Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

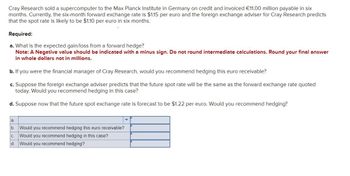

Transcribed Image Text:Cray Research sold a supercomputer to the Max Planck Institute in Germany on credit and invoiced €11.00 million payable in six

months. Currently, the six-month forward exchange rate is $1.15 per euro and the foreign exchange adviser for Cray Research predicts

that the spot rate is likely to be $1.10 per euro in six months.

Required:

a. What is the expected gain/loss from a forward hedge?

Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer

in whole dollars not in millions.

b. If you were the financial manager of Cray Research, would you recommend hedging this euro receivable?

c. Suppose the foreign exchange adviser predicts that the future spot rate will be the same as the forward exchange rate quoted

today. Would you recommend hedging in this case?

d. Suppose now that the future spot exchange rate is forecast to be $1.22 per euro. Would you recommend hedging?

a.

b. Would you recommend hedging this euro receivable?

C.

Would you recommend hedging in this case?

d. Would you recommend hedging?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ABC Company wants to possibly expand its plant in Europe. The current spot exchange rate is for Euro is €0.83. The initial investment is €2.1, with projected cash flows for three years at €950,000. The discount rate is 10%. The risk-free rate in the US is 5 percent and the risk-free rate in Europe is 7 percent. Calculate the NPV of the project into US Dollars, rounding to the nearest cent, format as "XXX,XXX.XX"arrow_forward9arrow_forwardAn investor starts with €1 million and converts them to £694,500 which is then invested for one year. In a year the investor has £736,170 which she then converts back to euros at an exchange rate of 0.68 pounds per euro. The annual euro rate of return earned was .0775 .06 .0826 .0813arrow_forward

- company will receive €75 million in 1 year from an Italian customer. observe the following data. $:€ Spot Rate $1.25:€1.00 $:€ Forward Rate $1.30:€1.00 How many USD will you receive if you employ a forward hedgearrow_forwardThe US 1 year spot rate is 3.61% and the Mexican 1 year spot rate is 7.44%. A US investor purchases a Mexican corporate bond with an expected 1 year return of 9.76%, as measured in Mexican peso. The current USD/MXP exchange rate is 0.18. If the investor decides to hedge the currency risk exposure in the forward market, what would be the expected return on this portfolio, if interest rate parity holds?arrow_forwardLakonishok Equipment has an investment opportunity in Europe. The project costs €18,406,730 and is expected to produce cash flows of €3,681,369 in Year 1, €4,992,682 in Year 2, and €6,337,782 in Year 3. The current spot exchange rate is $1.23/€ and the current risk-free rate in the United States is 3.71%, compared to that in Europe of 3.03%. The appropriate discount rate for the project is estimated to be 10.55%, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €12,529,609. What is the NPV of the project?arrow_forward

- i need help with this problem i know the answer is 5.86 i just need help on how to do it step by steparrow_forwardLakonishok Equipment has an investment opportunity in Europe. The project costs €20,065,563 and is expected to produce cash flows of €3,524,370 in Year 1, €4,549,121 in Year 2, and €5,590,740 in Year 3. The current spot exchange rate is $1.38/€ and the current risk-free rate in the United States is 3%, compared to that in Europe of 3.08%. The appropriate discount rate for the project is estimated to be 11.07%, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €13,733,917. What is the NPV of the project?arrow_forwardAnalyse the scenario below. In each case, explain your reasoning Suppose that the current EUR/GBP exchange rate is £0.92 per euro. The current2-year interest rates are: GBP 4%, EUR 5%. Suppose further that you can use a 2-year forward contract with a EUR/GBP rate of £0.91 per euro. Could this contractbe used for an arbitrage opportunity? If yes, provide an example. Calculatearbitrage profit and explain how this profit can be earnedarrow_forward

- Use the following information to calculate the dollar cost of using a money market hedge to hedge 200,000 Jordanian Dinar of payables due in 180 days. Assume the spot rate of the Jordanian Dinar is $2.02 and the 180 day forward rate is $2.00. The Jordanian interest rate is 5%, and the U.S. interest rate is 4% over the 180 day period. A)$391,210. B)$396, 190. C)$ 384,762. D)$400, 152 E)none of these.arrow_forwardLakonishok Equipment has an investment opportunity in Europe. The project costs €14,750,000 and is expected to produce cash flows of €3,350,000 in Year 1, €4,350,000 in Year 2, and €4,750,000 in Year 3. The current spot exchange rate is $.83/€ and the current risk-free rate in the United States is 3 percent, compared to that in euroland of 2.2 percent. The appropriate discount rate for the project is estimated to be 10 percent, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €9,250,000. What is the NPV of the project in U.S. dollars? (Round 2 decimal places) NPV : Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education