Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

short answer please

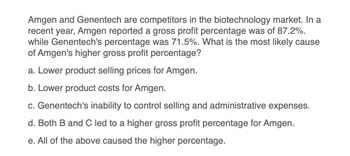

Transcribed Image Text:Amgen and Genentech are competitors in the biotechnology market. In a

recent year, Amgen reported a gross profit percentage was of 87.2%.

while Genentech's percentage was 71.5%. What is the most likely cause

of Amgen's higher gross profit percentage?

a. Lower product selling prices for Amgen.

b. Lower product costs for Amgen.

c. Genentech's inability to control selling and administrative expenses.

d. Both B and C led to a higher gross profit percentage for Amgen.

e. All of the above caused the higher percentage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- National Co. sells three products: AB, CD and EF. AB is the most profitable product while EF is the least profitable. Which of the following events will definitely decrease the firm’s overall BEP for the upcoming account period. An increase in AB’s raw materials An increase in anticipated sales of AB relative to the sales of CD and EF An increase in the overall market of CD An decrease in EF’s selling pricearrow_forwardGiven: A company XYZ in the United States is profitable and pays taxes. XYZ produces “widgets”, and in recent years, the cost of producing each widget has been falling because the price of raw materials has been falling. Each year for the past few years, XYZ has produced significantly more widgets each year than it has sold. True or False: XYZ would report lower Net Income on the Income Statement if it used FIFO accounting versus if it used LIFO accounting Explain your answer.arrow_forwardSuppose Crispy Pop is considering discontinuing its fruit and nuts product line. Assume that during the past year, the fruit and nuts' product line income statement showed the following: (Click the icon to view the income statement data.) (Click the icon for additional information.) If the company decides to discontinue the product line, what will happen to the company's operating income? Should Crispy Pop discontinue the fruit and nuts product line? Begin by preparing a contribution margin income statement for the fruit and nuts' product line. (Use a minus sign or parentheses to enter a loss.) Sales revenue Less: Variable expenses Contribution margin 5250000 Data table Less: Fixed expenses Operating income (loss) More info Fixed manufacturing overhead costs account for 40% of the cost of goods, while only 30% of the operating expenses are fixed. Since the fruit and nuts line is just one of the company's fruit operations, only $775,000 of direct fixed costs (the majority of which is…arrow_forward

- Calculate Zumwalt’s net profit margin and debt ratio. Earth’s Best Company has sales of $200,000, a net income of $15,000, and the following balance sheet: . The company’s new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 2.5, without affecting either sales or net income. If inventories are sold off and not replaced so as to reduce the current ratio to 2.5, if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? b. Now suppose we wanted to take this problem and modify it for use on an exam—that is, to create a new problem that you have not seen to test yourknowledge of this type of problem. How would your answer change if we made the following changes: (1) We doubled all of the dollar amounts? (2) We stated that the target current ratio was 3.0? (3) We said that the company had 10,000 shares of…arrow_forwardIt won’t let me ask this question in the marketing section. So if you can somehow help me with that... thank you...In 2014, Company A reported profits of about $52 billion on sales of $251 billion. For that same period, Company B posted a profit of about $22 billion on sales of $85 billion. So Company A is a better marketer, right? Sales and profits provide information to compare the profitability of these two competitors, but between these numbers is information regarding the efficiency of marketing efforts in creating those sales and profits. Using the following information from the companies' income statements (all numbers are in thousands), calculate profit margin, net marketing contribution, marketing return on sales (or marketing ROS), and marketing return on investment (or marketing ROI) for each company.This is all the information I was given.Company A Company BSales $250,670,000 $84,541,000Gross Profit…arrow_forwardRJM Enterprises is a manufacturer of consumer electronics products. The industry is very competitive, and RJM has seen its profits fall in recent years, including an operating loss of $17,525 last year. RJM was able to turn that around this year by aggressively cutting costs. The summarized financial results for RJM are shown below: Gross sales: Less variable costs Direct materials Direct labor Total contribution margin Fixed costs Operating income Current Year $ 982,290 480,870 221,940 $ 279,480 33,509 $ 245,971 Prior Year $ 1,344,725 807,500 498,750 $ 38,475 56,000 $ (17,525) Jim Green, the management accountant at RJM, is analyzing the company's performance for this year in order to explain to management the specific aspects that drove the company to success. Some of the information Jim obtained follows: Sales units Current Year 41,100 $ 23.90 $ 7.80 1.50 0.60 Prior Year 47,500 $ 28.31 $ 8.50 2.00 0.75 $ 14.00 Price Direct materials cost per unit of material Direct materials…arrow_forward

