Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

ગુલિક corporation most recent income statement appears below: get correct answer the accounting question

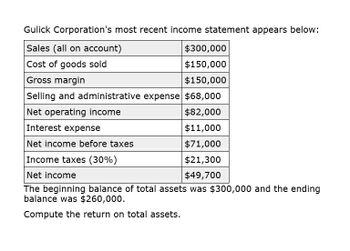

Transcribed Image Text:Gulick Corporation's most recent income statement appears below:

Sales (all on account)

Cost of goods sold

Gross margin

$300,000

$150,000

$150,000

Selling and administrative expense $68,000

Net operating income

$82,000

Interest expense

$11,000

Net income before taxes

$71,000

Income taxes (30%)

$21,300

$49,700

Net income

The beginning balance of total assets was $300,000 and the ending

balance was $260,000.

Compute the return on total assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardJester Corporation's most recent income statement appears below: Income Statement Sales (all on account) Cost of goods sold Gross margin Selling and administrative expense Net operating income Interest expense Net income before taxes Income taxes (30%) Net income $ 300,000 170,000 130,000 50,000 80,000 20,000 60,000 18,000 $ 42,000 The beginning balance of total assets was $240,000 and the ending balance was $236,700. The return on total assets is closest to:arrow_forwardThe following data and information are provided for Waltz Corporation. Use net income after taxes as margin. Sales Revenue $1,000,000 Average total assets used during the year = $200,000 Cost of Goods Sold -500,000 Inventory = $60,000 Gross Margin 500,000 Long-term liabilities = $100,000 Selling Expenses -386,000 Accounts receivable = $10,000 Administrative Expenses -80,000 Cost of total invested capital = 12% Net Operating Income 34,000 Fixed expenses = $300,000 Other Income & Expense -6,000 Variable expenses = 666,000 Net Income before Taxes 28,000 Average price per unit sold = $10 Income Taxes -8,000 Net Income after Taxes $ 20,000…arrow_forward

- Jester Corporation's most recent income statement appears below: Sales (all on account) Cost of goods sold Gross margin Selling and administrative expense Net operating income Interest expense Net income before taxes Income taxes (30%) Net income Multiple Choice O The beginning balance of total assets was $190,000 and the ending balance was $187,200. The return on total assets is closest to: O 23.9% Income Statement 22.3% 16.7% 31.8% $ 250,000 145,000 105,000 45,000 60,000 15,000 45,000 13,500 $ 31,500arrow_forwardRevenue and expense data for Rogan Technologies Co. are as follows: 20Y8 20Y7 Sales $701,000 $610,000 Cost of goods sold 434,620 347,700 Selling expenses 105,150 103,700 Administrative expenses 119,170 122,000 Income tax expense 21,030 12,200 a. Prepare an income statement in comparative form, stating each item for both 20Y8 and 20Y7 as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as a positive number. Rogan Technologies Co. Comparative Income Statement For the Years Ended December 31, 20Y8 and 20Y7 20Y8 Amount 20Y8 Percent 20Y7 Amount 20Y7 Percent $fill in the blank 6de34503cfdf061_2 fill in the blank 6de34503cfdf061_3% $fill in the blank 6de34503cfdf061_4 fill in the blank 6de34503cfdf061_5% fill in the blank 6de34503cfdf061_7 fill in the blank 6de34503cfdf061_8% fill in the blank 6de34503cfdf061_9 fill in the blank 6de34503cfdf061_10% Gross profit $fill in the blank…arrow_forwardAssume Martinez Company has the following reported amounts: Sales revenue $ 610,000, Sales returns and allowances $ 30,000, Cost of goods sold $ 396,500, and Operating expenses $ 84,000. (a) Compute net sales. Net sales (b) Compute gross profit. Gross profit (c) Compute income from operations. Income from operations (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %24arrow_forward

- Income statement information for Einsworth Corporation follows: Sales $1,200,000 Cost of goods sold 780,000 Gross profit 420,000Prepare a vertical analysis of the income statement for Einsworth Corporation.arrow_forwardCalculating the Average Total Assets and the Return on Assets The income statement, statement of retained earnings, and balance sheet for Santiago Systems are as follows: Santiago Systems Income Statement For the Year Ended December 31, 20X2 Amount Percent Net sales $5,345,000 100.0% Less: Cost of goods sold (3,474,250) 65.0 Gross margin $1,870,750 35.0 Less: Operating expenses (1,140,300) 21.3 Operating income $730,450 13.7 Less: Interest expense (27,000) 0.5 Income before taxes Less: Income taxes (40%)* $703,450 13.2 (281,380) 5.3 Net income $422,070 7.9 * Includes both state and federal taxes.arrow_forwardWhat is the net income for the current year?arrow_forward

- Joyner Company’s income statement for Year 2 follows: Sales $ 702,000 Cost of goods sold 96,000 Gross margin 606,000 Selling and administrative expenses 151,100 Net operating income 454,900 Nonoperating items: Gain on sale of equipment 6,000 Income before taxes 460,900 Income taxes 138,270 Net income $ 322,630 Its balance sheet amounts at the end of Years 1 and 2 are as follows: Year 2 Year 1 Assets Cash $ 298,230 $ 66,500 Accounts receivable 229,000 123,000 Inventory 320,000 288,000 Prepaid expenses 9,000 18,000 Total current assets 856,230 495,500 Property, plant, and equipment 639,000 508,000 Less accumulated depreciation 165,100 130,100 Net property, plant, and equipment 473,900 377,900 Loan to Hymans Company 43,000 0 Total assets $ 1,373,130 $ 873,400 Liabilities and Stockholders' Equity Accounts payable $ 314,000 $ 257,000 Accrued liabilities 44,000 50,000 Income taxes payable 86,000 81,400 Total…arrow_forwardPJ Corp. reported the following income statement results: Sales Sales returns & allowances Gross profit $ 9,87,400 $ 7,400 $3,78,280 Operating expense $ 2,64,500 Gain on sale of equipment $ 30,000 Net income $ 99,960 Calculate the gross profit margin.arrow_forwardGrandy productions reported the following items for the current year sales 15,250,000; cost of goods 8750,000; depreciation expense 335,000; taxes925,000 administrative expenses; 275,000 interest, expenses; 97,500 and marketing expenses 385,000. What is grandes operating income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning