Low

High

Moderate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the currency risk faced by Walt Disney Company (DIS), which generates revenues from all over the world. One of its biggest sources of income is Tokyo Disney. The firm expected to receive ¥500 mln from its Tokyo operation in three months and another ¥500 min in six months. It would like to lock in the exchange rate on these two cash flows and thereby eliminate the risk of an unfavorable move in exchange rates. The investment banker indicates that the three-month forward $/ rate is 0.009123. The investment banker also offers a six-months forward contract at a rate 0.009178 $/¥. What hedging strategy Disney will take? How much home currency will the company receive from its operation in Tokyo in six months?arrow_forwardSuppose that you are a US-based importer of goods from the United Kingdom. You expect the value of the pound to increase against the U.S. dollar over the next 30 days. You will be making payment on a shipment of imported goods in 30 days and want to hedge your currency exposure. The U.S. risk-free rate is 4.0 percent, and the UK risk-free rate is 30 percent. These rates are expected to remain unchanged over the next month. The current spot rate is $2.10. a. Whether you should use a long or short forward contract to hedge the currency risk O Long position in forward contract O Short position in forward contract b. Calculate the no-arbitrage price at which you could enter into a forward contract that expires in 30 days. (Do not round intermediate calculations. Round your answer to 4 decimal places.) No-arbitrage price c. Move forward 10 days. The spot rate is $2.13. Interest rates are unchanged. Calculate the value of your forward position. (Do not round intermediate calculations. Round…arrow_forwardCurrency content analysis technique indicates Risky cashflow = X SFR + Y USD, with currency risk in the SFR / USD exchange rate. If the spot exchange rate is 9.26 SFR / USD, the corresponding cashflow is USD 15.3 milion. If the spot exchange rate is 7.58 SFR / USD, the corresponding cashflow is USD 16.5 million. Solving the system of two equations in two unknowns, the values of X and Y will be 9.88 million SFR and 50.2 million SFR 50 million SFR and 10 million USD 10 million SFR and 50 million USD 50.2 million SFR and 9.88 million USDarrow_forward

- Foreign Exchange Risk and the Cost of Borrowing Swiss Francs. The chapter demonstrated that a firm borrowing in a foreign currency could potentially end up paying a very different effective rate of interest than what it expected. Using the same baseline values of a debt principal of SF 1.6 million, a one-year period, an initial spot rate of SF 1.4600/$, a 4.934% cost of debt, and a 38% tax rate, what is the effective after-tax cost of debt for one year for a U.S. dollar-based company if the exchange rate at the end of the period was: a. 1.4600SF/$ b. 1.4000SF/$ c. 1.3350SF/$ d. 1.5730SF/$arrow_forwardH3. The Central Bank of the Bahamas pegs the Bahamian Dollar to the United States Dollar at a price of 1 BSD per USD. As an analyst for XYZ Consulting Inc., you have been asked to predict the behavior of key macroeconomic variables in the Bahamas for different policy scenarios. Using all the appropriate diagrams, your analysis must describe the Bahamian money and output markets, as well as the foreign exchange market. To perform this task, you must assume that prices are sticky: fixed in the short-run and flexible in the long-run. The scenarios are: a) A temporary restrictive monetary policy in the Bahamas. b) A temporary restrictive fiscal policy in the Bahamas.arrow_forwardSuppose the U.S. yield curve is flat at 5% and the euro yield curve is flat at 3%. The current exchange rate is $1.25 per euro. What cash flows will be exchanged on a 4-year foreign exchange swap with notional principal of 260 million euros (or equivalently, at current exchange rates, $325 million)? Note: Do not round intermediate calculations. Enter your answer in dollars not millions rounded to the nearest dollar value. Swap rate ......... per yeararrow_forward

- HSBC (a large British bank) is quoting the following spot exchange rates for number of YEN per USD, number of THB per USD and number of YEN per THB respectively. YEN/USD = 116.91 -- 116.95 THB/USD = 44.30 -- 44.40 YEN/THB = 2.6900 -- 2.7100. You are trader at Wombat Capital, a US hedge fund, and your job is to try to find arbitrages in the currency markets. You have 10 mio USD risk capital provided by your fund. Using the 10 mio USD risk capital, how much arbitrage (guaranteed risk-free) profit can you make. If there is no arbitrage possible, enter zero. Give your answer in USD to the nearest USD. Please Do your calculation in excel and do not round anything until the very end.arrow_forwardWhat is likely to happen to an MNC in UK if the British pound appreciates: exports denominated in British Pound will probably increase. exports denominated in foreign currencies will probably increase. O All of these statements are correct. O U.S. sales will probably decrease. interest owed on foreign funds borrowed will probably increase.arrow_forwardA large bank is quoting the following spot exchange rates for number of YEN per USD, number of THB per USD and number of YEN per THB respectively. YEN/USD = 116.91 -- 116.95 THB/USD = 44.30 -- 44.40 YEN/THB = 2.6900 -- 2.7100. You are trader at Axe Capital, a US hedge fund, and your job is to try to find arbitrages in the currency markets. You have 10 mio USD risk capital provided by your fund. Using the 10 mio USD risk capital, how much arbitrage (guaranteed risk-free) profit can you make. If there is no arbitrage possible, enter zero. Give your answer in USD to the nearest USD. Please Do your calculation in excel and do not round anything until the very end.arrow_forward

- A Chinese investor invests in U.S. Treasury bills. If the Chinese renminbi (RMB) appreciates during the holding period against the U.S. dollar (USD), this investment increases in value but default risk remains unchanged. declines in value and decreases in default risk. declines in value but default risk remains unchanged. increases in value and decreases in default risk.arrow_forwardAssume the following to be a portion of the simplified balance of payments statement for a hypothetical country. The values are given in billions of dollars. Exports Imports Capital Outflows Capital Inflows $900 - $675 - $225 $135 If the central bank has not changed its holding of foreign-currency reserves during this period, then the capital-service account for this country should be equal to billion.arrow_forwardAn international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows: Base price level 100 Current U.S. price level 105 Current South African price level 111 Base rand spot exchange rate $ 0.194 Current rand spot exchange rate $ 0.177 Expected annual U.S. inflation 7 % Expected annual South African inflation 5 % Expected U.S. one-year interest rate 10 % Expected South African one-year interest rate 8 % Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively): a. The current ZAR spot rate in USD that would have been forecast by PPP. (Do not round intermediate calculations. Round your answer to 4 decimal places.) b. Using the IFE, the expected ZAR spot rate in USD one year from now. (Do not round intermediate calculations.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education