- In 2013, Company A reported profits of about $11 billion on sales of $19 billion. For that same period, Company B posted a profit of about $525 million on sales of $2.0 billion. So Company A is a better marketer, right? Sales and profits provide information to compare the profitability of these two competitors, but between these numbers is information regarding the efficiency of marketing efforts in creating those sales and profits. Using the following information from the companies' incomes statements (all numbers are in thousands), calculate profit margin, net marketing contribution, marketing return on sales (or marketing ROS), and marketing return on investment (or marketing ROI) for both companies. Which company is performing better? Company A $18,714,700 $10,443,300 $1,491,400 Marketing Expenses Net Income (Profit) $10,943,200 Fill in the table below. (Round the NMC to the nearest whole number and all other values to one decimal place.) Company A Company B Sales Gross Profit…arrow_forwardPlease select the option that best analyzes the PROFIT MARGIN for our example company. The profit margin indicates the amount of sales that are ultimately realized as income after all expenses are considered. Profit margin is not a good measure of how well a company performs, so this information does not indicate how well our company is performing financially. The profit margin indicates the amount of sales that are ultimately realized as income after all expenses are considered. Our company retains between 15-20% of its sales as income, which is a comfortable profit margin. The profit margin indicates the amount of sales that are ultimately realized as income after all expenses are considered. Our company retains between 80-85% of its income as sales, which is a very high profit margin. The profit margin indicates the amount of sales that are ultimately realized as income after all expenses are considered. Our company retains between 80-85% of its income as sales, which…arrow_forwardIsla Esme, Inc., sells tea products to various customers. In recent years, profits have been declining. The CFO of the business investigated the reasons for the profit decline and performed regression analysis for sales and costs. He determined that sales depend on product price, delivery speed, customer services, and marketing expenses. He also determined that total costs consist of variable costs of $25 per unit and fixed costs of $56,000. Marketing expenses have a coefficient of determination of 75% related sales.Question:If Isla Esme, Inc. produces 5000 units of output, what is the total cost?arrow_forward

- Real-world companies often seek to reduce the complexity of their operations in an attempt to increase profits. In 2012, Procter & Gamble (P&G) believed it could increase the company's profits by eliminating some product-lines. In 2017, P&G announced that it had "divested, discontinued, or consolidated 105 brands". As a result, even though its sales had decreased by 22 percent from 2012 to 2017, its profit as a percentage of sales had increased by 55 percent. Other companies have also tried to improve their financial performance by downsizing. In November 2017, General Electric announced it would begin a downsizing operation that would result in their exiting business using over $20 billion in assets in the next one to two years. In January 2018, Newell Brands, the company whose products include Tupperware, Sharpie pens, Elmer's Glue, and Rawlings sports products, announced it would be reducing its product offerings to the extent that it would close half of its facilities and reduce it…arrow_forwardCompany A's gross profit rate last year was 32.0% and this year it is 28.4%. Which of the following would not be a possible cause for this decline in the gross profit rate? O Company A's average margin between unit selling price and inventory unit cost is decreasing. O Company A may have seen a decline in total gross profit while maintaining net sales. Company A may have begun selling products with a higher markup. O Company A must have paid higher prices to suppliers without passing these costs on to customers.arrow_forwardFortune Brands Home & Security, Inc., sells Master Lock padlocks. It reported an increase innet sales from $3.3 billion in 2011 to $3.6 billion in 2012, and an increase in gross profit from $1.0billion in 2011 to $1.2 billion in 2012. Based on these numbers, determine whether the change ingross profit was caused by an increase in gross profit per sale, an increase in sales volume, or acombination of the two.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT