Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

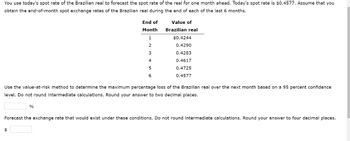

Transcribed Image Text:You use today's spot rate of the Brazilian real to forecast the spot rate of the real for one month ahead. Today's spot rate is $0.4577. Assume that you

obtain the end-of-month spot exchange rates of the Brazilian real during the end of each of the last 6 months.

End of

Month

1

2

3

4

5

6

%

$

Value of

Brazilian real

Use the value-at-risk method to determine the maximum percentage loss of the Brazilian real over the next month based on a 95 percent confidence

level. Do not round intermediate calculations. Round your answer to two decimal places.

$0.4244

0.4290

0.4283

0.4617

0.4725

0.4577

Forecast the exchange rate that would exist under these conditions. Do not round intermediate calculations. Round your answer to four decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please solve very soon completelyarrow_forwardAn investment opportunity requires a payment of $910 for 12 years, starting a year from today. If your required rate of return is 6.5 percent, what is the value of the investment to you today? (Round factor values to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25.)arrow_forwardAssume the appropriate discount rate for the following cash flows is 10.3 percent. Year Cash Flow 1 $2,150 2,050 234 1,750 1,550 What is the present value of the cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present valuearrow_forward

- Assume the appropriate discount rate for the following cash flows is 10.2 percent. Year Cash Flow 1 $2,100 2 2,000 3 1,700 4 1,500 What is the present value of the cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardAn investment offers a total return of 11 percent over the coming year. Alex Hamilton thinks the total real return on this investment will be only 7.4 percent. What does Alex believe the inflation rate will be over the next year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Inflation rate %arrow_forwardThis question will compare two different arbitrage situations. Recall that arbitrage should equalize rates of return. We want to explore what this implies about equalizing prices. In the first situation, two assets, A and B, will each make a single guaranteed payment of $100 in 1 year. But asset A has a current price of $80 while asset B has a current price of $90.a. Which asset has the higher expected rate of return at current prices? Given their rates of return, which asset should investors be buying and which asset should they be selling?b. Assume that arbitrage continues until A and B have the same expected rate of return. When arbitrage ceases, will A and B have the same price?Next, consider another pair of assets, C and D. Asset C will make a single payment of $150 in one year while D will make a single payment of $200 in one year. Assume that the current price of C is $120 and that the current price of D is $180.c. Which asset has the higher expected rate of return at current…arrow_forward

- Consider the following cash flows: Year Cash Flow 0 -$ 29,200 123 14,500 14,400 10,800 a. What is the profitability index for the cash flows if the relevant discount rate is 12 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index if the discount rate is 17 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index if the discount rate is 24 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability indexarrow_forwardRaghubhaiarrow_forwardes Suppose the returns on an asset are normally distributed. The historical average annual return for the asset was 5.7 percent and the standard deviation was 18.3 percent. a. What is the probability that your return on this asset will be less than -4.1 percent in a given year? Use the NORMDIST function in Excel® to answer this question. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter…arrow_forward

- Q1-13 If a speculator observes that the current 3-month forward rate on Swiss francs is 20¢ = 1 franc, but he/she expects that the spot rate in 3 months will be 30¢ = 1 franc, then this speculator would now a. buy dollars on the forward market. b. buy francs on the forward market. c. sell francs on the forward market. d. buy francs on the spot market and simultaneously sell francs on the 3-month forward market if the current spot rate is 25¢ = 1 franc.arrow_forwardAn investment offers to double your money in 30 months (don’t believe it). What rate per six months are you being offered? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forwardConsider the following cash flows: Year Cash Flow 0 −$ 29,000 1 14,700 2 14,200 3 10,600 What is the profitability index for the cash flows if the relevant discount rate is 10 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. What is the profitability index if the discount rate is 15 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. What is the profitability index if the discount rate is 22 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education